Gold resumes its climb

Chaos Clinic for 11/6/2020

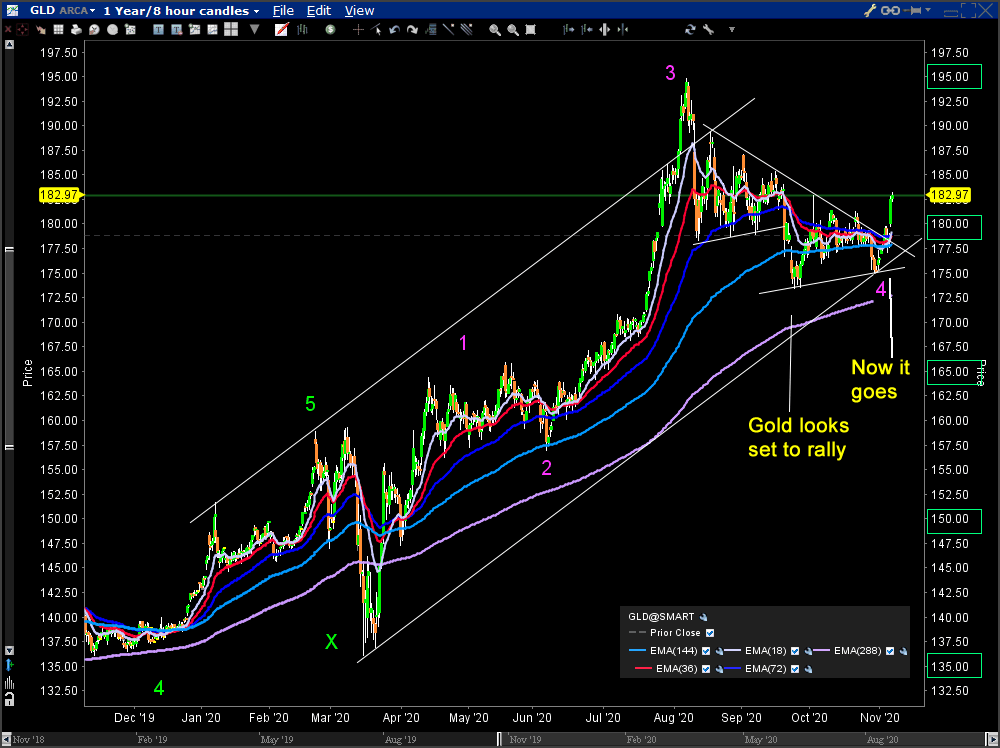

In early October Gold looked ready to rally. This 8-hour bar chart of the gold Exchange Traded Fund, GLD shows what happened. At that point, one could count 7 swings in the decline from the high at 3, so it looked like gold had completed a 7 move down Chaos Clamshell.

Then GLD broke lower, below the 144 bar EXMA. After several bars below that EXMA, prices recovered above it. Then over the next few weeks, prices formed another corrective base. If one looks closely there are now 13 moves down from the high at 3. This happens in fractals. Normally Chaos Clamshells have 7 moves. But on occasion, when two major cycles are turning, there are 13 moves.

Prices have now moved sharply upward, turning all of the EXMAs up, and breaking the resistance line. That 13 swing correction is now a clear descending wedge correction, So I have now labeled that point 4. That means move 5 is beginning.

The congestion traded close to the harmonic price of 180. These harmonic prices are the integer divisions of the circle of 360. The 24th harmonic has steps every 15 points. Move 5 can be expected to reach one of these steps. The long term channel top on a daily chart from 2005 is above 225 now and reaches 240 mid-2022, so GLD has a lot of upside potential.

Author

Dr. Al Larson, PhD

MoneyTide.com

Dr. Al Larson holds a Ph.D. in Electrical and Computer Engineering from the University of Wisconsin. He is a 1964 Distinguished Graduate of the U. S. Air Force Academy.