Gold Price Forecast: XAU/USD likely to face stiff resistance near $1795-$1800, focus on yields

- Gold extends gains towards $1800 as Treasury yields ease.

- Growing covid concerns weigh on stocks, yields.

- Rising wedge on the 4H chart points to stiff resistance around $1797.

Gold (XAU/USD) rebounded on Tuesday as the US Treasury yields tumbled alongside global stocks. Surging covid infections globally brought a reality check into the markets and triggered a fresh risk-aversion wave. The US dollar recovered from seven-week troughs amid resurgent haven demand. Although gold traders ignored the dollar bounce back, as the dynamics in the yields continued to have a significant bearing on the yieldless gold. Dovish comments from Fed Chair Powell also aided the upside in gold. The US central bank chief said that they remain fully committed to both legs of the dual mandate.

Looking ahead, the US rates could resume their decline should the risk-off mood worsen, benefiting gold further. The relentless rise in the covid cases threatenS to derail the global economic recovery, which unnerves the investors. Amid a lack of relevant economic data, gold will continue to follow the yields for fresh directives.

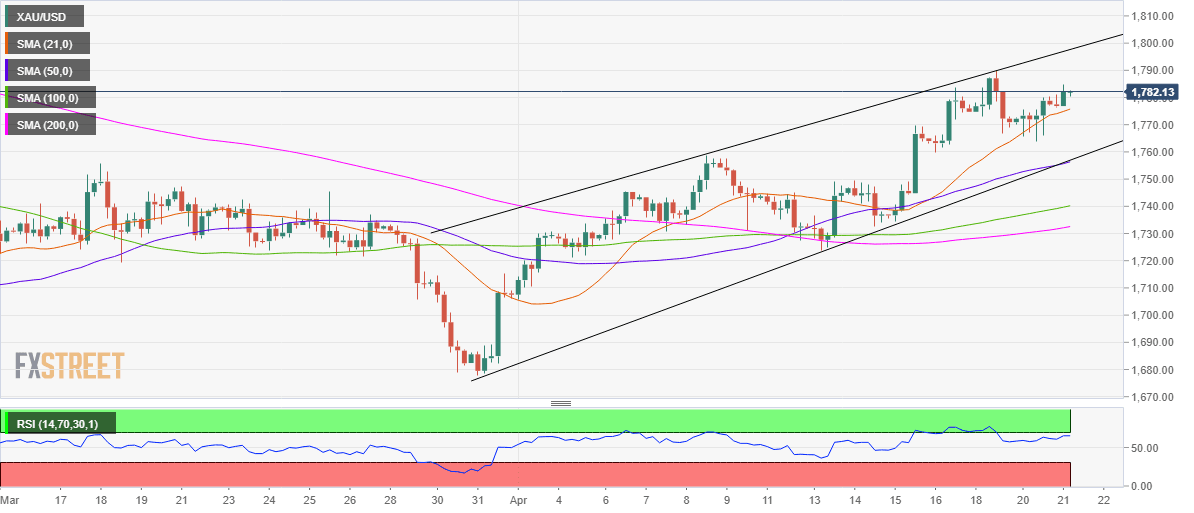

Gold Price Chart - Technical outlook

Gold: Four-hour chart

As observed on the four-hourly chart, gold remains on track to test the rising wedge hurdle at $1797 en-route $1800.

The price has managed to hold above the 21-simple moving average (SMA) at $1775, with the bullish Relative Strength Index (RSI) pointing towards extra gains.

Further up, the horizontal 100-day SMA at $1804 could be probed.

Alternatively, a four-hourly candlestick close below the 21-SMA will recall the sellers.

The confluence of the wedge support and 50-SMA at $1757 could emerge as strong support.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.