Gold Price Forecast: XAU/USD returns to its comfort zone around $2,030

XAU/USD Current price: 2,0331.60

- Government bond yields and Fed’s speakers lead the way.

- Robust United States employment figures further undermined rate cut odds.

- XAU/USD volatile price action ended without providing directional clues.

Spot Gold hovers around $2,030 in the American session, posting modest intraday losses on Thursday. The US Dollar remained weak during Asian trading hours, picking up some steam ahead of Wall Street’s opening but holding within familiar levels. In the absence of relevant macroeconomic data, market players are taking clues from yields and central banks’ speakers.

The yield on the 10-year US Treasury note surged intraday to 4.16% following United States (US) employment data. The country reported that weekly unemployment claims rose to 218K in the week finished February 2, beating the 220K expected. Robust data from the labor sector further undermined the rate-cut odds in the country. Meanwhile, remarks from Federal Reserve (Fed) officials align with Chair Jerome Powell’s comments following the central bank monetary policy meeting.

American policymakers are confident inflation is in the right direction but maintain the cautious stance of waiting for more data to confirm it will keep trending lower. Overall, market participants are trying to digest the fact that rate cuts could be less than initially expected this year.

XAU/USD short-term technical outlook

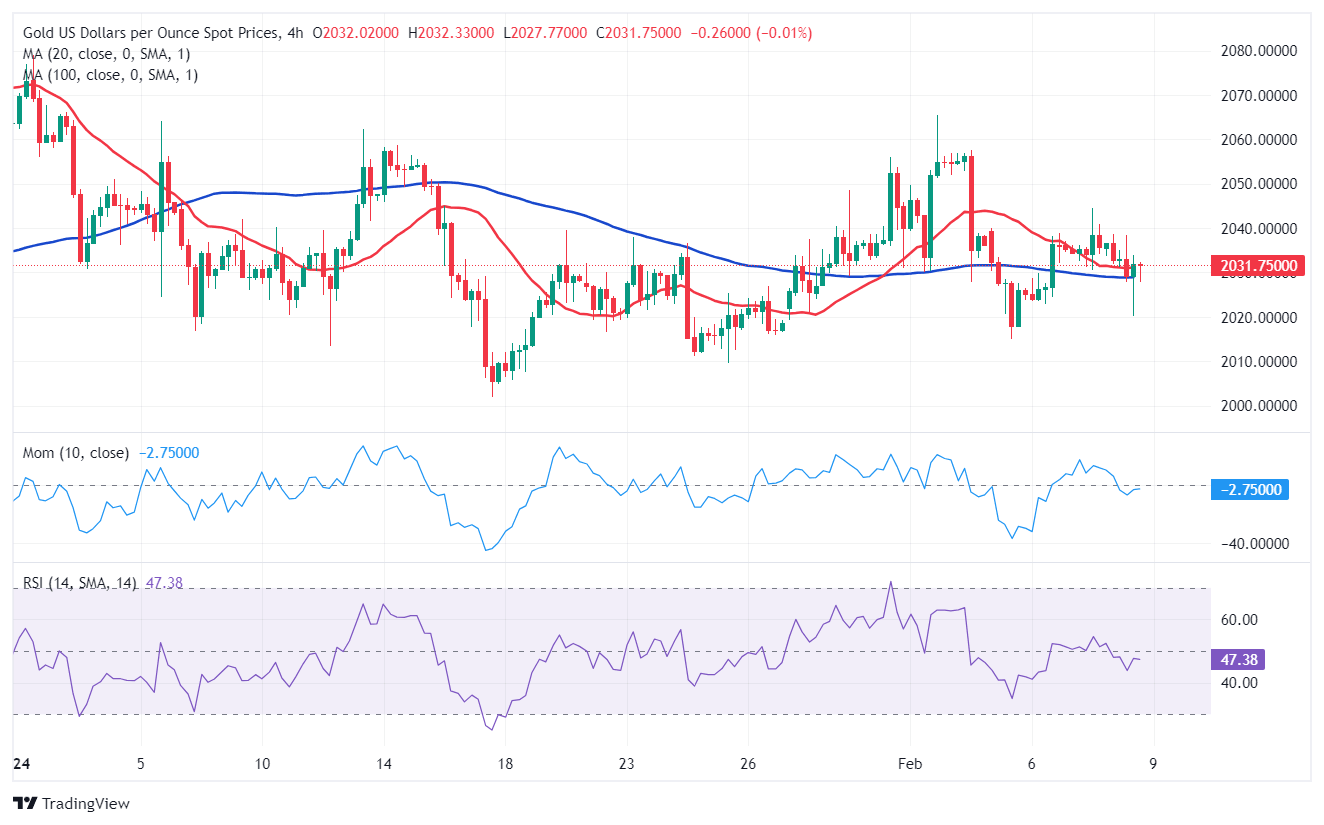

XAU/USD fell to an intraday low of $2,020.08, recovering $10 afterwards, and went back to its comfort zone. The pair is technically neutral according to the daily chart, still stuck around a directionless 20 Simple Moving Average (SMA). The longer moving averages remain far below the current level, partially losing their upward strength. Finally, technical indicators have returned to consolidate around their midlines, reflecting the lack of directional conviction.

For the near term, the upward potential seems limited. XAU/USD briefly dipped below all its moving averages, which anyway lack directional strength, but quickly returned to above the 20 and 100 SMAs. Technical indicators, in the meantime, turned back north but remain around neutral levels, failing to provide fresh clues.

Support levels: 2,022.75 2,009.10 1,988.90

Resistance levels: 2,044.60 2,053.10 2.065.60

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.