Gold Price Forecast: XAU/USD keeps sight on $4,080 key resistance

- Gold hits ten-day highs above $4,050 at the start of the week on Monday.

- US Dollar holds the latest upswing, fuelled by US government reopening hopes.

- Gold eyes acceptance above 21-day SMA near $4,080 amid bullish technical setup.

Gold is building on Friday’s rebound in Asian trades on Monday, having briefly regained the $4,050 psychological barrier to hit ten-day highs. Traders await fresh cues on the end to the record US government shutdown amid mounting economic concerns.

Gold looks north amid bullish catalysts

Gold consolidates its latest leg higher, with buyers taking a breather amid a positive shift in risk sentiment as markets stay hopeful about the US government reopening.

US Senate voted 60-40 in the first approval on extending the enhanced Affordable Care Act subsidies early Monday, passing the government funding bill to end the shutdown.

Additionally, risk flows dominate as China announced on Sunday the temporary suspension of its ban on approving exports of dual-use items related to gallium, germanium, antimony and super-hard materials to the United States, per Reuters.

Despite the broader market optimism, investors remain wary as the amended package would still have to be passed by the House of Representatives and sent to President Donald Trump for his signature, a process that could take several days.

This, combined with growing concerns over the US economy amid the fallout of the record government shutdown continues to lend support to the traditional store of value, Gold.

The University of Michigan (UoM) released data on Friday, which showed that the preliminary Consumer Sentiment Index dropped to 50.3 in early November, the lowest in nearly three-and-a-half years.

Weakening consumer sentiment followed the data published by the executive outplacement firm Challenger, Gray & Christmas on Thursday, revealing that corporations announced a 183.1% monthly surge in layoffs, the worst October in over two decades, per Reuters.

Against this backdrop, markets continue to price in about a 66% chance of the US Federal Reserve (Fed) lowering interest rates in December.

Gold also draws support from rising metal holdings by China. China’s Gold Exchange-Traded Funds (ETF) surged 164% in the first nine months of 2025, while the People’s Bank of China (PBOC) boosted its Gold purchases for an 11th straight month, raising reserves to 2,303.5 tons.

Looking ahead, Gold’s price action will likely be determined by the US shutdown news and the probable publication timeline of the missed economic data releases. In the time, market sentiment and Fed rate cut expectations will continue providing sone trading incentives in Gold.

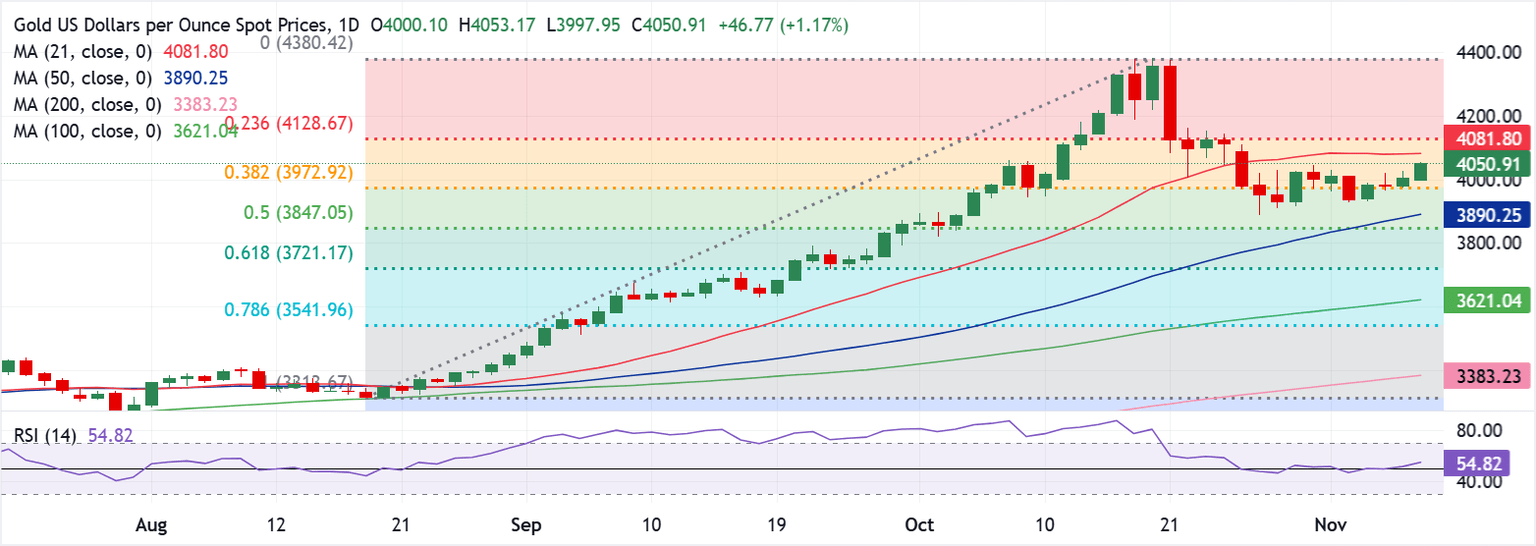

Gold price technical analysis: Daily chart

The daily chart suggests that upside risks prevail in the near term for Gold as the 14-day Relative Strength Index (RSI) points north of the midline.

Gold now looks for acceptance above the $4,050 psychological level to take on the 21-day Simple Moving Average (SMA) at $4,081.

A sustained move above the latter will expose the 23.6% Fibonacci Retracement level of the parabolic rise to the record high that began on August 19 at $4,129.

On the downside, the initial hurdle is seen at $3,973, the 38.2% Fibo level of the same advance.

Next on sellers’ radars will be the intermittent lows near $3,930, a break below which would expose the $3,900 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.