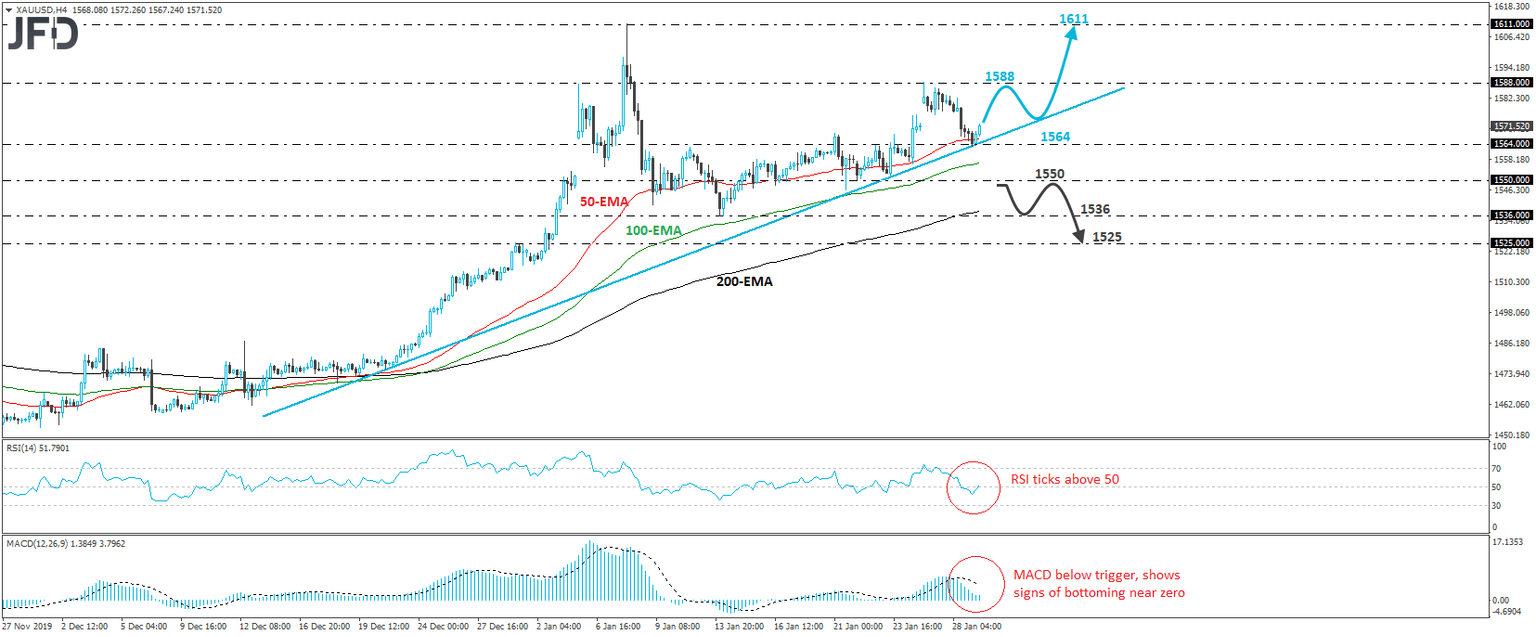

Gold Rebounds from an Upside Support Line

XAU/USD traded lower yesterday, but during the Asian morning today, it hit support near the crossroads of the 1564 level and the upside support line drawn from the low of December 20th. Then, it rebounded somewhat. The metal continues to trade above that line, while it also stands above all three of our moving averages. Thus, we would consider the short-term picture to be somewhat positive for now.

If the bulls are strong enough to stay in the driver’s seat, we could soon see them challenging the 1588 zone, marked as a resistance by the peak of January 26th. They may decide to take a break after testing that zone, thereby allowing the price to correct slightly lower. However, as long as the retreat stays limited above the aforementioned upside line, we would see decent chances for the bulls to jump back into the action and push the metal higher again. If they manage to overcome the 1588 hurdle this time around, we may experience extensions towards the 1611 territory, marked by the high of January 8th.

Shifting attention to our short-term oscillators, we see that the RSI rebounded and just poked its nose back above the 50 barrier, while the MACD, although below its trigger line, shows signs of bottoming slightly above zero. These indicators suggest that the yellow metal may start gathering upside speed soon, which enhances our view for some near-term advances.

On the downside, we would like to see a decisive dip below 1550, a zone which provided decent support between January 15th and 22nd, before we start examining whether the bulls have dropped their swords. The price would be already below the pre-mentioned upside support line, and may sail south towards the low of January 14th, at around 1536. If the bears are not willing to abandon the field near that zone, then a break lower may extend the slide towards the 1525 obstacle, marked by the inside swing high of December 31st.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Author

JFD Team

JFD