Gold Weekly Forecast: Concerns over recession in US leave room for additional gains

- Gold reclaimed $2,900 after suffering large losses to end February.

- Inflation data from the US and political headlines could continue to drive Gold’s pricing in the near term.

- The bullish bias remains intact but the uptrend has yet to gather momentum.

After declining sharply in the last week of February, Gold (XAU/USD) started March on a bullish note and reclaimed the $2,900 level. February inflation data from the United States (US) and political headlines could continue to influence the precious metal’s performance in the near term.

Gold rebounds above $2,900 on broad USD weakness

Gold began the week on a firm footing and rose more than 1% on Monday, supported by escalating geopolitical tensions following US President Donald Trump’s cancellation of the signing of a minerals deal with Ukraine, which could have paved the way to a Russia-Ukraine ceasefire and possibly a truce deal.

Meanwhile, growing fears over an economic downturn in the US weighed heavily on the USD, helping XAU/USD continue to push higher. The US Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) declined to 50.3 in February from 50.9 in January, reflecting a loss of growth momentum in the manufacturing sector's business activity. Additionally, the Employment Index slumped to 47.6 from 50.3, showing a contraction in the sector's payrolls. Other data from the US showed that Construction Spending declined by 0.2% on a monthly basis in January. Following these data releases on Monday, The Federal Reserve Bank of Atlanta revised its Gross Domestic Product (GDP) projection in its GDPNow report to -2.8% for the first quarter from -1.5% on February 28.

As the Trump administration’s 25% tariffs on Canadian and Mexican imports, as well as the additional 10% on Chinese goods, went into effect early Tuesday, the USD selloff picked up steam. In turn, XAU/USD rose about 0.9% on Tuesday and closed the day comfortably above $2,900.

Although the selling pressure surrounding the USD persisted in the second half of the week, XAU/USD struggled to preserve its bullish momentum. The impressive performance of the Euro (EUR) after the conservatives and the Social Democrats in Germany agreed to seek a loosening of Germany's debt brake triggered a sharp decline in the XAU/EUR pair, suggesting that the Euro attracted capital outflows out of Gold. On a weekly basis, XAU/EUR declined about 2.5%. Moreover, the Trump administration’s decision to exempt autos from Canada and Mexico tariffs helped the market mood improve, further limiting Gold’s upside.

On Friday, the US Bureau of Labor Statistics reported that Nonfarm Payrolls rose by 151,000 in February. This reading missed the market expectation of 160,000. Other details of the report showed that the Unemployment Rate edged higher to 4.1% from 4%, even though the Labor Force Participation Rate declined to 62.4% from 62.6% in the same period. The USD struggled to stage a rebound following these data and allowed Gold to remain within the upper half of its weekly trading range.

Gold investors await US inflation data

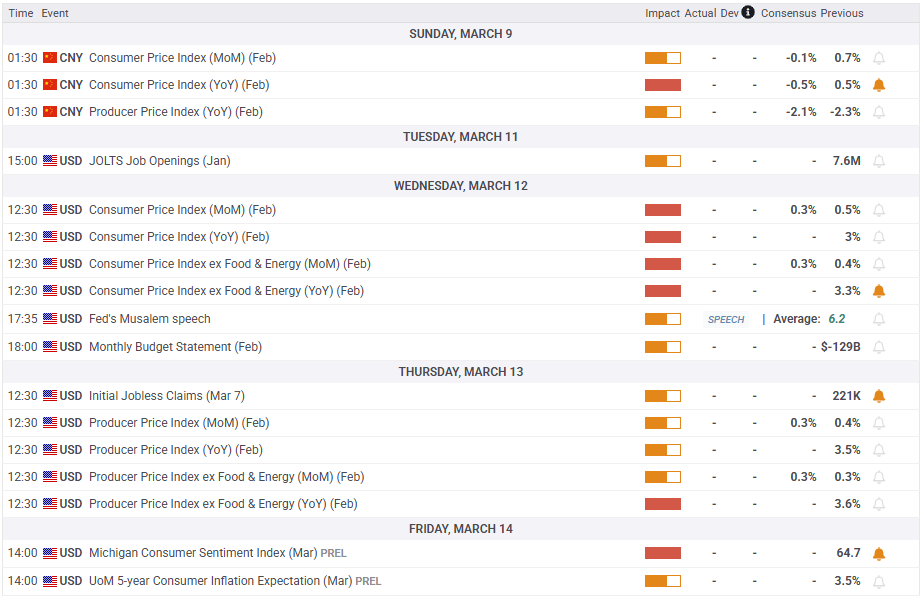

The US economic calendar will feature Consumer Price Index (CPI) data for February on Wednesday. Because the Federal Reserve (Fed) will be in the blackout period ahead of the March 18-19 policy meeting, the inflation report could influence the market pricing of the Fed rate outlook and drive Gold’s action.

