Gold Price Forecast: XAU/USD needs to move above $1,918 to unleash upside potential

- Gold price attempts a bounce after failing to sustain $1,930 once again.

- US Dollar clings to recovery gains amid risk-aversion and hawkish FOMC Minutes.

- Gold price fails to confirm a bullish wedge for the fourth day in a row as RSI stays bearish.

- Gold traders await US employment data, ISM Services PMI and Fedspeak for fresh incentives.

Gold price makes a minor recovery attempt to regain the $1,920 barrier in Thursday’s trading. The risk-off market mood, combined with expectations of more US Federal Reserve (Fed) tightening, support the United States Dollar (USD) while US Treasury bond yields hit fresh multi-month highs heading into a slew of critical US employment data.

United States ADP and JOLTS job openings in focus

Risk sentiment remained in a weak spot on Wednesday as US traders returned to their desks after the July 4 holiday and reacted negatively to the renewed trade tensions between the United States and China. Earlier this week, the US curbed AI chips’ shipments to Beijing. In retaliation, China announced abrupt controls on exports of some gallium and germanium products, effective from August 1. US President Joe Biden’s administration is also considering limiting on cloud-computing services for China.

Accentuating the risk-averse market condition, the Minutes of the Federal Reserve’s June meeting delivered hawkish signals, with almost all Fed officials indicating that further tightening is likely. The document, however, reflected some disagreement among members.

The US Dollar gathered steam as risk-off flows dominated, fuelling a retreat in Gold price from a fresh eight-day high of $1,935. The Greenback also tracked US Treasury bond yields higher after US government bonds were sold off into the hawkish Fed expectations following the FOMC Minutes release. The benchmark 10-year US Treasury bond yields rallied to fresh four-month highs above 3.95%, adding to the weight on the non-interest-bearing Gold price. The bright metal settled near daily lows of $1,915.

Early Thursday, Gold price attempts a tepid bounce amid a pause in the US Dollar upside. However, the US Treasury bond yields are extending gains, with the 10-year one closing in on the 4.0% level, which could restrict the rebound in the Gold price. Also, traders will refrain from placing fresh bets on Gold price ahead of a raft of high-impact economic data from the United States.

The US docket will kickstart with the ADP Employment Change, followed by the JOLTS Job Openings, Jobless Claims and the ISM Services PMI data. Softening labor market conditions in the US could raise concerns about the Fed’s view on further rate increases, which could boost Gold price at the expense of the US Dollar and US Treasury bond yields. US employment data will hold the key ahead of Friday’s Nonfarm Payrolls and wage inflation numbers. Apart from US economic data, speeches from Fed policymakers could also drive sentiment around the US Dollar and Gold price.

Gold price technical analysis: Daily chart

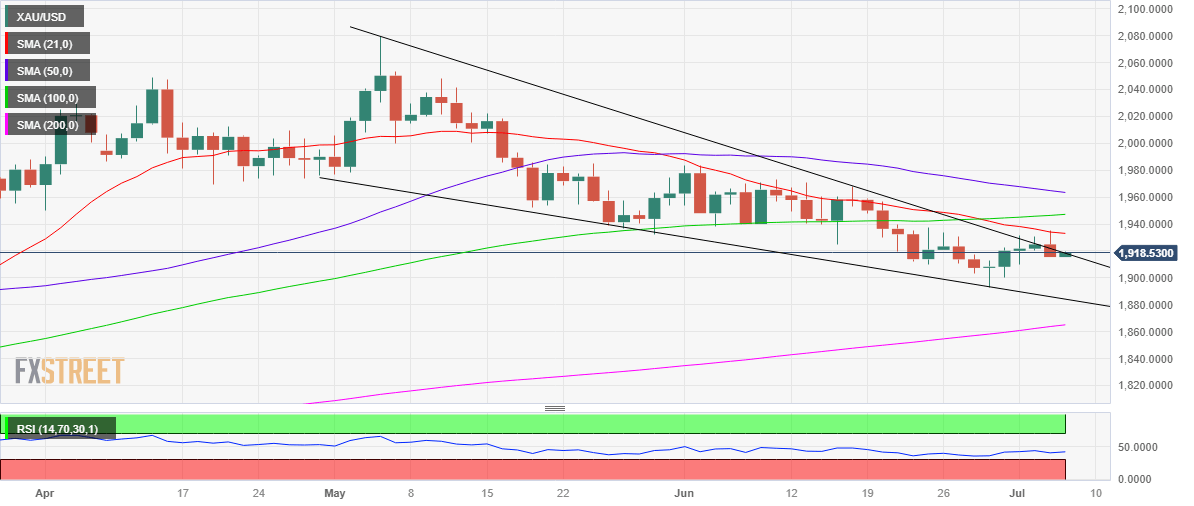

As observed on the daily chart, Gold price has failed to yield a daily closing above the critical falling trendline (wedge) resistance, now at $1,918, to validate a bullish wedge formation. Gold price has been trading within a falling wedge after topping out at record highs of $2,080 in early April.

Last week’s Bear Cross remains in play, while the 14-day Strength Index (RSI) lurks below the midline, keeping Gold sellers in control.

Acceptance above the falling trendline resistance of $1,918 on a daily closing basis is needed to take on the $1,950 threshold, where the mildly bullish 50-Daily Moving Average (DMA) aligns. But Gold buyers would need to reclaim the 21-DMA barrier at $1,933 beforehand.

On the downside, the immediate support awaits at Monday’s low of $1,910, below which the $1,900 key level will be tested. The next cushion is envisioned at the three-month low of $1,893.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.