Gold Price Forecast: XAU/USD’s bullish potential intact despite the US dollar’s bounce

- Gold eyes additional upside towards $1880 amid economic growth concerns.

- The US dollar’s bounce appears temporary amid dovish Fed expectations.

- US dollar dynamics and Fedspeak in focus for near-term trading impetus.

Gold (XAU/USD) extended the bounce for the second straight session on Friday, rallying nearly $30 from intraday lows, as the all-important US Retail Sales disappointed markets and boosted odds for the Fed to sticks to its accommodative monetary policy stance for longer. The US consumer demand showed no growth in April, which tamed the mounting fears over higher inflation. Treasury yields dropped further towards the 1.60% level dragging the US dollar across the board while boosting the demand for the non-yielding gold. Markets ignored the comments from Dallas Fed Chief Robert Kaplan, as he expressed concerns over rising inflation expectations and its potential impact on wages.

Starting out a fresh week, gold remains on the front foot so far this Monday, having taken out the critical 200-daily moving average (DMA) at $1846. The gold price hovers near three-month highs above $1850, shrugging off the bounce in the US dollar across the board. Gold is benefiting from the risk-averse market conditions, thanks to the renewed worries about coronavirus restrictions in Asia. A major covid outbreak haunts Taiwan and Singapore while India and Japan struggle with rising cases and regional lockdowns. Further, dovish Fed expectations and concerns over dwindling Chinese economic recovery also keep the bullish undertone intact in gold. Gold investors now look forward to the Fedspeak and dollar dynamics amid a quiet start to the week.

Gold Price Chart - Technical outlook

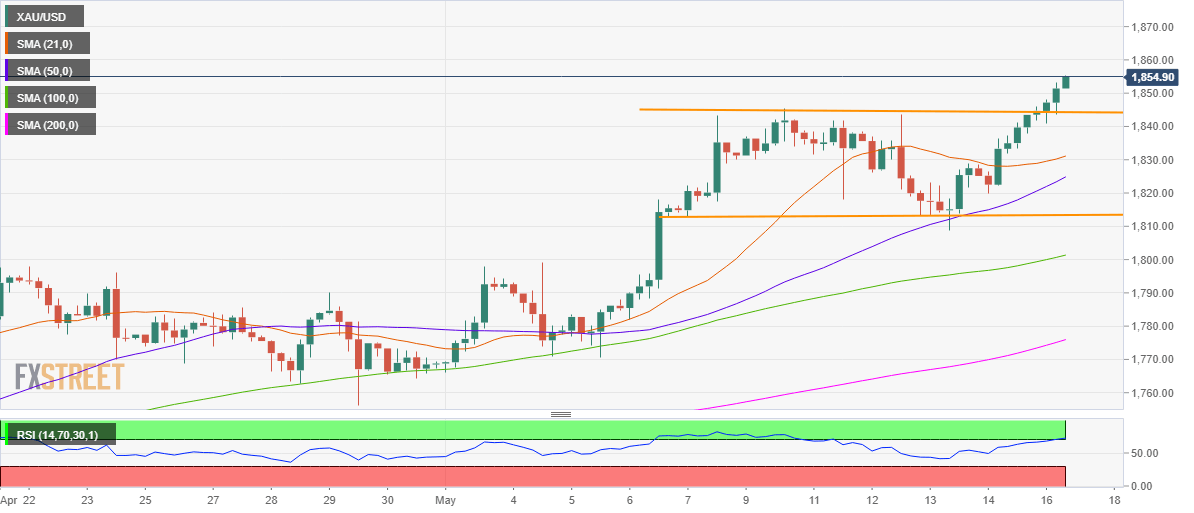

Gold: Four-hour chart

Gold prices have confirmed a rectangle breakout on the four-hour chart in early dealing, with additional upside seen towards $1880.

However, with the Relative Strength Index (RSI) peeping into the overbought territory, the gold bulls could turn a bit cautious before resuming another leg higher.

Alternatively, the immediate downside is likely to be cushioned at the pattern resistance now support at $1844.

The mildly bullish 21-simple moving average (SMA) at $1831 could be the next significant cap.

All in all, gold’s path of least resistance appears to the upside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.