Gold Price Forecast: XAU/USD looks south as US dollar cheers stimulus gloom

- Gold tracked stocks lower on Tuesday after Trump rejected stimulus talks.

- Trump’s latest call for partial stimulus lent some support, but not for long.

- Technical indicators favor the bears ahead of Fedspeak, FOMC minutes.

The latest tweet from US President Donald Trump on stimulus early Wednesday saved the day for the gold bulls, as Gold (XAU/USD) attempts a tepid bounce from weekly lows of $1874. Trump called on for partial stimulus, urging Congress to approve paycheck protection and airline support. The sentiment received a fresh lift propping the Asian equities while the US dollar stalled its overnight rally.

Despite gold’s pullback, the path of least resistance remains to the downside, as the safe-haven dollar will likely remain in demand amid fresh concerns on the US economic recovery, in the wake of no prospects of fiscal stimulus until after the US elections. Also, markets would favor the US currency ahead of the Fedspeak and FOMC minutes, keeping the gold bulls at bay.

Late Tuesday, President Trump rejected House Speaker Nancy Pelosi’s $2.4 trillion fiscal aid offer, which triggered a fresh risk-aversion wave across the financial markets. Gold tumbled in tandem with the Wall Street stocks amid resurgent demand for the greenback, as a safe-bet.

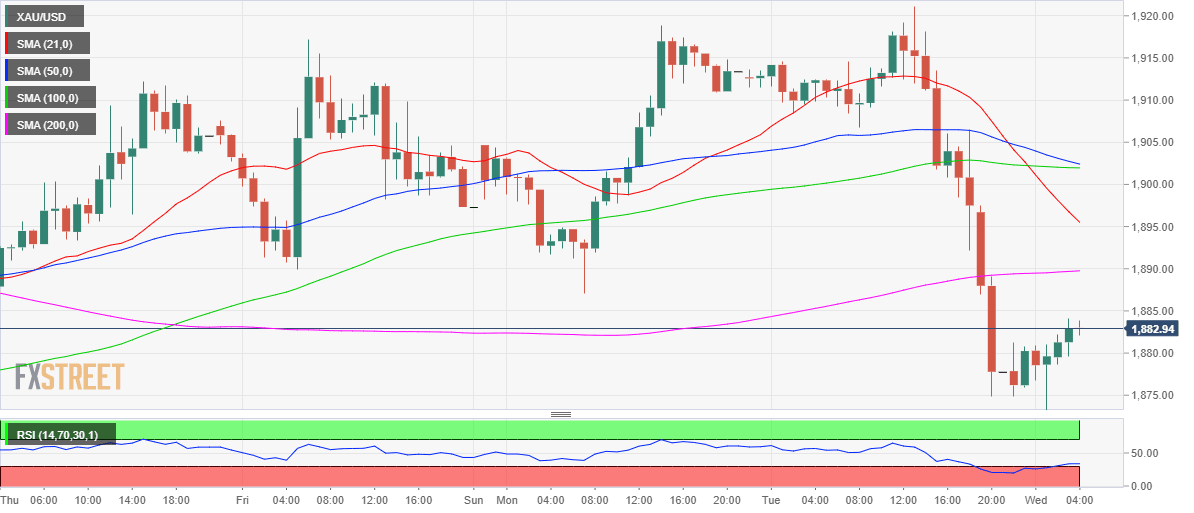

Gold: Short-tern technical outlook

Hourly chart

Acceptance above the latter would expose the bearish 21-HMA at $1895. The next critical resistance awaits at $1902, the confluence of the 50 and 100-HMAs.

Alternatively, a failure to defend the weekly lows of $1873, the next robust support at $1860 will be put to test, which is the 100-day Simple Moving Average (DMA).

The hourly Relative Strength Index (RSI) trades flat around 33.40, after bouncing from the oversold territory, suggesting that there is more scope to the downside.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.