Gold retreats after sharp rally as Dollar recovery pressures upside

Gold (XAU/USD) is under pressure after a sharp reversal from recent highs. A deal between President Trump and Senate Democrats eased shutdown concerns and boosted confidence in the Dollar. At the same time, the Federal Reserve’s decision to hold rates steady triggered profit-taking after gold’s sharp rally. Rising volatility and uncertainty over the next Fed Chair have added to the pullback. Markets now await further signals on policy direction, while geopolitical risks continue to support underlying demand for gold.

Gold faces pressure from Dollar gains and Fed uncertainty

Gold’s recent pullback reflects renewed strength in the U.S. Dollar, which has gained traction across global markets. The rebound follows a series of macro developments, including a reported agreement between President Trump and Senate Democrats to prevent a government shutdown. The deal helped stabilize fiscal outlooks and lifted confidence in the Dollar.

In addition, the Federal Reserve’s decision to hold interest rates steady added pressure to gold. The Fed’s cautious stance signaled policy patience, but it also encouraged profit-taking after the metal’s historic rally. As volatility picked up ahead of key policy developments, market participants moved to lock in gains, deepening the pullback.

Attention now shifts to the upcoming Fed Chair nomination. Bloomberg reports that former Fed Governor Kevin Warsh is emerging as a leading candidate. Markets view the decision as a key signal for future monetary policy. A more hawkish choice could extend Dollar strength and weigh on gold in the short term. Even so, elevated geopolitical risks, including fresh U.S. tariff threats against Cuba and Canada, continue to underpin safe-haven demand for gold.

Gold retests breakout zone after clearing long-term channel resistance

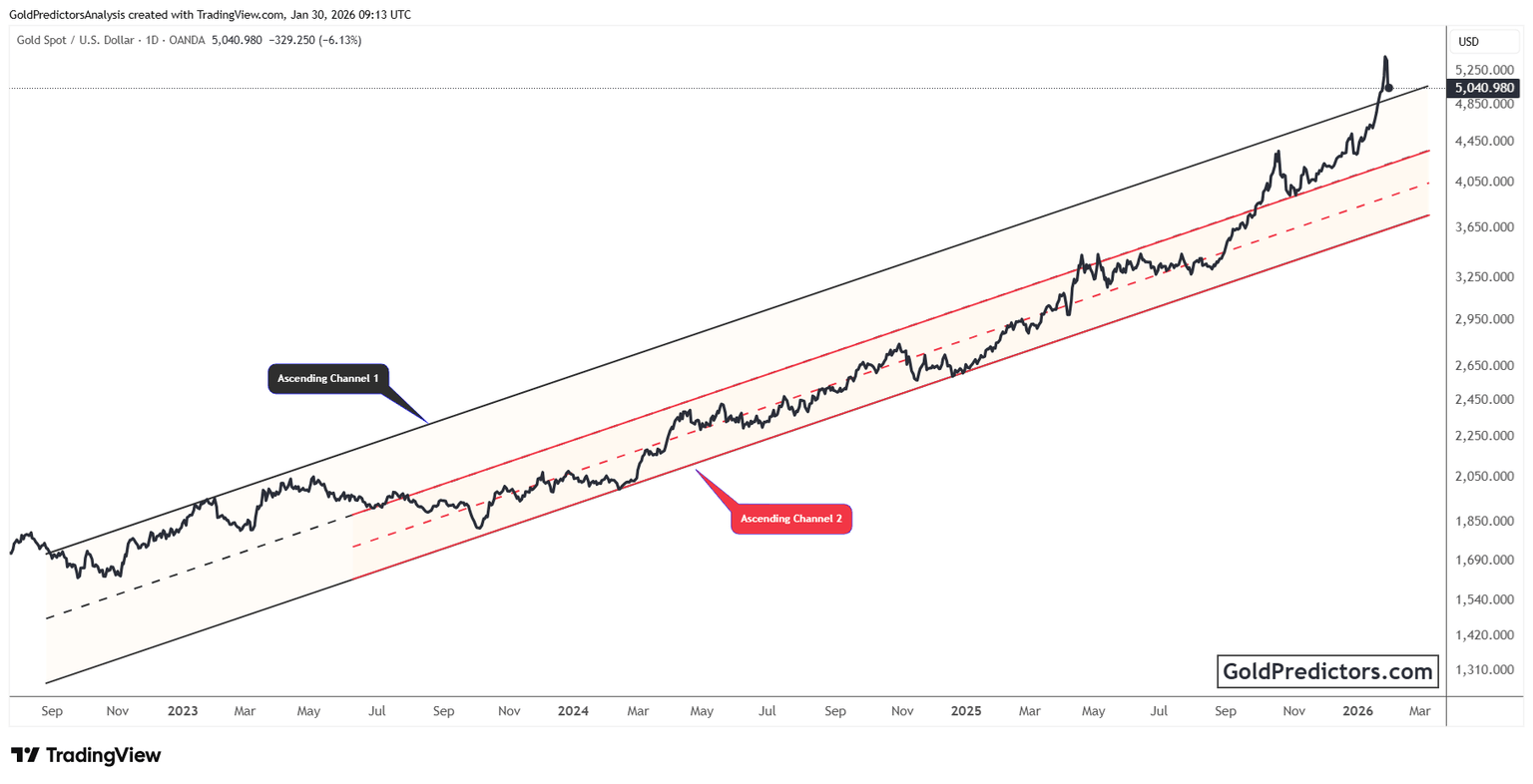

The gold chart below shows a decisive breakout from multiple ascending channels that shaped price action over several years. The broader structure called Ascending Channel 1 reflects a long-term uptrend where price consistently respected its boundaries. A steeper internal path called Channel 2 later developed within this range and marked a phase of accelerated momentum during gold’s mid-cycle rally.

In January 2026, gold rallied sharply and broke above the upper boundary of Channel 1. The move triggered strong upward momentum that carried the metal toward $5,600. This shift marked a transition from steady accumulation to rapid acceleration and confirmed a major breakout above multi-year resistance.

However, the current pullback is drawing price back toward Channel 1 support. This level, which previously acted as resistance, may now provide structural support. A strong defense near the $4,800–$4,900 zone would preserve the integrity of the broader bullish trend. However, a clean break below this area could open the door to a more extended consolidation.

Gold forecast: Rising volatility and Dollar gains challenge bullish momentum

Gold remains under pressure as markets digest renewed Dollar strength and the Fed’s policy stance. The pullback reflects both macro stabilization and investor caution ahead of key policy decisions. If the upcoming Fed Chair nomination signals a hawkish shift, the Dollar could extend gains. However, elevated geopolitical tensions continue to support underlying demand for gold. As long as price holds above structural support, the broader bullish trend remains intact.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.