Gold Price Forecast: XAU/USD’s 4H chart signals caution amid stimulus hopes, ahead of Fed

- US stimulus and vaccine optimism downs US dollar along with gold.

- 4H chart spots a potential descending triangle and bearish crossover.

- US stimulus talks closely followed ahead of Wednesday’s Fed decision.

Gold (XAU/USD) settled last week with modest losses below $1940, as the bears dominated amid fading hopes for a US coronavirus relief aid. Further, investors remained optimistic about the US Food and Drug Administration’s (FDA) authorization to Pfizer’s covid vaccine. Although the looming concerns over the virus growth on both sides of the Atlantic and no-deal Brexit fears cushioned the downside in the safe-haven gold.

The risk sentiment has improved starting out a fresh week, weighing on the yellow metal, as markets await the vaccine rollout in the US after the FDA authorization early Saturday. Further, renewed Brexit optimism after the talks extended past a Sunday deadline added to the upbeat market mood.

The vaccine optimism counters the likelihood of a US fiscal stimulus deal to be reached this week, rendering gold-negative. According to sources, a $908 billion bipartisan coronavirus relief package will be introduced in the US Congress as early as Monday. Also, gold traders remain jittery heading into the much-awaited and the final FOMC monetary policy decision of this year.

Gold Price Chart - Technical outlook

Gold: Four-hour chart

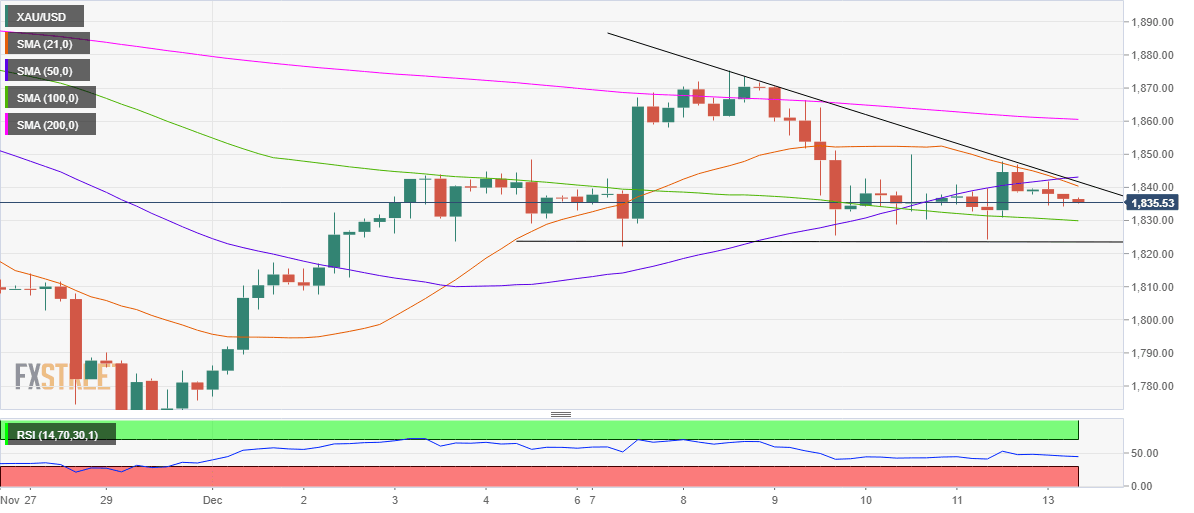

Looking at the four-hour chart, the outlook for gold remains downbeat in the coming sessions. The spot has carved out a descending triangle formation on the given timeframe, with the upside attempts capped by the confluence of the falling trendline resistance and bearish 21-simple moving average (SMA) at $1841, as of writing.

The sentiment has turned somewhat bearish, as the 21-SMA has pierced through the 50-SMA from above, confirming a bear crossover. Adding credence to the downside, the Relative Strength Index (RSI) point south (currently at 44.58) below the midline.

Immediate support awaits at the horizontal 100-SMA at $1830, below which the triangle support at $1823.50 could be tested.

Alternatively, a sustained break above the aforesaid critical resistance could confirm the descending triangle breakout and negate the recent downside bias. The XAU bulls could then challenge the 200-SMA at $1861.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.