Gold settles at highest level ever

Gold has had things all its own way lately with pretty well every price driver in its favour ; however tomorrow it faces a real challenge with the release of the all important US jobs data. This will be a good test of sentiment and how gold behaves will give us a good indication just how much fuel it has in the tank regarding further gains.

Trump as been at pains to highlight that the last 2 non-farm payroll reports have been the strongest in US history. It us clear his re-election chances are linked to an economic recovery - and for that to happen, he needs to project a positive message about the economic outlook. Earlier this week on Fox News he boasted "big job numbers are coming on Friday."

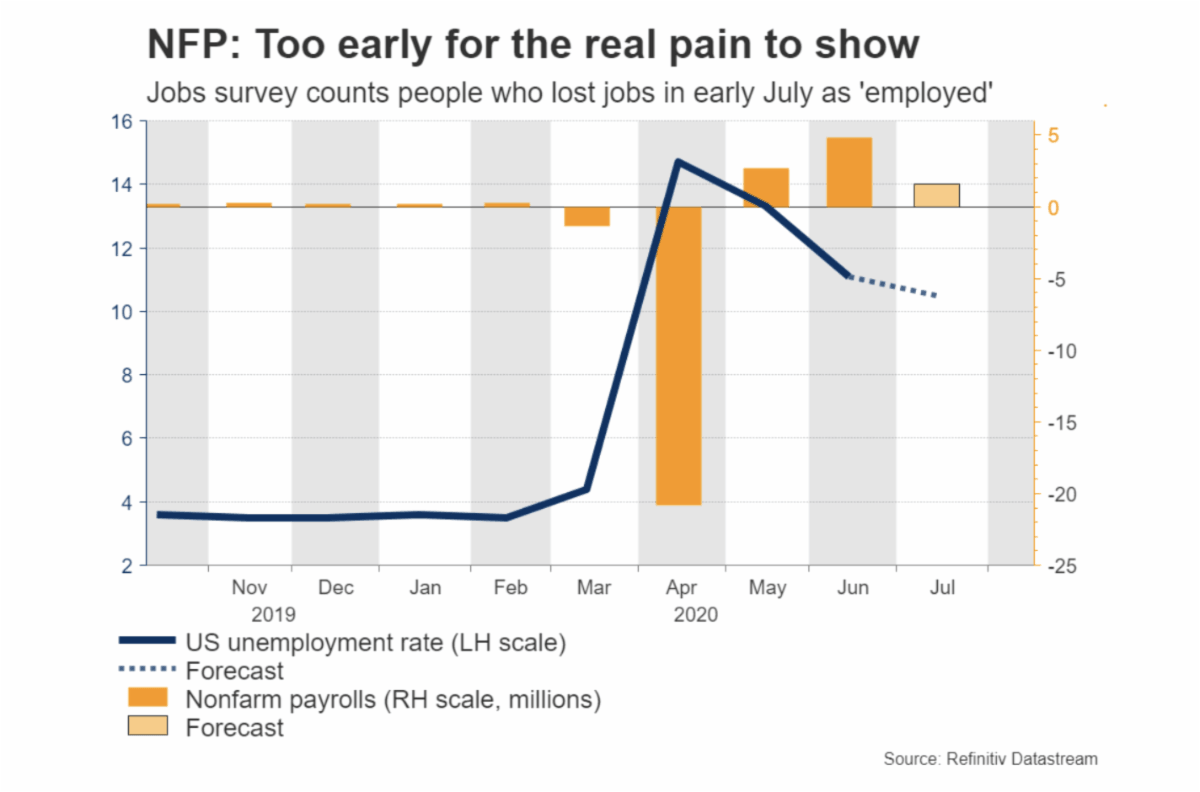

Although gold has only half an eye on the US dollar (the dollar index just slipped to a 2 year low), strong employment figures should boost the greenback and by extension, gold should correct lower. The outcome depends less on the absolute number and more on the relative number compared to expectations. The consensus is around 1.6 million jobs gained in July, following a massive leap of 4.8 million in June 2020. The report will be released at 12:30 GMT tomorrow.

In the last 18 weeks 55.3 million Americans have lost their jobs which has erased a decade of growth. To put that in perspective, there have been over 330 layoffs for every COVID death in the US.

Whatever the outcome, we should be clearer about the strength of conviction of gold bulls. Should we see a figure below growth of 1.6 million jobs then you might add an extra one to that number in due course … Trump himself.

Author

Ross Norman

Sharps Pixley

Sharps Pixley Ltd is owned by Ross Norman.