Gold Price Forecast: XAU/USD rallies hard as Israel-Iran conflict sparks flight to safety

- Gold price hits fresh seven-week highs and nears $3,450 early Friday.

- Israel-Iran geopolitical escalation lifts safe havens such as Gold, US Dollar and Treasuries.

- Gold price looks north after acceptance above $3,377, with the daily RSI bullish.

Gold price is gaining roughly 1.50% in Asian trading on Friday, underpinned by intense flight to safety amid escalating geopolitical tensions between Israel and Iran.

Gold price looks to record highs at $3,500

Israel said earlier on that it attacked Iranian nuclear targets to block Tehran from developing atomic weapons.

Several Iranian media outlets now claim that Iran will declare a war on Israel and retaliate "soon."

Iran's Armed Forces General staff responded on Friday, warning that Israel and the US will "pay a very heavy price".

Against this backdrop, US President Donald Trump has convened a meeting of the National Security Council in the White House situation room later in the day at 15 GMT.

Investors run for cover in the traditional safe-haven assets such as Gold price, the US Treasury bonds and the Japanese Yen (JPY) in times of market panic and uncertainty.

Therefore, the ultimate store of value, Gold price, is seeing unabated demand as it extends its winning streak into a third consecutive day on Friday, sitting at the highest level in seven weeks.

Gold buyers now aim for the record high of $3,500 if the Mid East conflict intensifies, with Iran initiating a harsh response to the Israeli pre-emptive strikes on Iran’s main enrichment facility in Natanz.

However, the strengthening haven demand for the US Dollar (USD) could impede Gold price rally.

Markets shrug off the latest trade headlines as geopolitics dominate alongside risk-off flows.

Reuters reported that tariffs on a range of imported household appliances, which are currently at 50% for most countries, would take effect on an additional range of “steel derivative products” on June 23.

Looking ahead, all eyes will remain on Iran’s probable retaliation to the Israeli strikes and the US’ response to the Middle East conflict.

The University of Michigan (UoM) Consumer Sentiment and Inflation Expectations could play second fiddle to the geopolitical headlines.

Markets ramp up odds for a US Federal Reserve (Fed) interest rate cut in September following softer-than-expected US Consumer Price Index (CPI) and Producer Price Index (PPI) data released earlier in the week.

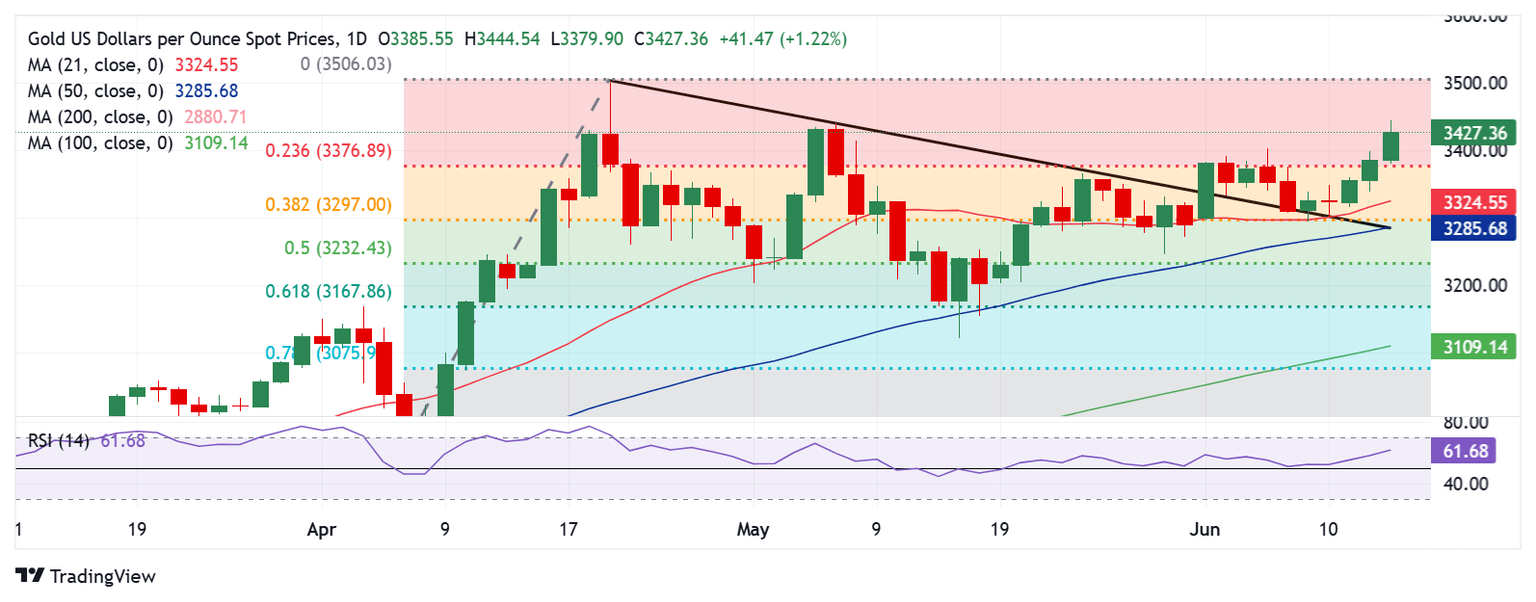

Gold price technical analysis: Daily chart

Having closed Thursday above the critical resistance at $3,377, the 23.6% Fibonacci Retracement (Fibo) level of the April record rally, Gold price solidified its bullish momentum on Friday.

The 14-day Relative Strength Index (RSI) holds firm above the midline, currently near 62, suggesting that there is more room for the upside.

The next stiff resistance is spotted at the $3,450 psychological level, above which the lifetime high of $3,500 will be threatened.

On the downside, the immediate support is aligned at the $3,400 threshold, below which the resistance-turned-support of the 23.6% Fibo level at $3,377 will come into play.

Deeper declines will likely challenge the 21-day Simple Moving Average (SMA) of $3,325.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.