Gold prices poised to break higher, targeting $4,358 [Video]

![Gold prices poised to break higher, targeting $4,358 [Video]](https://editorial.fxsstatic.com/images/i/gold-02_XtraLarge.jpg)

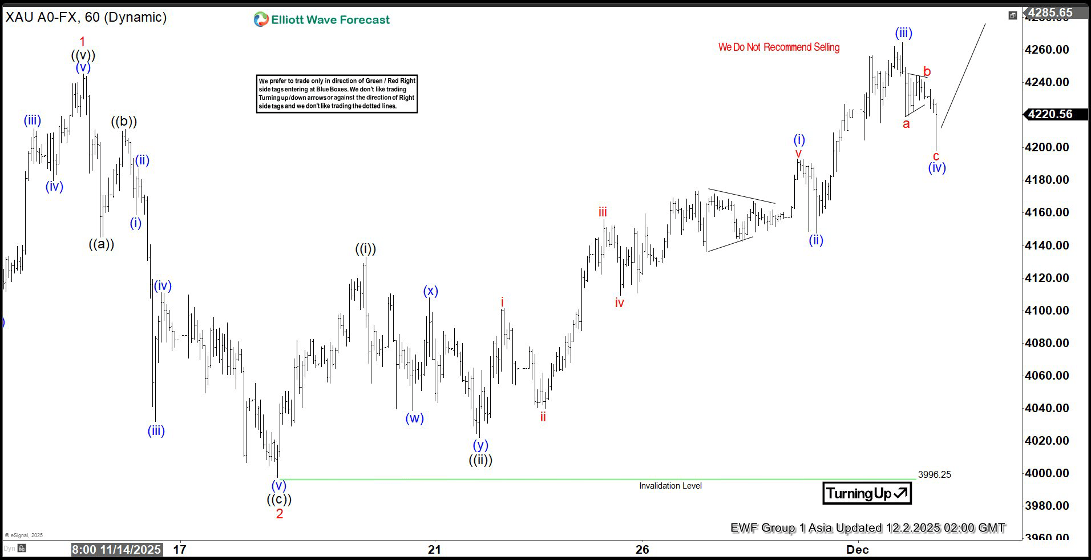

Gold continues to exhibit a bullish sequence from the 28 October low, suggesting further upside potential. The rally from that low is unfolding as a five‑wave impulse, with wave 1 concluding at 4245.22, as reflected in the one‑hour chart. Following this, wave 2 developed into a zigzag Elliott Wave structure. From the peak of wave 1, wave ((a)) ended at 4144.97, while the subsequent rally in wave ((b)) terminated at 4211.31. The decline in wave ((c)) reached 3996.25, thereby completing wave 2 at a higher degree.

The metal has since resumed its upward trajectory in wave 3, decisively breaking above the prior wave 1 peak. This confirms that the next leg higher has commenced. From the conclusion of wave 2, wave ((i)) ended at 4132.81. The corrective pullback in wave ((ii)) finished at 4022.07, forming a double three structure. One more leg higher is anticipated to complete wave ((iii)), after which a modest pullback in wave ((iv)) should occur. The market is then expected to advance again in wave ((v)), thereby concluding wave 3.

The potential target for this advance lies within the 100% to 161.8% Fibonacci extension of wave 1, calculated at 4358–4579. In the near term, as long as the pivot at 3996.25 remains intact, any pullback should find support within a sequence of 3, 7, or 11 swings, paving the way for continued strength. This structure reinforces the bullish outlook and highlights the importance of maintaining the key pivot level to sustain momentum.

Gold 60-minute Elliott Wave chart from 11.28.2025

Gold Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com