Gold Price Forecast: XAU/USD threatens key $3,155 support ahead of US data, Powell

- Gold price remains vulnerable near monthly lows below $3,200 early Thursday.

- The US Dollar snaps the overnight rebound ahead of key US data and Powell’s speech.

- Will Gold price defend the 50-day SMA at $3,155 as RSI stays bearish?

Gold price is looking to extend the previous day’s over 2% sell-off early Thursday. The yellow metal remains vulnerable near monthly lows, trading below $3,200, as it awaits the high-impact US Producer Price Index (PPI) and Retail Sales data ahead of Federal Reserve (Fed) Chair Jerome Powell’s speech.

Gold price at the mercy of US data and geopolitics

A negative shift in risk sentiment in Asian trades on Thursday seems to be exerting renewed downward pressure on the US Dollar (USD), helping Gold price pause its decline at the moment.

Traders are turning cautious and refraining from placing directional bets on the Greenback and Gold price before the release of the US PPI inflation and Retail Sales data, which could significantly impact the markets’ expectations of future interest rate cuts by the Fed.

Retail volumes could see a big boost from frontloading to get ahead of US tariffs impact, while the US PPI inflation is set to decline to 2.5% over the year in April. Markets are pricing in about 53 basis points (bps) of Fed rate cut this year, with a probability of a 25 bps rate reduction in September standing at about 50%, according to the CME Group’s Fed Watch Tool.

The increased odds of fewer Fed rate cuts continue to act as a headwind to the non-yielding Gold price, even though the US Consumer Price Index (CPI) cooled slightly in April. Annually, US CPI rose 2.3% in the same period, compared to a forecast of 2.4%.

Gold price also bears the brunt of receding US recession fears, courtesy of the trade truce between the world’s two largest economies – the US and China. Furthermore, optimism over US-South Korea trade talks and expectations of a US-Iran nuclear deal keep the traditional safe-haven Gold price under pressure.

However, it remains to be seen if the Gold price continues its descent, as risk sentiment could deteriorate further if the upcoming Ukraine-Russia peace talks turn sour. Weaker-than-expected US PPI and Retail Sales data could rekindle dovish Fed expectations and provide the much-needed support to Gold price.

Additionally, Gold price could draw support from rising tensions over the US deficit after Treasury reported a $1.049 trillion budget deficit for the first seven months of fiscal 2025, which started October 1, up 23%, or $194 billion, from a year earlier.

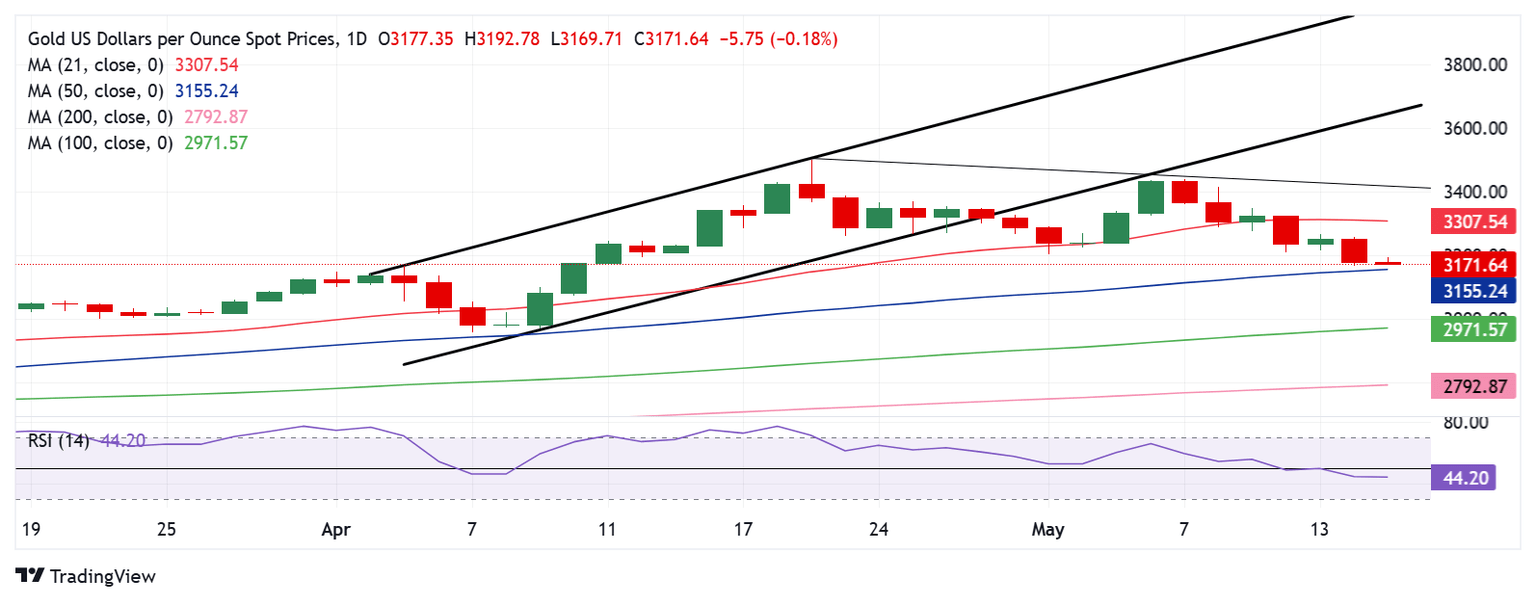

Gold price technical analysis: Daily chart

Technically, Gold price remains exposed to further downside risks so long as the price stays below the 21-day Simple Moving Average (SMA) at $3,308.

Currently, the yellow metal is challenging the key 50-day Simple Moving Average (SMA) at $3,155.

The 14-day Relative Strength Index (RSI) is currently holding below the midline, near 44, indicating more downside potential.

However, if buyers manage to defend the 50-day SMA at $3,155, a rebound toward the 21-day SMA at $3,308 cannot be ruled out.

Further up, the falling trendline resistance at $3,419 will come into play.

A sustained break below the 50-day SMA support could trigger a fresh downtrend toward the 100-day SMA at $2,972

Ahead of that, the $3,100 round level and the April 10 low of $3,072 would be tested.

Economic Indicator

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Next release: Thu May 15, 2025 12:40

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.