Gold price outlook: Trade deals pressure XAU/USD while Fed cut bets offer support

Gold (XAUUSD) prices face renewed pressure as improving trade sentiment and a stronger US Dollar weigh on demand. A new trade deal between the US and Vietnam has boosted investor confidence, triggering profit-taking in gold. Meanwhile, hopes for further tariff relief have added to the optimism. However, unresolved issues with Japan and weak US labour data keep uncertainty high. Expectations of Federal Reserve rate cuts continue to support gold, creating a push-pull dynamic in the market.

US labour market weakness and trade deals impact Gold’s safe-haven demand

President Donald Trump’s announcement of a trade agreement with Vietnam brought relief to global markets. The US will impose lower tariffs on Vietnamese imports, while American companies gain tariff-free access to Vietnam’s markets. This breakthrough eased trade tensions and sparked risk-on sentiment, leading to profit-taking in gold after a three-day rally. Simultaneously, US-India trade talks are progressing, with hopes of sealing a tariff-reducing deal before Trump’s July 9 deadline. These developments have reduced demand for gold as a haven, as investor confidence improves.

Despite some progress, trade uncertainty persists. Talks between the US and Japan remain stalled, and Trump has not indicated any intention to extend negotiation deadlines. This ongoing tension leaves markets cautious, with gold likely to retain some support due to its safe-haven appeal. Although risk sentiment has improved, lingering concerns over unresolved trade issues persist. As a result, gold may continue to find support as a safe-haven asset.

On the economic front, U.S. labour market data have raised fresh concerns. The ADP private-sector report showed an unexpected drop of 33,000 jobs in June, marking the first decline in over two years. The prior month’s figure was also revised lower. Additionally, the JOLTS report revealed weaker job openings, signalling a cooling labour environment. As a result, expectations for Federal Reserve rate cuts have intensified, with traders pricing in a 25% chance of a July cut and anticipating two total cuts by year-end. These dovish expectations are capping the US Dollar’s recovery and providing downside support for gold. All eyes are now on Friday’s US Nonfarm Payrolls (NFP) report, which could determine gold’s near-term direction.

Gold price consolidation near trendline reflects market indecision

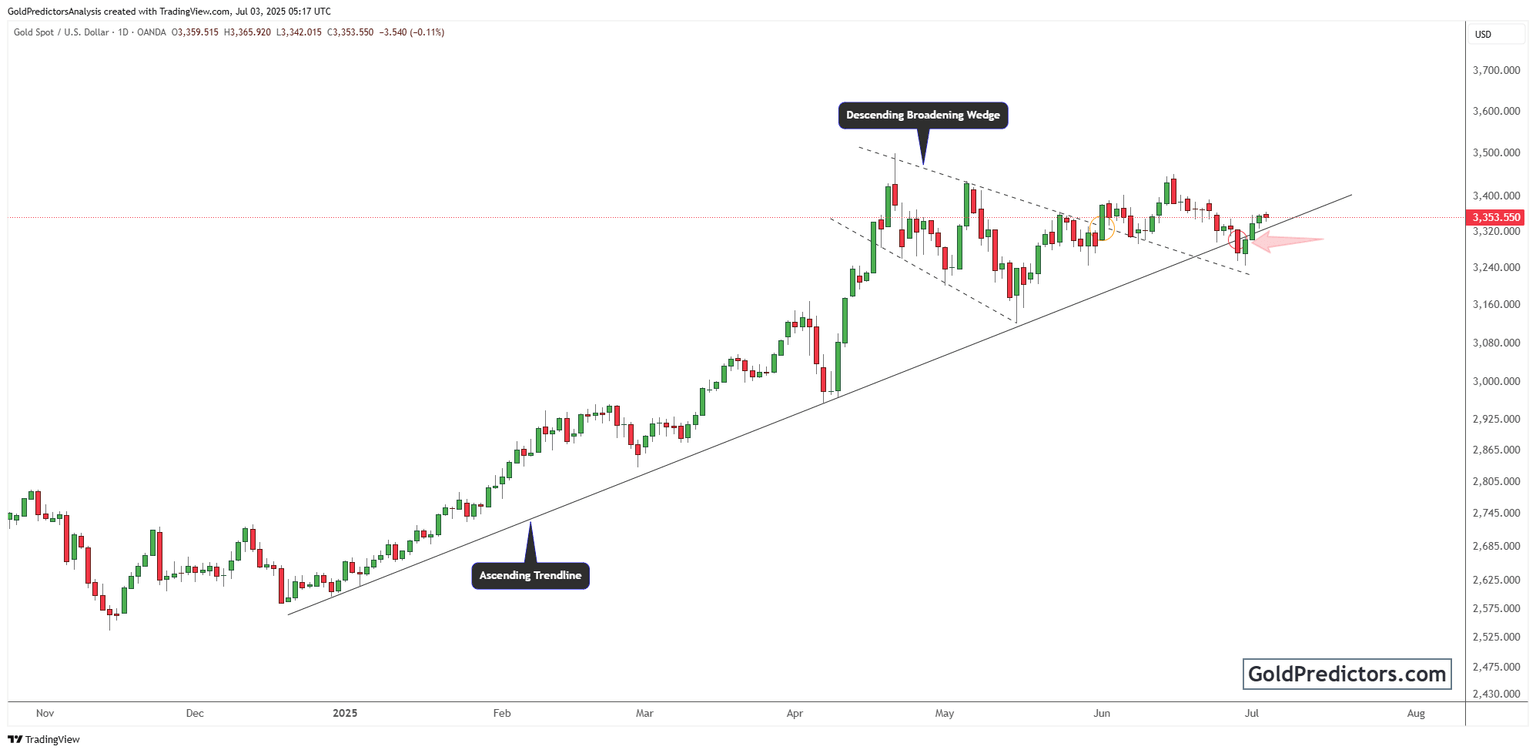

The gold chart below shows a well-defined uptrend supported by an ascending trendline that extends from late 2024 to mid-2025. This trendline has consistently acted as a key technical support level throughout the rally. In April and May, gold formed a Descending Broadening Wedge, a classic bullish continuation pattern, and successfully broke out of it, reinforcing the upward bias.

Despite the breakout, the rally faced resistance around the $3,400 to $3,420 zone. Recent candlestick patterns indicate a failed attempt to sustain movement above the ascending trendline. Gold briefly dipped below the trendline but managed a swift recovery and is now hovering near it once again, suggesting indecision among traders.

Immediate support lies around the $3,320 level, marked by a pink arrow on the chart. A clean break below this zone could trigger a deeper correction. Conversely, a daily close above $3,380 is needed to restore bullish momentum. Overall, price action remains mixed, with the market reflecting underlying uncertainty tied to trade negotiations and the Federal Reserve's policy direction.

Conclusion

Gold remains caught between competing forces. Positive trade developments and a stronger US Dollar are pressuring prices, while weak US labour data and expectations of Fed rate cuts are offering support. The metal’s technical setup reflects this tug of war, with key levels defining near-term direction. Until clearer signals emerge from upcoming economic data, gold is likely to trade sideways, balancing risk sentiment and demand for safe havens.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.