Gold, Silver, WTI crude

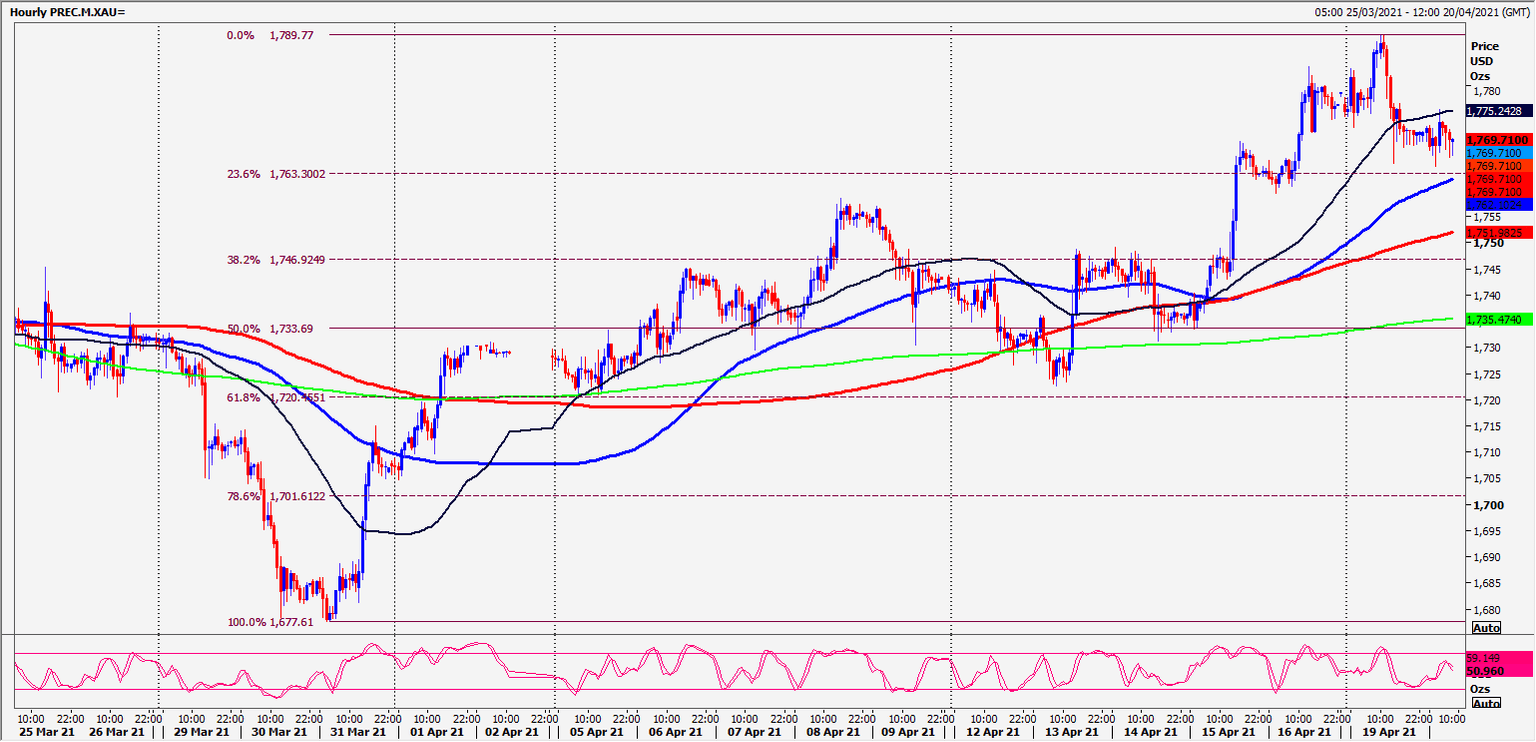

Gold Spot shot higher to 1789. Minor support at 1771/69 then better support at 1762/59.

Silver Spot still holding the next target of 2610/20.

WTI Crude JUNE Future tests the next target & resistance at 6380/6400. Update daily at 06:30 GMT

Today’s Analysis.

Gold best support today at 1764/61. Longs need stops below 1759. A break lower targets 1752/50 with support at 1748/46.

Holding best support today at 1764/61 on the downside targets 1775/80. Further gains retest yesterday’s high at 1788/90. A break higher today targets minor resistance at 1792/96 before strong 100 day moving average resistance at 1803/05.

Silver hit the next target of 2610/20 & topped exactly here as expected over the past 2 days. However a break above 2630 this week targets 2650/60, perhaps as far as 2685/95.

Strong support at 2575/65 saw a low for the day exactly as predicted. Longs need stops below 2755 today. Strong support at 2540/30 but longs need stops below 2510.

WTI Crude retests resistance at 6380/6400 this morning. If we continue higher today look for 6480/85 with strong resistance at 6535/65.

No representation or warranty is made as to the accuracy or completeness of this information and opinions expressed may be subject to change without notice. Estimates and projections set forth herein are based on assumptions that may not be correct or otherwise realised. All reports and information are designed for information purposes only and neither the information contained herein nor any opinion expressed is deemed to constitute an offer or invitation to make an offer, to buy or sell any security or any option, futures or other related derivatives.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk