Gold Price Forecast: XAU/USD recaptures key 50-day SMA resistance, where next?

- Gold price is looking to extend the previous pullback from weekly highs early Wednesday.

- US Dollar snaps the overnight sell-off but will the rebound last heading into the US ADP jobs data?

- Gold price reclaims key 50-day SMA barrier but daily RSI struggles at the midline.

Gold price has come under renewed selling pressure early Wednesday, as the US Dollar (USD) attempts a tepid bounce amid a deteriorating risk sentiment.

Gold price sees two-way risks ahead of US jobs data

The USD finds renewed demand, snapping the overnight sell-off led by fresh concerns over US tariffs and US President Donald Trump’s ‘big, beautiful’ spending bill, while checking the Gold price upside.

Late Tuesday, Trump said that he is “not thinking about extending the deadline date,” while adding that “tariffs in Japan could reach 30-35%.”

The Greenback was also hit by Trump’s continued attacks on Powell, putting Fed independence at risk.

Meanwhile, increased concerns over a $3.3 trillion addition to the national debt, after the spending bill was passed by the US Senate, added to the USD’s bearish undertone. The bill will return to the House for final approval on Wednesday.

Earlier in the day on Tuesday, the Greenback received the much-needed reprieve from the US economic data releases, which indicated a strong US economy.

Job openings, a measure of labor demand, were up 374,000 to 7.769 million by the last day of May, compared to the expectations of 7.3 million in the reported period.

The US ISM Manufacturing PMI improved to 49 in June versus May’s 48.5 and the forecast of 48.8.

However, the upswing in the US Dollar was short-lived as markets digested comments from US Federal Reserve (Fed) Chairman Jerome Powell at the European Central Bank (ECB) Forum on central banking in Sintra on Tuesday.

Powell said: "We're taking time, for as long as the US economy is solid, the prudent thing is to wait."

About the timing of the next interest rate move, Powell noted, “I wouldn't take any meeting off the table. Can't say if July is too soon to cut rates, will depend on data."

According to the CME Group’s FedWatch Tool, markets now price in a 22 chance of the Fed trimming rates this month while predicting a 72% probability of a rate cut in September, down from 77% seen before Powell’s comments.

The USD dynamics continue to influence the Gold price direction as all eyes now turn to the US ADP jobs data due later this Wednesday and the critical Nonfarm Payrolls (NFP) report on Thursday.

The US private sector is expected to create 95K jobs in June, following a meager 37K job gain in May.

Weak labor data could revive the odds of a July Fed rate cut and also bets for more than three rate reductions this year.

However, the US NFP data could hold the key to altering the market’s pricing of the Fed rate cut expectations.

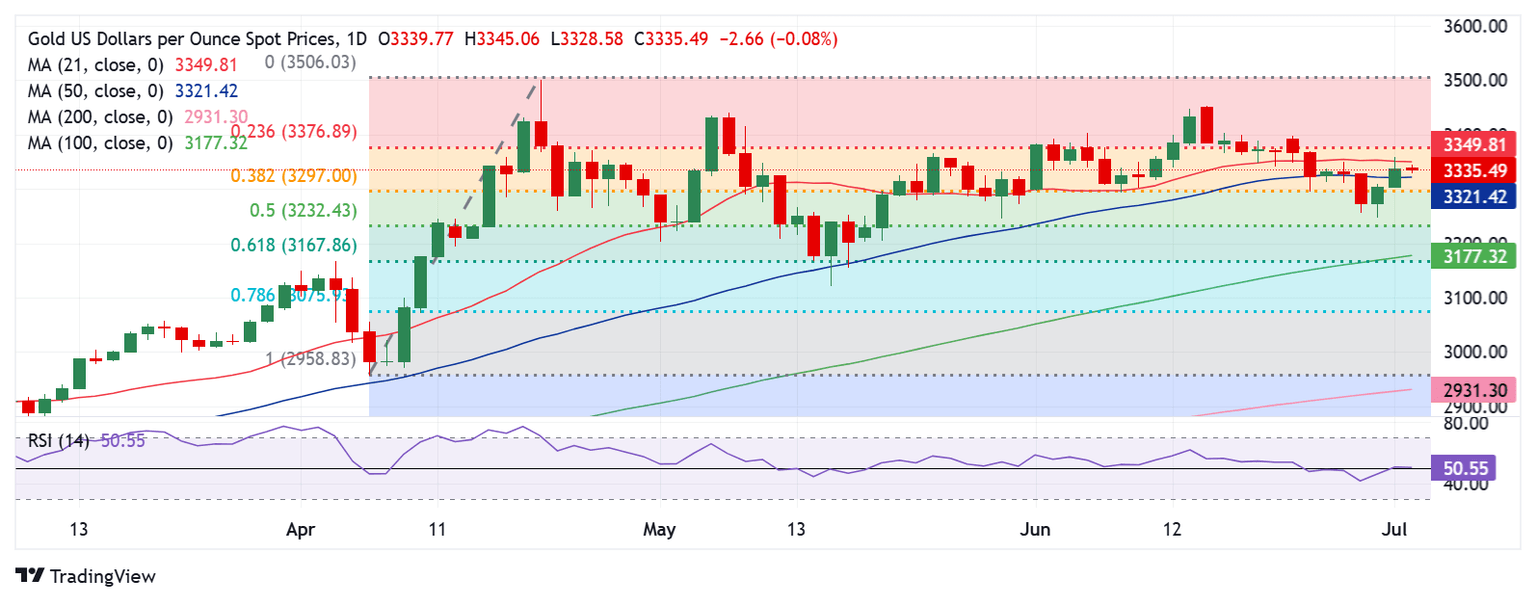

Gold price technical analysis: Daily chart

Gold price settled Tuesday above the key 50-day Simple Moving Average (SMA) resistance, then at $3,320, having briefly tested offers above the 21-day SMA at $3,350.

In Wednesday’s trading so far, the 14-day Relative Strength Index (RSI) holds its recovery at around the midline, suggesting that buyers need conviction to continue the recent upward correction from monthly lows.

Therefore, only a sustained break above the 21-day SMA could strengthen the bullish bias, driving Gold price back toward the 23.6% Fibonacci Retracement (Fibo) level of the April record rally at $3,377.

Further up, the June 23 high of $3,397 will be on buyers’ radars.

Alternatively, acceptance below the 50-day SMA, now at $3,321, could challenge the $3,297 38.2% Fibo level once again.

Deeper declines will target the monthly lows of $3,248.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.