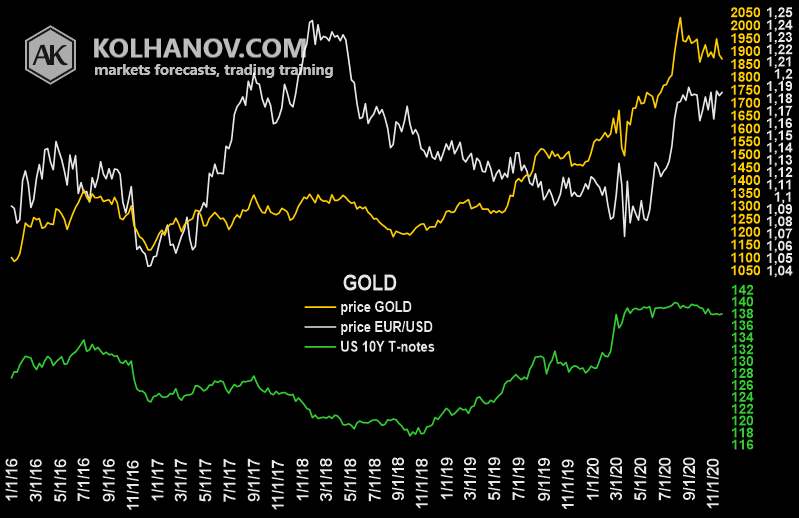

Gold: Conditions in currency and interest rates sectors showing fair price on the level 1750

Thursday Forecast

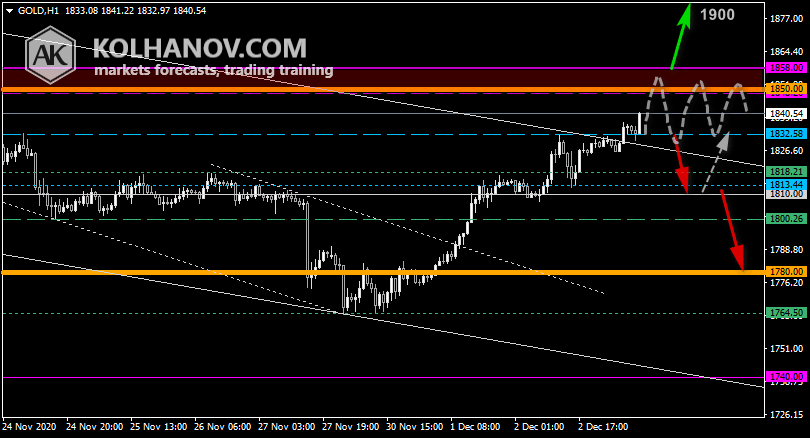

Uptrend scenario

The uptrend may be expected to continue in case the market rises above resistance level 1858, which will be followed by reaching resistance level 1900.

Downtrend scenario

An downtrend will start as soon, as the market drops below support level 1832, which will be followed by moving down to support level 1810 and if it keeps on moving down below that level, we may expect the market to reach support level 1780.

Previous forecast

This/Next Week Forecast (November 30 - December 4, 2020)

Uptrend scenario

An uptrend will start as soon, as the market rises above resistance level 1850, which will be followed by moving up to resistance level 1899.

Downtrend scenario

The downtrend may be expected to continue in case the market drops below support level 1780, which will be followed by reaching support level 1740.

Previous week gold forecast chart

Fundamental Analysis

Conditions in currency and interest rates sectors showing fair price on the level 1750, but new covid wave and lockdown increasing creating uptrend pressure.

Monthly Forecast, December 2020

Uptrend scenario

An uptrend will start as soon, as the market rises above resistance level 1850, which will be followed by moving up to resistance level 1950.

Downtrend scenario

The downtrend may be expected to continue in case the market drops below support level 1780, which will be followed by reaching support level 1680.

Previous forecast

Author

Anton Kolhanov

Anton Kolhanov

Anton Kolhanov is a trader and an analyst. He started to study the Forex market in 2003.