Gold Price Forecast: XAU/USD overbought again as focus shifts to US Retail Sales, Powell speech

- Gold price resumes its record rally on Wednesday, with eyes on $3,300.

- China’s annual Q1 GDP beats expectations but US tariff uncertainty looms, aiding Gold price upside.

- Gold price is back in the overbought zone on the daily chart; US Retail Sales and Powell eyed.

Gold price is consolidating its latest uptick to a new record high of $3,275 early Wednesday as buyers take a breather in anticipation of the top-tier US Retail Sales data and Federal Reserve (Fed) Chairman Jerome Powell’s speech due later in the day.

Gold price keenly awaits Powell and tariff talks

Gold price preserves its renewed bullish momentum from the previous day after fairly upbeat growth and activity data from China, the world’s second biggest economy. China’s Q1 Gross Domestic Product (GDP) beat expectations with 5.4% year-over-year (YoY) while the country’s Retail Sales and Industrial Production also reported a bigger-than-expected growth in March.

Despite the improvement in China’s macro picture in the first quarter, looming risks from US tariffs impact dim its outlook, keeping investors on the edge while maintaining the safe-haven demand for Gold price. China’s National Bureau of Statistics (NBS), however, said that “US tariffs will not change the long-term improving trend in China’s economy.”

Heightened markets’ nervousness heading into China data dump propelled Gold price to a fresh all-time high. Additionally, the traditional safe-haven Gold price also capitalized a fresh risk-aversion wave in Asia as traders reacted negatively to the overnight slump in the American artificial intelligence (AI) leader Nvidia, who said that the US government will begin requiring a license to export the company’s H20 chips to China, citing about a likely $5.5 billion hit to the company.

Meanwhile, the US-China trade war fears show no signs of abating after the Wall Street Journal (WSJ) reported early Wednesday, citing sources, the Trump administration may use tariff negotiations to try to pressure US trading partners to limit dealings with China.

This comes after Bloomberg News reported on Tuesday that the European Union (EU) expects most of the US import tariffs to remain in place after little progress was made in the latest talks.

Escalating trade tensions and increasing recession risks continue to power the Gold price. Furthermore, ANZ Bank raised its year-end Gold price forecast to $3,600 per ounce and its six-month forecast to $3,500, keeping Gold buyers hopeful.

Traders eagerly look forward to the high-impact US Retail Sales data for March and Fed Chair Jerome Powell’s speech for hints on the state of the US economy and the Fed’s interest rate outlook, in the face of heightened geopolitical and economic risks.

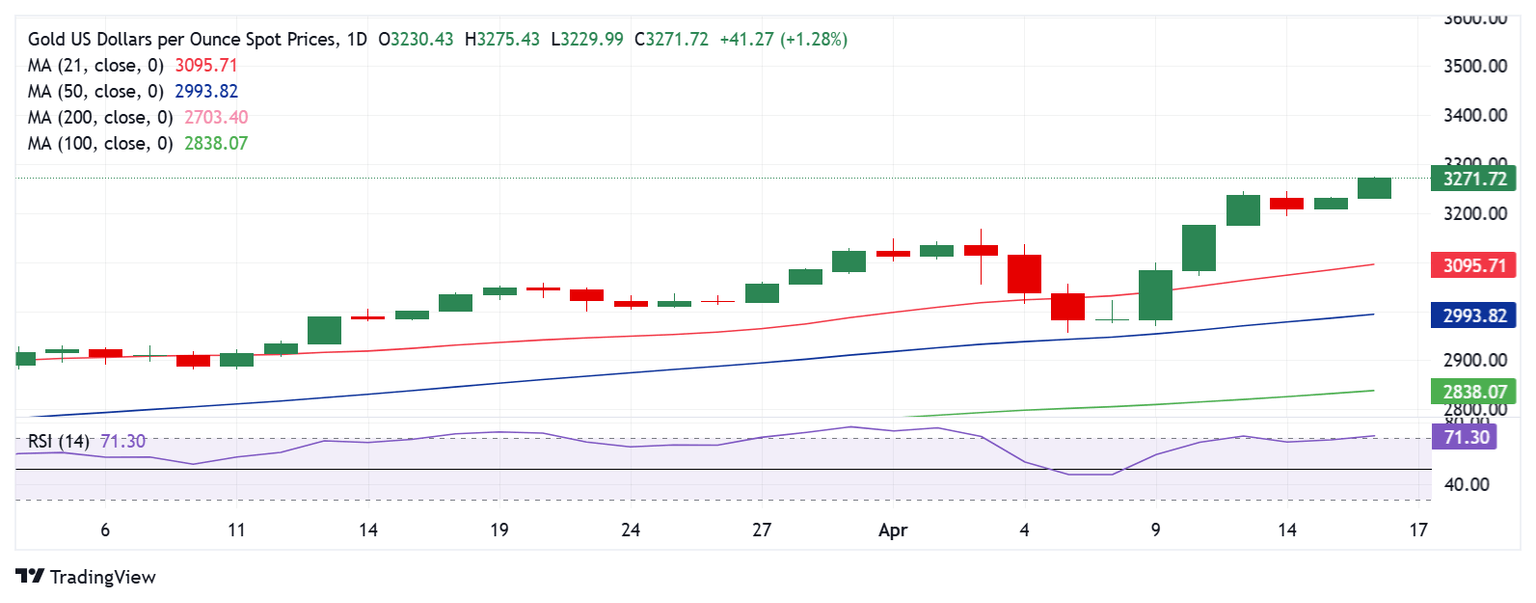

Gold price technical analysis: Daily chart

The daily chart shows that the 14-day Relative Strength Index (RSI) has re-entered the overbought region, currently near 71, warranting caution for buyers.

If they manage to sustain above the $3,275 level on a daily closing basis, a test of the $3,300 mark will be inevitable, opening the door toward the $3,350 psychological mark.

Conversely, the initial support aligns at the $3,200 threshold, below which the April 11 low of $3,176 will be challenged.

Additional declines could test the $3,100 round level, where the 21-day Simple Moving Average (SMA) resistance-turned-support closes in.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.