Gold Weekly Forecast: Buyers hesitate as focus shifts to key US data, trade negotiations

- Gold corrected sharply after setting a new record high at $3,500.

- Growing optimism about a de-escalation of the US-China trade conflict caused traders to lose interest in Gold.

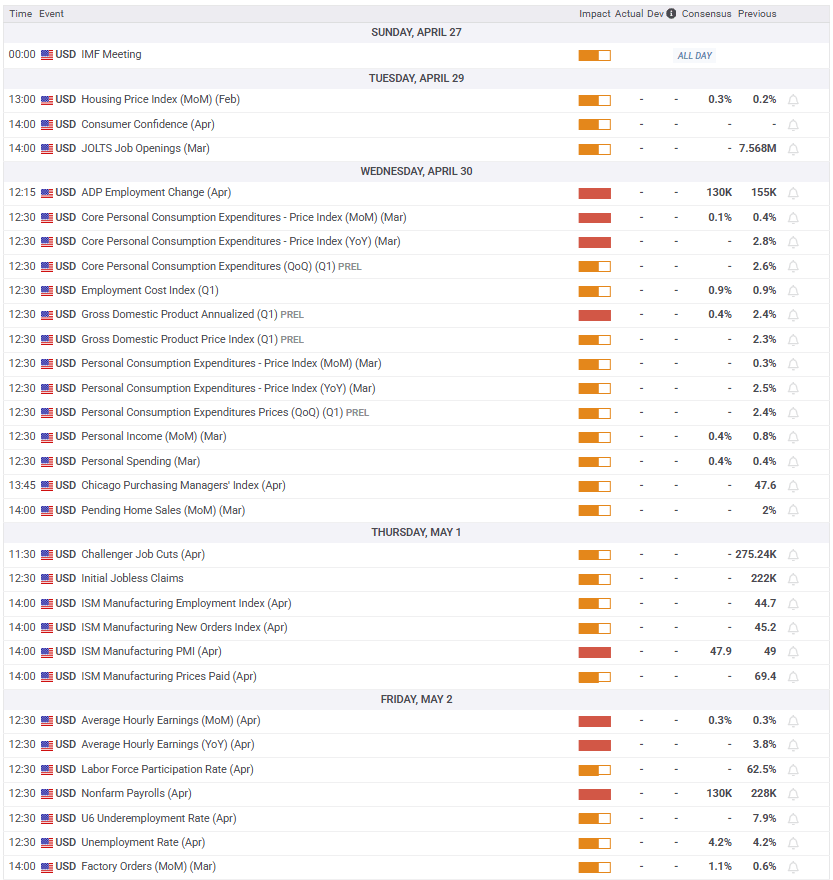

- Employment and growth data from the US will be watched closely by market participants.

Gold (XAU/USD) started the week on a bullish note and set a new record high at $3,500 in the Asian session on Tuesday before staging a deep correction in the second half of the week. Fresh developments surrounding the US-China trade relations and key macroeconomic data releases from the US could drive Gold’s valuation in the near term.

Gold reverses direction after notching new all-time high

Gold gathered bullish momentum to start the week as safe-haven flows dominated the action in financial markets on growing fears over the Federal Reserve (Fed) losing its independence and a lack of de-escalation in the US-China trade conflict.

White House economic adviser Kevin Hassett said United States (US) President Donald Trump and his team were continuing to study if firing Fed Chairman Jerome Powell was an option in a way that it wasn't before. Meanwhile, citing several people familiar with the matter, the Financial Times reported early Monday that Chinese state-backed funds were cutting off new investment in US private equity.

Later in the day, Trump voiced his criticism of Powell, once again, putting additional weight on the US Dollar (USD). Trump claimed that there was virtually no inflation in the US and accused Powell of lowering interest rates in late 2024 for political reasons. As the USD sell-off picked up steam during the Asian trading hours, XAU/USD advanced to $3,500.

As Trump softened his rhetoric and said that he had no intention of firing Powell later on Tuesday, Gold declined sharply. Trump also noted that trade negotiations with China were going “very well”. Risk flows returned to markets, leading to a more than 1% loss for Gold on the day.

The Wall Street Journal reported on Wednesday that the White House was considering slashing tariffs on Chinese goods to de-escalate the trade conflict. Later in the day, United States (US) Treasury Secretary Scott Bessent acknowledged that current tariff levels were not sustainable for either China or the US, adding that he would not be surprised if they were to come down in a mutual way. Gold extended its correction midweek on improving market mood and fell 2.7% on a daily basis.

Although Gold corrected higher on Thursday, it failed to preserve its bullish momentum. Trump told reporters late Thursday that a meeting with Chinese officials had taken place earlier in the day. Moreover, Bloomberg reported that China is mulling suspending its 125% tariff on some US imports, including medical equipment, as well as plane leases. XAU/USD came under renewed bearish pressure and dropped below $3,300 on Friday.

Gold investors shift attention to US data releases

The US Bureau of Economic Analysis (BEA) will publish its first estimate of the first-quarter Gross Domestic Product (GDP) growth. Markets expect the US economy to expand at an annual rate of 0.4%, a much slower pace compared with the 2.4% expansion recorded in the last quarter of 2024.

A negative GDP print could trigger a USD sell-off with the immediate reaction and boost XAU/USD. According to the CME FedWatch Tool, markets see virtually no chance of a Fed rate cut in May, while seeing a nearly 40% probability of another policy hold in June. Disappointing growth data could feed into expectations for a 25 basis points (bps) rate reduction in June. On the other hand, the USD could benefit from a reading of 1% or higher, and force the pair to stretch lower.

