Gold Weekly Forecast: XAU/USD inverse correlation with US T-bond yields stays intact

- Gold advanced to its highest level in five weeks above $1,750.

- Plunging US Treasury bond yields fueled XAU/USD’s rally.

- Gold could target $1,785 if it manages to break above 50-day SMA.

The XAU/USD pair stayed stuck in a tight range at the start of the week as the thin trading conditions due to Easter Monday allowed financial markets to remain calm. On Tuesday, the sharp drop witnessed in the US Treasury bond yields weighed heavily on the greenback and triggered a rebound in the pair. Although gold struggled to break above the key resistance at $1,745 on Wednesday, a 3.7% decline seen in the benchmark 10-year US T-bond yield provided a boost to the precious metal on Thursday. After touching its highest level since early March at $1,758, XAU/USD staged a correction on Friday and settled below $1,750, gaining nearly 1% on a weekly basis.

What happened last week

The data published by the Institute for Supply Management (ISM) showed on Monday that the economic activity in the US service sector expanded at its strongest pace on record. The ISM Services PMI jumped to 63.7 in March from 55.3 in February and beat the market expectation of 58.5 by a wide margin. This upbeat report caused risk flows to dominate the markets at the start of the week and the S&P 500 Index notched a new all-time high while the USD struggled to find demand.

In the absence of significant macroeconomic data releases, the 10-year US T-bond yield continued to slide on Tuesday and the US Dollar Index slumped to a two-week low before going into a consolidation phase on Wednesday.

The minutes of the FOMC’s March 16-17 meeting revealed on Wednesday that policymakers were largely in agreement about keeping the policy unchanged to foster the recovery despite the slight hawkish shift witnessed in the Summary of Economic Projections (SEP). “A number of participants highlighted the importance of communicating progress well in advance of potential QE taper; timing would depend on the economy, the pace of progress,” the publication further noted.

While speaking at a conference organized by the International Monetary Fund (IMF) on Thursday, FOMC Chairman Jerome Powell acknowledged that the traditional tool to deal with inflation would be to raise rates but reiterated that a one-time increase in prices does not necessarily point to persistent inflation. With Powell downplaying inflation concerns, the US T-bond yields continued to push lower and helped XAU/USD preserve its bullish momentum.

Finally, the US Bureau of Labor Statistics announced on Friday that the Core Producer Price Index (PPI) in March edged higher to 3.1% on a yearly basis from 2.5%

