Gold Weekly Forecast: A key week with Fedspeak and US PCE on the table

- Gold clinched its fifth consecutive week of gains, including a record high past $3,700.

- If bullish momentum persists, the $4,000 mark emerges immediately to the upside.

- Geopolitical tensions and expectations of Fed rate cuts continue to support Gold.

Gold (XAU/USD) extended its positive performance this week, hitting all-time tops in levels just beyond the $3,700 mark per troy ounce soon after the Federal Reserve (Fed) announced its largely telegraphed interest rate cut on Wednesday, its first of the year.

The rally in the precious metal remained untamed, reaching its fifth consecutive week and always underpinned by, firstly, steady expectations of extra interest rate reductions by the Fed in the latter part of the year and well into 2026, and secondly, persistent geopolitical effervescence stemming mainly from the Middle East, while the Russia-Ukraine conflict also adds to the matter.

Last but not least, contributing to the uptrend in bullion also emerged the equally persevering offered stance of the US Dollar (USD), despite it managed to regain some composure since the FOMC event, as the ‘sell the fact’ axiom seems to have kicked in.

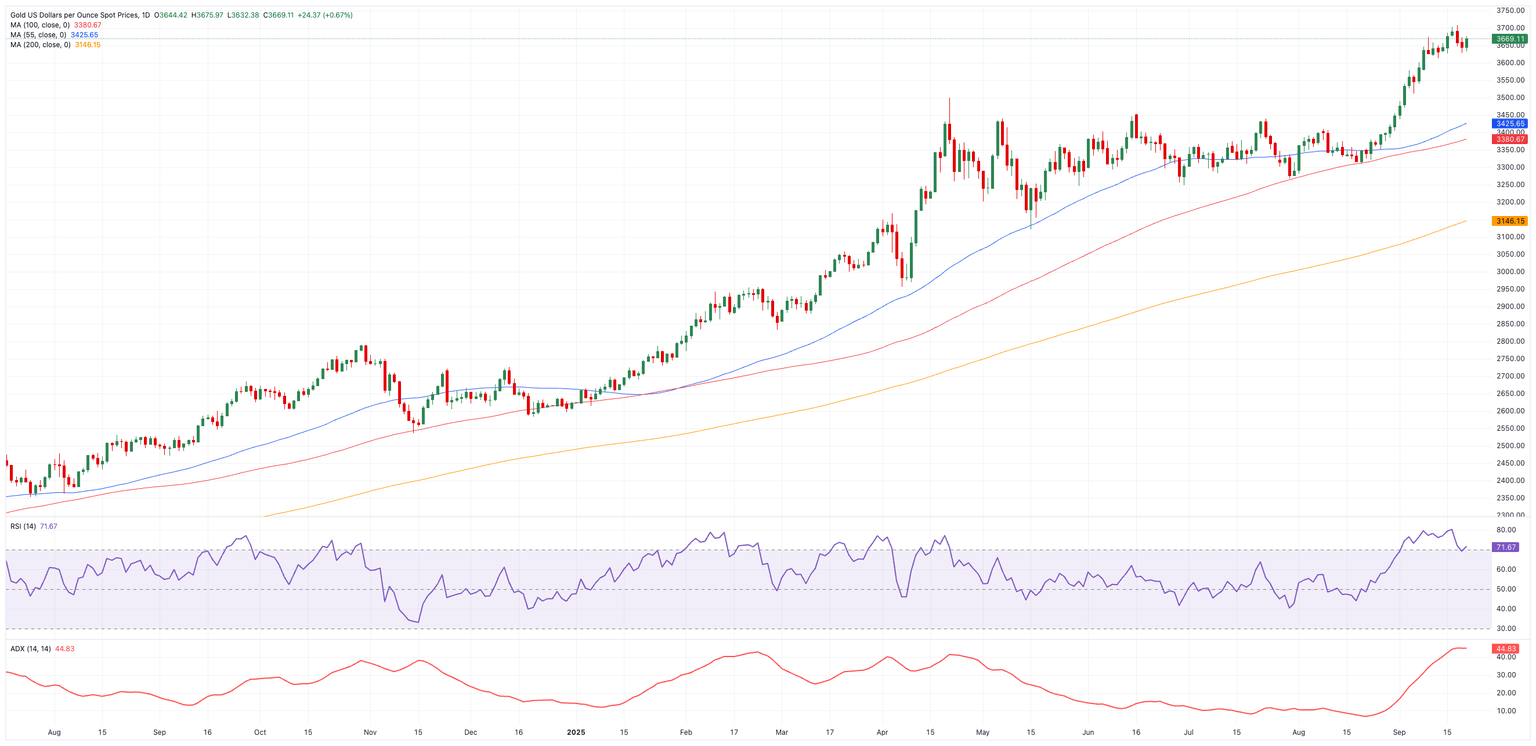

XAU/USD daily chart

Next on tap… $4,000?

