Gold Price Forecast: XAU/USD marching towards $4,000

XAU/USD Current price: $3,958.10

- Political jitters in Japan, France, and the United States boosted demand for safety.

- The US Dollar shed ground after Wall Street’s opening amid the US government's continued shutdown.

- XAU/USD extended its record run, bulls retain control despite extreme overbought conditions.

Spot Gold reached fresh record highs on Monday, trading above the $3,950 threshold as global political turmoil boosted demand for the safe-haven metal. The US Dollar (USD) started the day on a strong footing, maintaining a positive momentum during Asian and European trading hours amid political headlines coming from Japan and France. Still, Gold also rose on safety demand. The USD turned south as American traders reached their desks, further fueling the XAU/USD pair advance.

Over the weekend, the Japanese ruling Liberal Democratic Party (LDP) elected Sanae Takaichi, a 64-year-old lawmaker, positioning her to become Japan's first female Prime Minister. The news heavily weighed on the JPY amid mounting speculation of upcoming increased federal spending and a looser monetary policy.

Meanwhile, France had yet another Prime Minister resigning. Newly appointed Sébastien Lecornu resigned less than a day after his cabinet was unveiled. The country's crisis revolved around the government's massive debt and the lack of Parliamentary agreement to deal with it. The headline further boosted demand for safety.

Another factor weighing on markets is the continued United States (US) government shutdown. The country entered its sixth day of reduced federal activity, with no visible signs of a potential agreement between Democrats and Republicans. President Donald Trump warned about upcoming massive layoffs should the situation continue.

XAU/USD short-term technical outlook

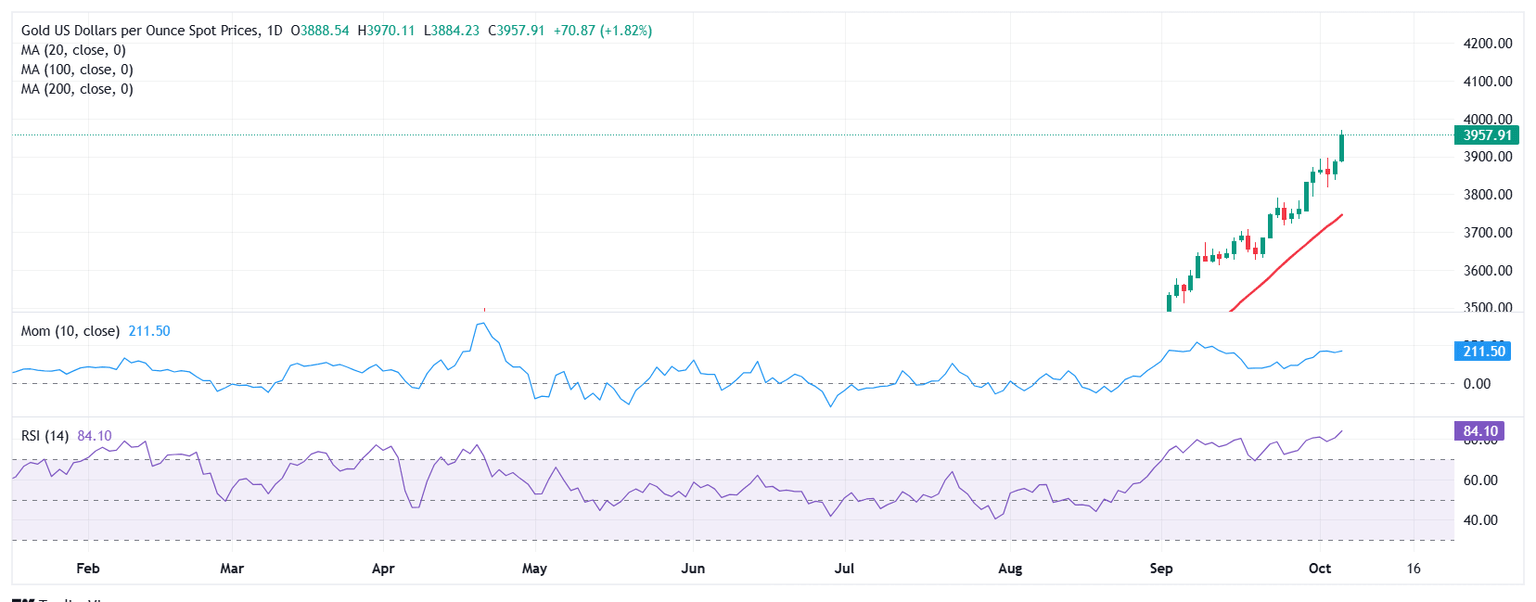

From a technical point of view, the daily chart for the XAU/USD pair shows that it trades near it record high of $3,970.11, with a strong bullish bias. The Momentum indicator aims north almost vertically well above its 100 level, while the Relative Strength Index (RSI) indicator extends its upward slope at around 84, without signs of upward exhaustion. At the same time, the pair trades far above all its moving averages, with a bullish 20 Simple Moving Average currently standing at around $3,745.

In the near term, and according to the 4-hour chart, XAU/USD is bullish. Technical indicators resumed their advances within overbought territory after a modest corrective slide, in line with prevalent buying interest. At the same time, the bright metal extends its advance beyond all bullish moving averages. The 20 SMA currently gains upward at around $3,889, while the longer ones accelerated their advances well below it, in line with the dominant bullish trend.

Support levels: 3,945.20 3,931.15 3,916.90

Resistance levels: 3,970.00 3,995.00 3,410.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.