Gold Price Forecast: XAU/USD risks a pullback on overbought conditions, US PMIs eyed

- Gold price flirts with record highs near $2,625 early Monday.

- The US Dollar rebounds with Treasury bond yields, awaiting US PMI data and Fedspeak.

- Overbought daily RSI warrants caution for Gold buyers, as $2,550 support remains in sight.

Gold price is looking to build on its two-day uptrend in Asian trades on Monday even as the US Dollar (USD) attempts a tepid recovery alongside the US Treasury bond yields in the run-up to the global preliminary business PMI data.

Gold price eyes Mid-East concerns, US PMI data

Following the jumbo US Federal Reserve (Fed) interest rate cut-led subdued performance, the USD buyers ae trying their luck at the start of the new week, underpinned by escalating Middle East geopolitical tensions even as markets price in another 50 basis points (bps) Fed rate cut in November.

On Saturday night, Hezbollah fired at least 10 missiles into northern towns and cities of Israel's Jezreel Valley, the Times of Israel reported. In response, Israeli jets carried out a series of retaliatory strikes across southern Lebanon, targetting at least 110 Hezbollah positions.

The Greenback also finds support from the US House Republicans’s announcement to unveil a stopgap spending bill to fund the government through December 20. The bill due to be voted on the House floor by mid-week.

The uptick in the US Treasury bond yields aids the US Dollar’s latest leg higher but the further upside depends upon the upcoming Euro are and US preliminary Manufacturing and Services PMI data.

Should the PMI reports rekindle recessionary fears worldwide, the US Dollar recovery could likely gain traction on increased safe-haven buying, triggering a fresh correction in the Gold price from record highs.

However, the downside in Gold price is likely to remain cushioned by the expectations of another 50 bps rate cut by the Fed and looming Middle East tensions. Further, hopes for more stimulus coming in from China after the People’s Bank of China’s surprise rate cut early Monday, could also render positive for Gold buyers.

China's central bank surprised markets by lowering its 14-day repo rate by 10 bps to stimulate the economic recovery impeded by the manufacturing sector slowdown and the property market woes.

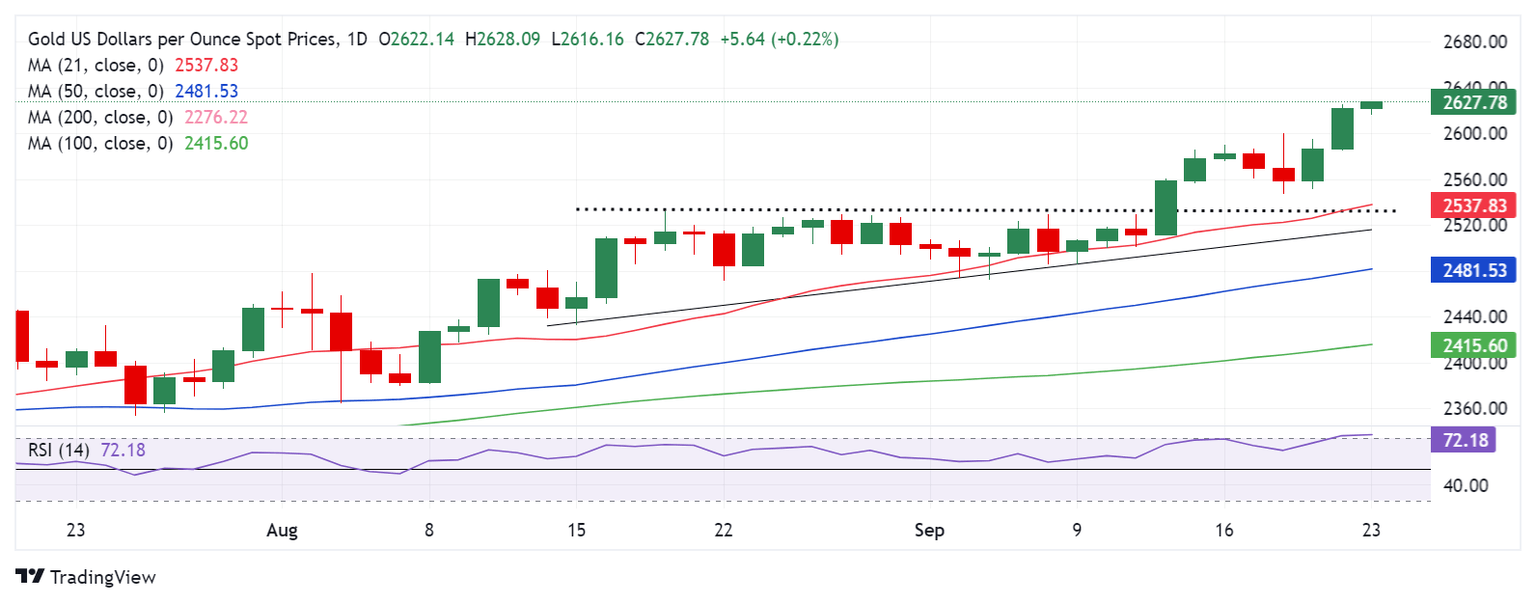

Gold price technical analysis: Daily chart

As observed on the daily chart, Gold price looks primed for a correction, as the 14-day Relative Strength Index (RSI) sits within the overbought territory, currently near 72.

If buyers manage to defy the bearish pressures, the $2,530 round level needs to be taken out decisively for further upside. Acceptance above that level will call for a test of the $2,650 psychological barrier, as buyers then target the $2,700 threshold for the first time ever.

On a corrective move lower, Gold price will test the previous day’s low of $2,585, below which the static support at around $2,550 will be challenged.

Depper correction could threaten the key support near $2,535, where the August 20 high and the 21-day Simple Moving Average (SMA) converge.

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity in the manufacturing sector is generally declining, which is seen as bearish for USD.

Read more.Next release: Mon Sep 23, 2024 13:45 (Prel)

Frequency: Monthly

Consensus: -

Previous: 47.9

Source: S&P Global

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.