Following the latest developments, the probability of the Fed holding the policy rate unchanged in May declined to nearly 50% from about 70% at the end of February. Hence, a monthly core CPI print of 0.2% or lower could feed into expectations for an interest rate cut by the central bank in May and help Gold push higher. On the other hand, a print of at least 0.5% in this economic data could help the USD find demand and make it difficult for XAU/USD to gather bullish momentum.

Investors will continue to assess the fresh developments surrounding the US trade policy as well. In case the Trump administration announces additional concessions in tariffs, risk flows could return to markets and cap Gold’s upside.

Gold technical analysis

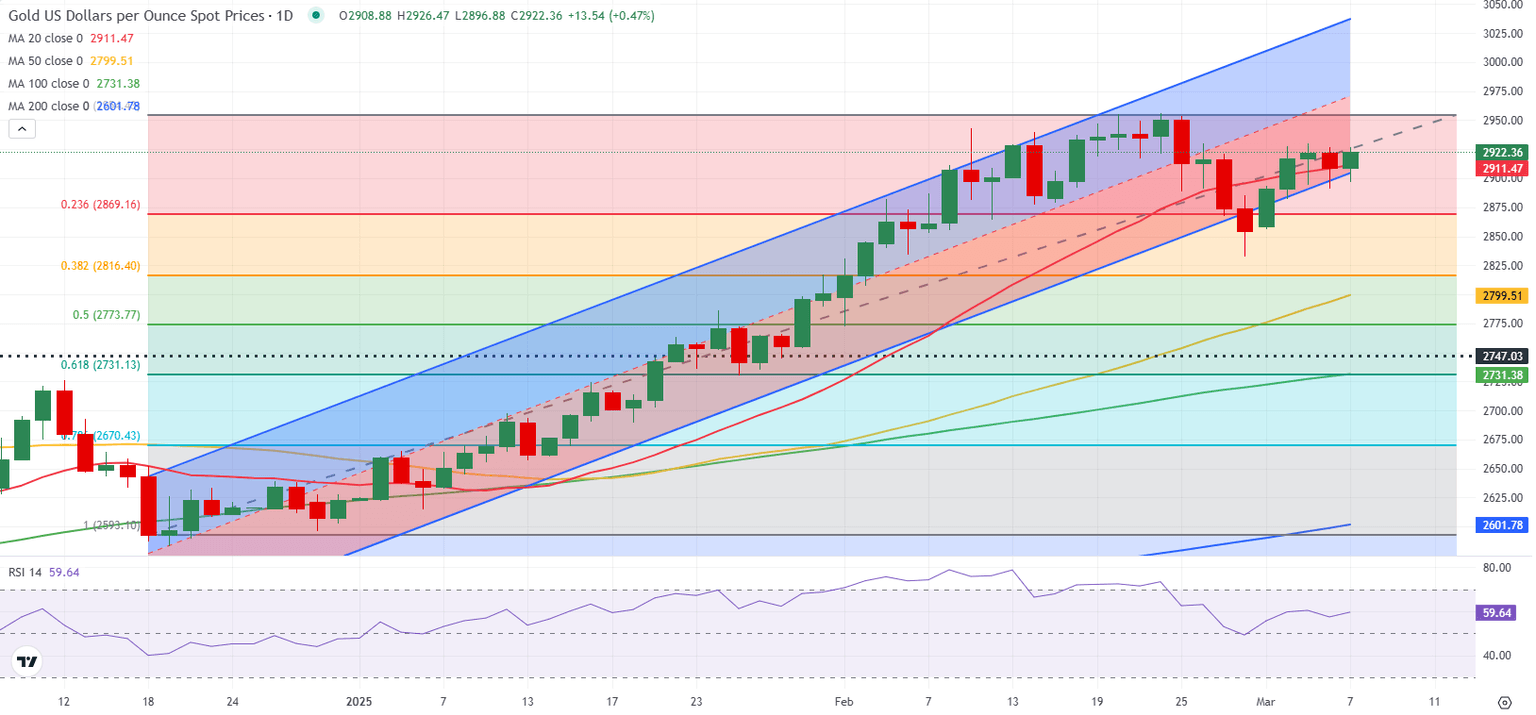

Gold returned within the ascending regression channel and the Relative Strength Index (RSI) indicator on the daily chart rose toward 60 after testing 50 on the last trading day of February, suggesting that the bullish bias remains intact following a technical correction. Additionally, Gold’s last four daily candles closed above the 20-day Simple Moving Average (SMA).

On the upside, $2,955 (record-high) aligns as the first resistance before $2,975 (mid-point of the ascending channel) and $3,000 (psychological level, round level). In case XAU/USD drops below $2,910-$2,900 (20-day SMA, lower limit of the ascending channel) and confirms this area as resistance, technical buyers could be discouraged. In this scenario, $2,870 (Fibonacci 23.6% retracement of the December-March uptrend) could be seen as the next support before $2,815 (Fibonacci 38.2% retracement).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.