On Friday, investors will scrutinize the April employment report from the US. Fed policymakers have been voicing their concerns over the labor market outlook. Minneapolis Fed President Neel Kashkari said late Thursday that he is worried that businesses could start laying workers off because of the uncertainty caused by trade frictions. Similarly, Fed Governor Christopher Waller told Bloomberg that he would not be surprised to see more layoffs and higher unemployment. “Easiest place to offset tariff costs is by cutting payrolls,” Waller noted.

Hence, a significant negative surprise in the Nonfarm Payrolls (NFP), with a print at or below 100,000, could put additional weight on the USD’s shoulders and help XAU/USD push higher heading into the weekend. On the flip side, a downtick in the Unemployment Rate, combined with a strong NFP figure above 200,000, could cause markets to doubt a June rate cut and drag the pair lower.

Market participants will assess the fresh developments regarding the US-China trade conflict as well. In case either side takes a step back and decides to either pause or lower tariffs, Gold could struggle to find demand as a safe-haven.

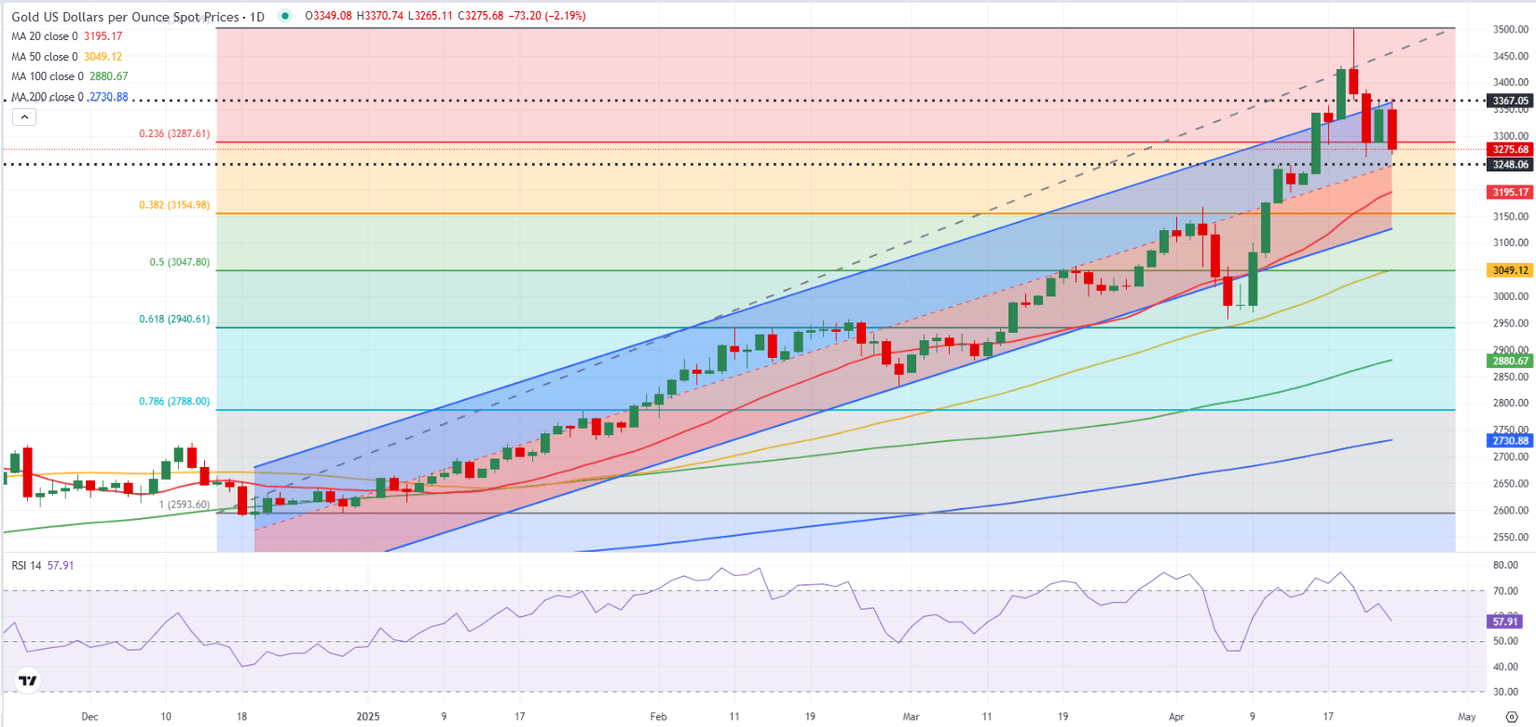

Gold technical analysis

Gold returned within the four-month-old ascending regression channel and the Relative Strength Index (RSI) indicator on the daily chart dropped below 70, suggesting that the recent decline was a technical correction rather than the beginning of a trend reversal.

The Fibonacci 23.6% retracement of the December-April uptrend aligns as a pivot level at $3,290. If Gold confirms this level as resistance, technical sellers could take action. In this scenario, the mid-point of the ascending channel could be seen as the next support level at $3,250 ahead of $3,155 (Fibonacci 38.2% retracement) and $3,120 (lower limit of the ascending channel).

Looking north, the first resistance could be spotted at $3,370 (upper limit of the ascending channel) before $3,400 (round level) and $3,500 (record high).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.