Gold surges amid mounting global risks

The price of gold reached 3,383 USD per ounce on Wednesday, trading near a two-week high. The rally is being driven by strong demand for safe-haven assets, fuelled by growing concerns over the independence of the US Federal Reserve.

US President Donald Trump has signalled a potential legal battle following the resignation of Federal Reserve Board member Lisa Cook, whom he had accused of misconduct. Her departure has reignited debates about the central bank's autonomy and the issue of political pressure. Cook's exit could accelerate the timing of interest rate cuts, aligning with Trump's public calls for a more accommodative monetary policy. Market pricing currently indicates an approximately 80% probability of a 25-basis-point rate cut by the Fed in September.

Trade tensions have further contributed to market unease. US authorities stated that a trade agreement with India before a key deadline is unlikely, which could result in tariffs on Indian goods doubling to 50%. Conversely, Indonesia has secured an exemption from tariffs on a range of raw materials. Simultaneously, Trump has threatened to impose severe tariffs on Chinese exports of rare earth metals, significantly escalating tensions between the two economic superpowers.

Political risks are also intensifying in Europe. The French Prime Minister continues to promote an austerity plan ahead of a crucial confidence vote, creating additional political uncertainty in the region.

Technical analysis: XAU/USD

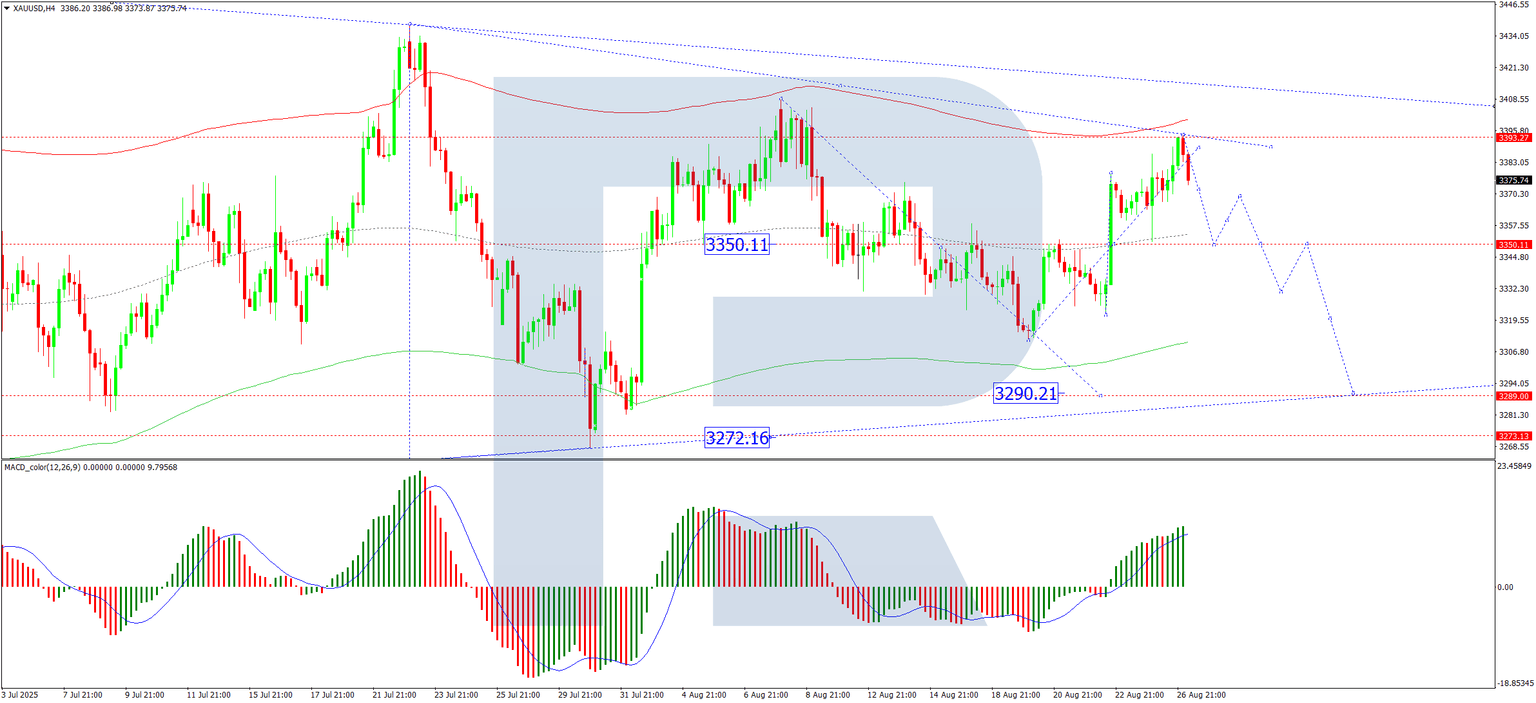

Four-hour chart

The XAU/USD pair on the H4 chart completed an upward wave towards the 3,393 USD level. The focus now shifts to the potential for a decline to the 3,350 USD support level. The market appears to be consolidating within a broad range around this point. A decisive break below this range would open the potential for a further downward wave towards 3,290 USD.