Next week

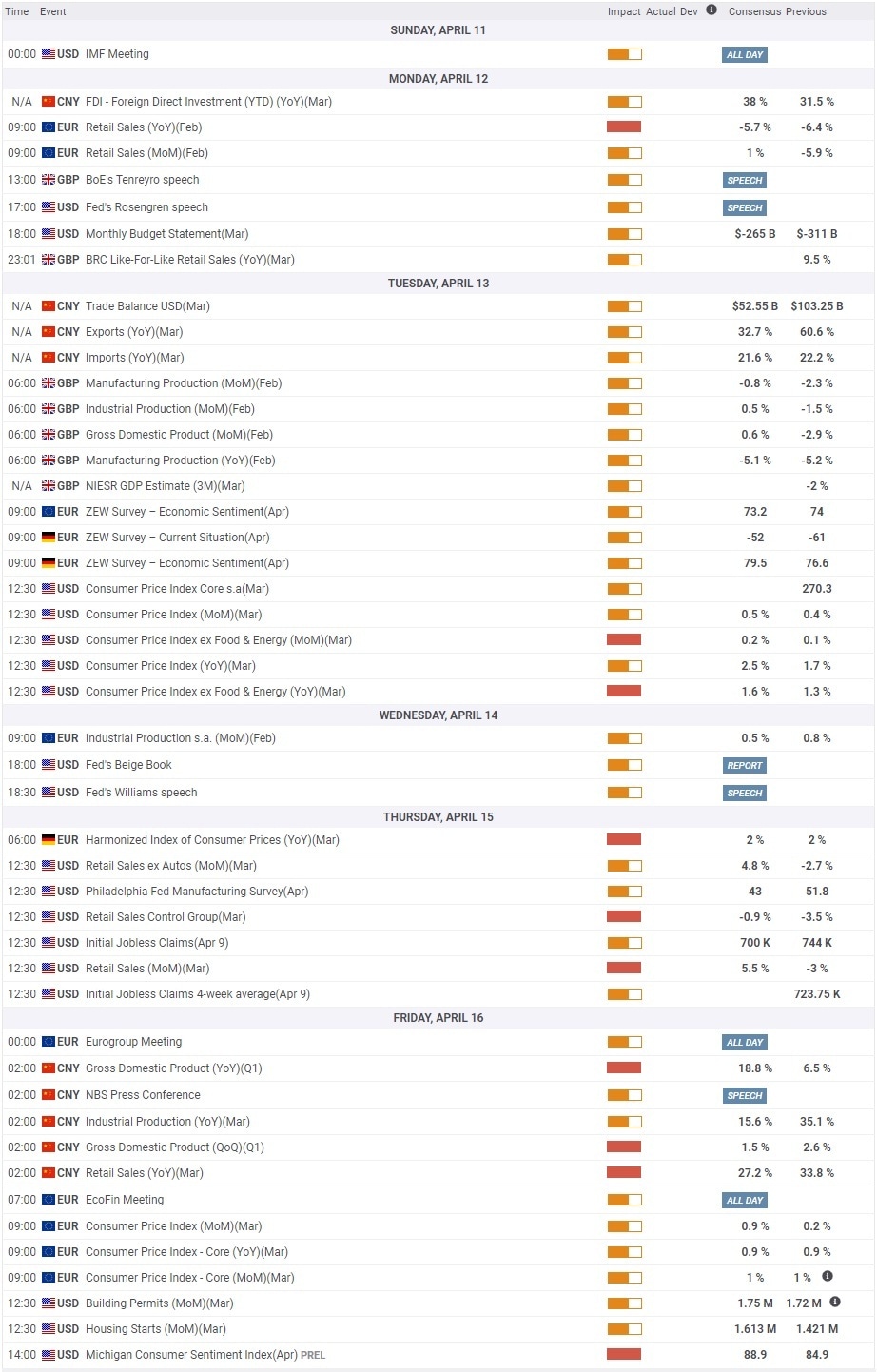

On Tuesday, the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data. Investors expect the Core CPI, which excludes volatile food and energy prices, to rise to 1.5% in March from 1.3% in February. Although the Fed uses the Personal Consumption Expenditures (PCE) Price Index as its preferred gauge of inflation, a stronger-than-expected reading could have a positive impact on T-bond yields and support the USD.

On Thursday, Retail Sales data will be featured in the US economic docket. The market consensus points to a 4.7% increase in March following February’s 3% contraction and a better print could fuel another rally in US stock indexes and keep the greenback’s potential gains limited. Ahead of the weekend, the Consumer Price Index data from the euro area and the first-quarter Gross Domestic Product (GDP) report from China will be looked upon for fresh impetus.

Nevertheless, movements of US Treasury bond yields are likely to remain the primary driver of gold’s prices throughout the week.

Gold technical outlook

Gold seems to have encountered strong resistance near $1,760, where the 50-day SMA is located, following Thursday’s decisive upsurge. On a bullish note, however, Friday’s downward correction lost momentum near the 20-day SMA at $1,731 and XAU/USD finished the week near the Fibonacci 23.6% retracement of the January-March downtrend at $1,745.

Meanwhile, the Relative Strength Index (RSI) indicator stays afloat above 50, suggesting that sellers are struggling to dominate gold’s action.

As mentioned above, the initial hurdle could be seen at $1,760 and a daily close above that level could open the door for additional gains toward $1,785 (Fibonacci 38.2% retracement). On the other hand, if XAU/USD stays below $1,745 and confirms that level as a resistance, it could retest the 20-day SMA at $1,731 and target $1,720 (static level) afterward.

Gold sentiment poll

Gold’s near-term outlook remains neutral with a slight bullish bias according to the FXStreet Forecast poll. However, the average price target of $1,745 on a one-month view suggests that gains are expected to remain limited around current price levels.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.