Gold Price Forecast: XAUUSD rebound - a good selling opportunity?

- Gold Price rebounds from two-month lows but eyes worst month in seven.

- Disappointing US Q1 GDP re-ignites XAUUSD’s safe-haven appeal.

- Gold Price eyes acceptance above Fibonacci 23.6% ahead of US PCE inflation.

Gold Price is holding the higher ground above $1,900, looking to extend the recovery from over two-month lows of $1,872. Despite the renewed upside, Gold Price remains on track to book its worst month in seven on an increasingly hawkish Fed. The rebound in XAUUSD is mainly powered by reviving safe-haven appeal of the metal after the US preliminary GDP showed an unexpected 1.4% contraction in Q1.

The details in the report, however, remain robust, suggesting that the disappointing headline figure is unlikely to deter the Fed’s commitment to fighting inflation. The CME’s FedWatch tool continues to show a 96.5% probability of a 50-bps rate hike in May and an 85% probability that the world’s most powerful central bank will go for another 50-bps raise in June. The US dollar, therefore, is likely to have an upper edge across the G10 fx space, keeping any upside in Gold Price short-lived. Adding to it, the greenback will also likely benefit from looming China’s covid concerns and the EU-Russia energy crisis, courtesy of the Russian invasion of Ukraine.

That said, the fate of Gold Price will hinge on the upcoming Eurozone Q1 Preliminary GDP release while the inflation readings from both sides of the Atlantic will also have a strong bearing on the USD-priced bright metal. The Fed preferred inflation gauge, the Core PCE Index, is likely to arrive at 0.3% MoM in March and at 5.3% YoY, slightly softer than the previous prints. The US Michigan Consumer Sentiment Index for April will be also closely followed ahead of the May 4 Fed meeting. The broader market sentiment and the dollar price action will remain the main market drivers, although the month-end flows could also come into play.

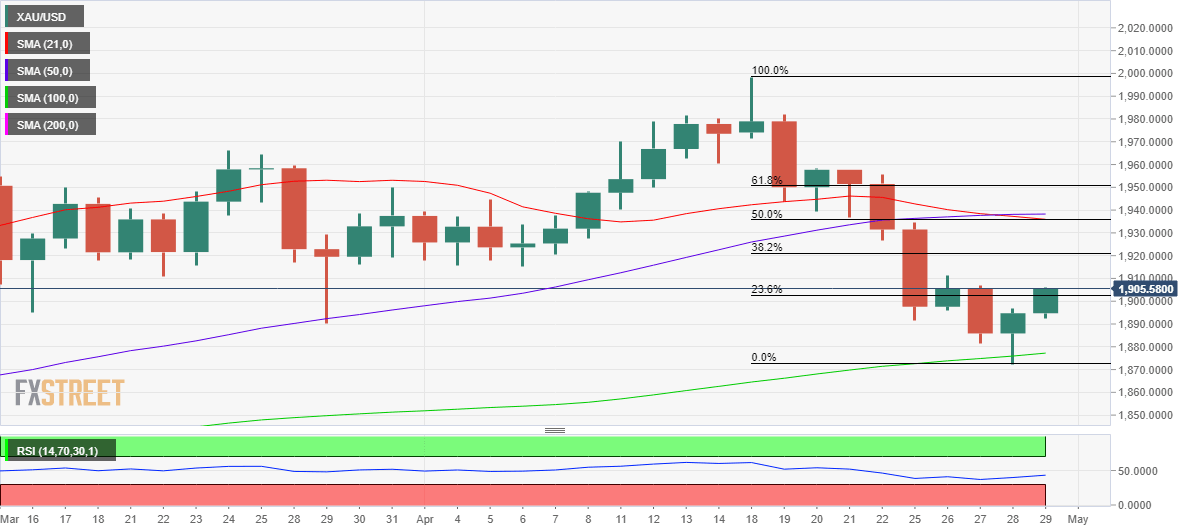

Gold Price Chart: Daily chart

The daily chart shows that Gold Price has recaptured $1,902 hurdle, which is the Fibonacci Retracement (Fibo) level of the correction from April 18 highs of $1,998 to the two-month troughs of $1,872.

If bulls manage to find a strong foothold above the latter on a daily closing basis, then the recovery could extend towards the April 26 highs of $1,911.

Further up, the Fibo 38.2% of the same decline at $1,921 will challenge the bearish commitments.

The 14-day Relative Strength Index (RSI) is edging higher but remains well below the midline, suggesting that the bearish bias remains intact in the near term.

Also, a bear cross confirmed Wednesday is in play, adding credence to the resumption of the downtrend.

Selling resurgence could see a retest of the daily lows at $1,892, below which the April 27 low of $1,881 will be targeted.

Thursday’s low of $1,872 will be the level to beat for XAUUSD bulls should bears keep their sights on the $1,850 psychological barrier.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.