This bearish scenario is supported by the MACD indicator. Its signal line is above zero at recent highs but has diverged from the histogram, which suggests weakening momentum and a potential move towards new lows.

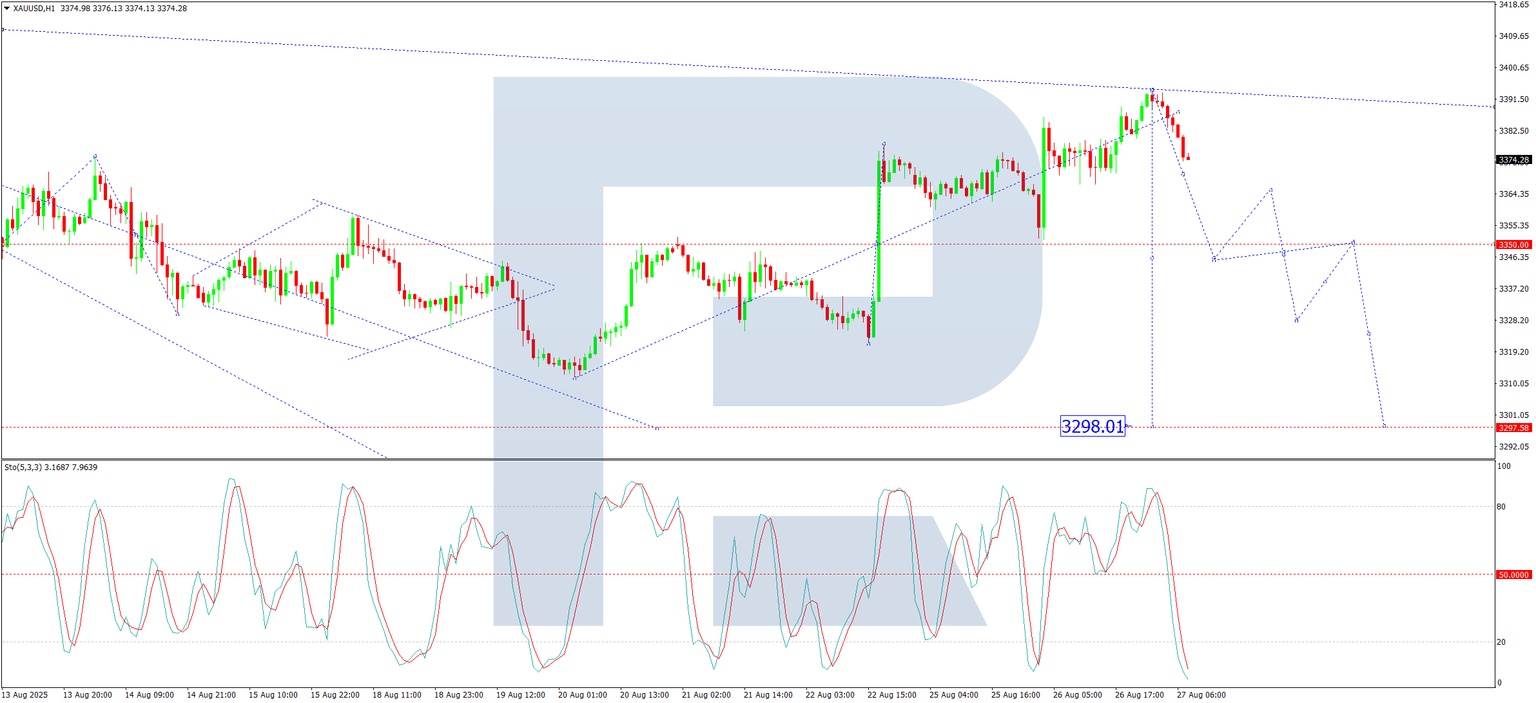

One-hour chart

On the H1 chart, the market has also completed a wave structure up to 3,393 USD, with a corrective wave down to 3,350 USD underway. Upon reaching this level, we anticipate the formation of a tight consolidation range. A subsequent breakout below this range could extend the decline to 3,330 USD, with the broader trend potentially targeting 3,290 USD.

This outlook is corroborated by the Stochastic oscillator. Its signal line is currently below the 50 level and is pointing sharply downwards towards 20, indicating strengthening downward momentum.

Conclusion

The fundamental landscape, marked by political and trade uncertainties, is bolstering gold's appeal as a safe-haven asset. Technically, after a period of consolidation, the indicators suggest a heightened potential for a downward move if key support levels are breached.

Author

RoboForex Analysis Department

RoboForex

RoboForex Analysis Department provides timely market insights, expert technical analysis, and actionable forecasts across forex, commodities, indices, and equities.