As the Greenback navigates the lower end of its three-year range when tracked by the US Dollar Index (DXY), the precious metal remains en route to close its fifth straight week in the green, up nearly 40% since the beginning of the year.

Indeed, the yellow metal broke above the April-August consolidative phase, regaining a strong upside impulse from late August, a timing coincident with the Jackson Hole Symposium.

Among the drivers of that marked rebound, we can recall poor results from the US labour market, particularly the last couple of Nonfarm Payrolls (NFP), along with the downward revision seen afterwards.

The above contributed to exacerbating speculation of extra interest rate cuts by the Fed in the second half of the year, which was in turn bolstered by fears that the US economy could lose further momentum in the following periods.

All of this occurs amidst persistently high inflation, which continues to surpass the Fed's 2.0% target. Despite Chief Jerome Powell sticking to his cautious message at the latest FOMC event, market participants seem to remain laser-focused on the jobs data and its direct link with a weakening economy. Not that inflation does not matter anymore; it just seems to be a change in the markets’ view of what could drive bullion prices higher or what could inspire the Fed to keep lowering its interest rates.

Geopolitical effervescence also support the uptrend

Another driver of the important move higher in the precious metal is the unabated geopolitical jitters surrounding the Middle East crisis, as well as the Russia-Ukraine conflict, which entered its third year last February.

What about the US Dollar?

The Greenback has been on a firm bearish leg since Inauguration Day (January 20), accompanied by increasing speculation of extra monetary policy easing by the Fed as well as an erratic and confusing trade policy by the White House.

Now that the Fed has resumed its rate cut cycle and signalled that more reductions could be in the pipeline, hopes for a sustained recovery of the US Dollar seem to dim on a daily basis, at least in the near-term future.

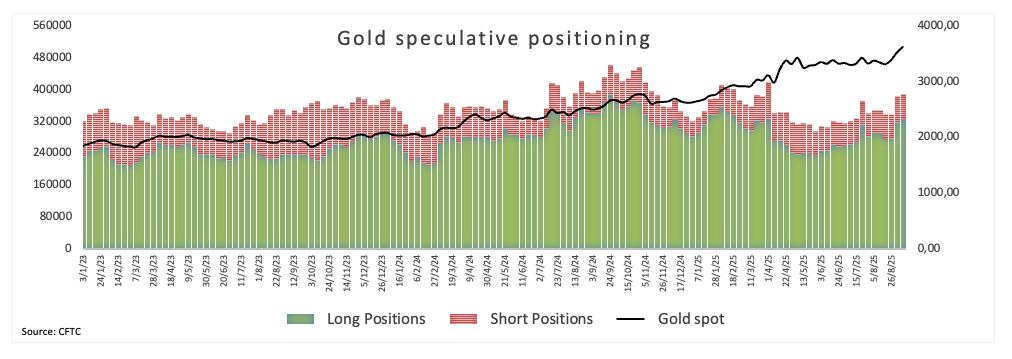

Specs remain supportive of Gold

According to the CFTC data for the week ending September 9, speculative net longs in Gold increased to levels last seen in February, near 261.8K contracts, while open interest rose for the third straight week, approaching 510K contracts, the highest since March.

Gold technical outlook

A word of caution for the current uptrend of the precious metal comes from the current overbought conditions, as per the daily Relative Strength Index (RSI) near 72, which could spark a technical correction in the short term.

However, the constructive outlook seems to remain strong and unaffected. That said, there is an immediate up-barrier at the record peak of $3,707 (September 17). Once this level is surpassed, the Fibonacci extensions of the February 2024-March 2025 rally emerge at $3,912, seconded by $4,127 and then $4,437.

Let's assume that sellers regain some momentum. In this scenario, there is provisional contention at the 55-day and 100-day SMAs at $3,425 and $3,380, respectively, prior to the weekly floor of $3,311 (August 20), which comes ahead of the July valley of $3,268 (July 30).

From a technical perspective, the metal’s positive outlook should remain unchanged as long as it trades above the key 200-day SMA at $3,147.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.