Gold pulls back but holds support on geopolitics and Fed bets

Gold is easing from recent highs, but key macro forces are still in play. Geopolitical instability across Venezuela, the Middle East, and Eastern Europe is keeping safe-haven demand elevated. At the same time, markets are focused on the Federal Reserve’s policy outlook, with rate cut expectations growing amid signs of labor market softening. This combination of unresolved global risks and shifting monetary conditions continues to shape gold’s outlook, offering support even as prices consolidate.

Gold eases from highs but finds support in global tensions and Fed bets

Gold is pulling back from recent highs, but geopolitical tensions continue to limit downside pressure. Despite the retracement, underlying global risks remain unresolved and sustain safe-haven demand. The initial reaction to the U.S. capture of Venezuelan President Nicolas Maduro has faded, yet broader instability persists. Furthermore, unrest in the Middle East, stalled Russia‑Ukraine negotiations, and rising tensions with Iran create an environment that favors defensive positioning. These risks keep demand for gold intact and are limiting additional downside.

At the same time, the Federal Reserve’s monetary policy outlook remains a key driver. Markets are increasingly betting on rate cuts starting as early as March. Soft economic data and cooling inflation are fueling dovish sentiment. Although some indicators, like the ISM Services PMI, came in stronger than expected, the broader trend points to a slowing labor market. This divergence is keeping pressure on real yields and supporting demand for non-yielding assets like gold.

Labor market data released this week painted a mixed picture. ADP employment rose by 41,000, modestly above the previous month but below expectations. Meanwhile, the JOLTS report showed job openings dropped to 7.15 million, suggesting cooling demand. Markets remain cautious ahead of the NFP report, which could clarify the Fed’s policy outlook.

Gold finds support inside rising channel with bullish momentum intact

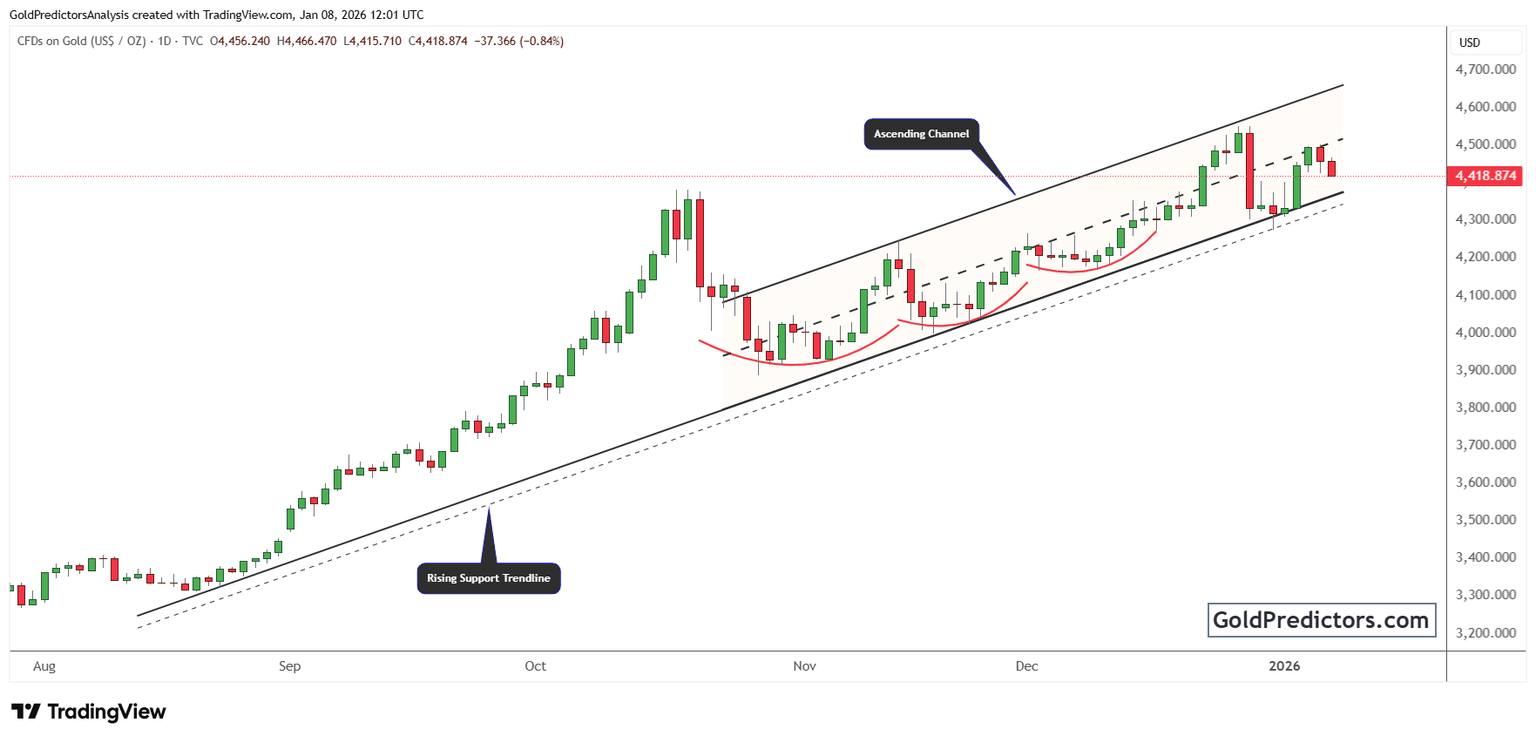

The gold chart below shows price holding within a well-defined ascending channel. This structure has guided price action since November, with higher highs and higher lows forming a clear uptrend. The recent dip has pulled prices slightly below the channel’s midline, though the broader bullish structure remains intact. A strong support zone lies near $4,370, aligned with both the lower boundary of the ascending channel and the rising trendline.

Moreover, a series of rounded bottom formations can be observed within the channel. These suggest recurring accumulation phases, each followed by renewed upside. The pattern highlights continued buying interest on dips, which validates the underlying trend. Every time gold has tested the lower boundary of the channel, it has bounced back with renewed strength, highlighting the channel’s reliability.

Additionally, the chart shows a rising support trendline extending from late August. This secondary trendline adds further confirmation of bullish momentum. As long as gold remains above this level, the broader technical outlook stays positive. A breakout above the channel’s upper band near $4,600 could trigger a fresh rally, while a break below $4,370 would raise short-term caution.

Gold outlook: Price holds key support ahead of NFP and policy clarity

Gold is retreating from recent highs, yet core support levels and macro drivers continue to hold. Geopolitical tensions continue to elevate safe-haven demand, while softer labor data fuels expectations for Fed rate cuts. Technically, gold is holding above rising support near $4,370, even after slipping below the channel’s midline. As long as this zone holds, the broader structure stays constructive. Markets now await the NFP report to confirm whether gold can stabilize or face deeper short-term pressure.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.