Gold Price Forecast: XAU/USD poised to challenge September highs at $1,735

- Gold price is attempting a bounce as US dollar holds lower ground with yields.

- Market remains upbeat despite a lack of clarity on the Fed rate hike outlook.

- XAU/USD eyes $1,735 on a sustained break above the 50 DMA barrier.

Gold price is holding onto the latest bounce, as the US dollar sags alongside yields amid underperformance of the Treasury yields across the curve. The risk tone appears positive, reflective of higher Asian stocks and S&P 500 futures, exerting downward pressure on the safe-haven dollar while benefiting the bright metal. Investors remain wary about the size of the next Fed rate hike after Wednesday’s mixed US economic data. Markets also remain unconvinced about Fed officials’ denial of rate cuts next year, which could be also boding ill for the greenback. Meanwhile, they price in a 65% chance of a 75 bps Fed rate hike next month. The US Nonfarm Payrolls on Friday will provide clarity on the Fed tightening outlook that could have a significant impact on the gold price. The US economy is expected to add 250K jobs in September vs. +315K previous. In the meantime, several Fed policymakers’ speeches will be closely followed while geopolitics and risk sentiment will also remain pivotal.

Also read: Gold Price Forecast: XAU/USD bulls target $1,735 as focus shifts to US NFP – Confluence Detector

On Wednesday, XAU/USD enjoyed good two-way businesses, initially dropping to test the $1,700 threshold before staging a decent comeback to settle around $1,715, still down for the day. The moves in the bright metal were directed by the dynamics of the US dollar and the Treasury yields. The greenback extended its intraday gains and spiked to daily highs near 111.75 against its main rivals amid risk aversion and stronger than expected US ADP employment data. The US ADP jobs grew by 208K vs. +200K expectations. Although, the dollar rally quickly faded after the US ISM Services PMI eased to 56.7 in September while the Prices Paid component fell to 68.7 vs. 69.8 consensus forecasts. Meanwhile, the rebound in the yields also kept the non-yielding bullion under the grip of sellers.

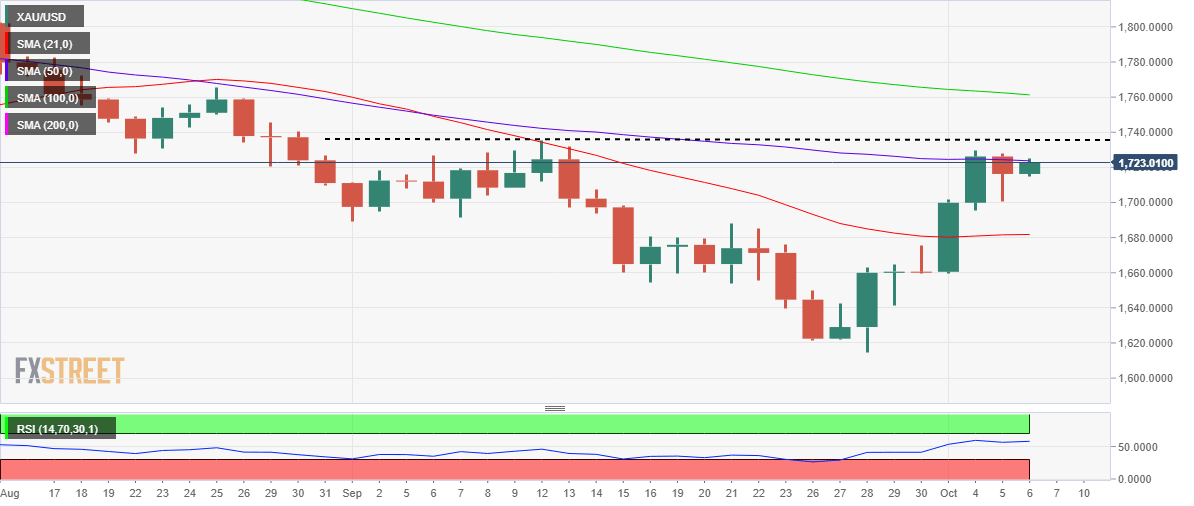

Gold price technical outlook: Daily chart

The bearish 50-Daily Moving Average (DMA) at $1,724 continues to limit the upbeat momentum.

A firm break above the latter could revive bullish interest, calling for a test of the $1,730 round figure. The next stop for bulls will be seen at the September high of $1,735.

The 14-day Relative Strength Index (RSI) is inching higher above the midline, supporting the renewed upside in the metal.

A sustained break above the 50 DMA is needed to challenge the September highs at $1,735, above which the $1,750 psychological level will come into play.

Alternatively, sellers could test the previous critical resistance now support at $1,700 before approaching Tuesday’s low of $1,695.

The horizontal 21 DMA at $1,682 will be targeted on the additional declines.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.