Gold Price Forecast: XAU/USD looks to $3,400 and beyond on renewed trade jitters

- Gold price stages an impressive rebound from the weekly low of $3,260 early Thursday.

- The US Dollar fades recovery as trade concerns re-emerge while US business growth slumps.

- Gold price sees dip-buying as the daily RSI points higher in the bullish territory.

Gold price rebounds from a weekly low of $3,260 early Thursday as buyers are back with vigour, although replicating the moves seen in Wednesday’s Asian session.

Gold price keeps an eye on trade talks

Markets appear cautiously optimistic this Thursday as they take account of the trade talks by the US President Donald Trump’s administration, concerning China and Japan. The recent relief rally on global stocks, triggered by Trump’s backpedalling on attacks on Federal Reserve (Fed) Chair Jerome Powell and his softer stance on the US-China trade deal, seems to have stalled.

The US Dollar (USD) also fades the recovery from over three-year lows against its major currency rivals, as sentiment stutters, allowing the Gold price to resume its uptrend toward a record high of $3,500 set on Tuesday.

On Wednesday, a Wall Street Journal (WSJ) report said that the White House is considering lowering Chinese import tariffs. Following the report, a source told Reuters that the Trump administration would look at reducing tariffs on imported Chinese goods.

However, the reviving trade optimism quickly evaporated after US Treasury Secretary Scott Bessent denied the WSJ report, noting that there's 'no unilateral offer' to slash tariffs on China. Meanwhile, the US headline S&P Global US PMI Composite Output Index fell from 53.5 in March to 51.2 in April, hitting the lowest level in 16 months. The slump in US business growth raises concerns over an economic slowdown while keeping the door open for aggressive easing by the Fed in the coming months.

As investors digest the latest US-Japan trade talks, this narrative fuels a fresh leg down in the Greenback. Citing multiple government sources, the NHK broadcaster reported late Wednesday that the US told Japan that it cannot give Japan special treatment regarding tariffs during talks held earlier this month.

Another roadblock on the trade front is the US threatening Canada with tariffs higher than 25% on Canadian cars.

In the day ahead, a bigger-than-expected dip in the German business sentiment data could threaten the latest EUR/USD uptick, reviving the demand for the US Dollar at the expense of Gold price. However, trade headlines will continue to remain the leading market force as US President Trump continues to backflip on his earlier tariff announcements.

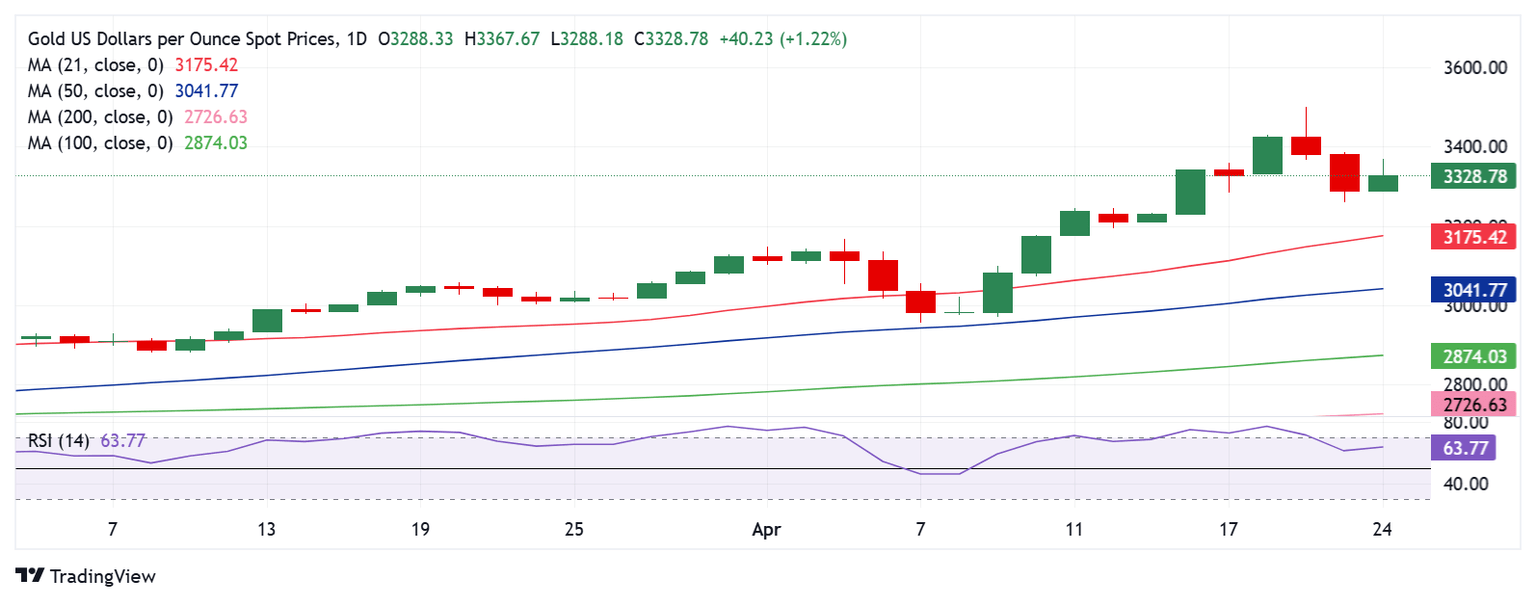

Gold price technical analysis: Daily chart

The short-term outlook for Gold price seems to have turned in favor of buyers as the 14-day Relative Strength Index (RSI) looks north while within the positive territory.

If the uptrend gathers traction, the Gold price could retake the $3,400 threshold en route to the record highs of $3,500.

In case Gold sellers return with conviction, a test of the 21-day Simple Moving Average (SMA) at $3,175 will be inevitable on a sustained move below the previous day’s low of $3,260, followed by the $3,200 barrier.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.