Gold Price Forecast: XAU/USD keeps marching toward $1,800

XAU/USD Current price: $1,821.71

- US Q4 Gross Domestic Product growth was downwardly revised from 2.9% to 2.7%.

- Mixed United States macroeconomic figures added to broad equities’ weakness.

- XAU/USD trades near a fresh February low with room to test the $1,800 threshold.

Spot gold remains on the back foot, with XAU/USD bottoming this Thursday at $1,817.42 a troy ounce. The US Dollar maintained its momentum throughout the day, pausing temporarily during European trading hours but resuming its advance after the US opening. Mixed American data ended up weighing on stock markets, as the annualized economic growth suffered a downward revision. The second estimate of the Q4 Gross Domestic Product grew by 2.7%, below the 2.9% initially calculated. On a positive note, Initial Jobless Claims for the week ended February 17 declined to 192K vs the increase of 200K expected.

More relevantly, Q4 Personal Consumption Expenditure Prices came in higher than anticipated. The headline figure rose 3.7% QoQ, while the core reading came in at 4.3% against the 3.9% gain from the third quarter of 2022, which are bad news for those still betting on a Federal Reserve monetary policy pivot.

XAU/USD price short-term technical outlook

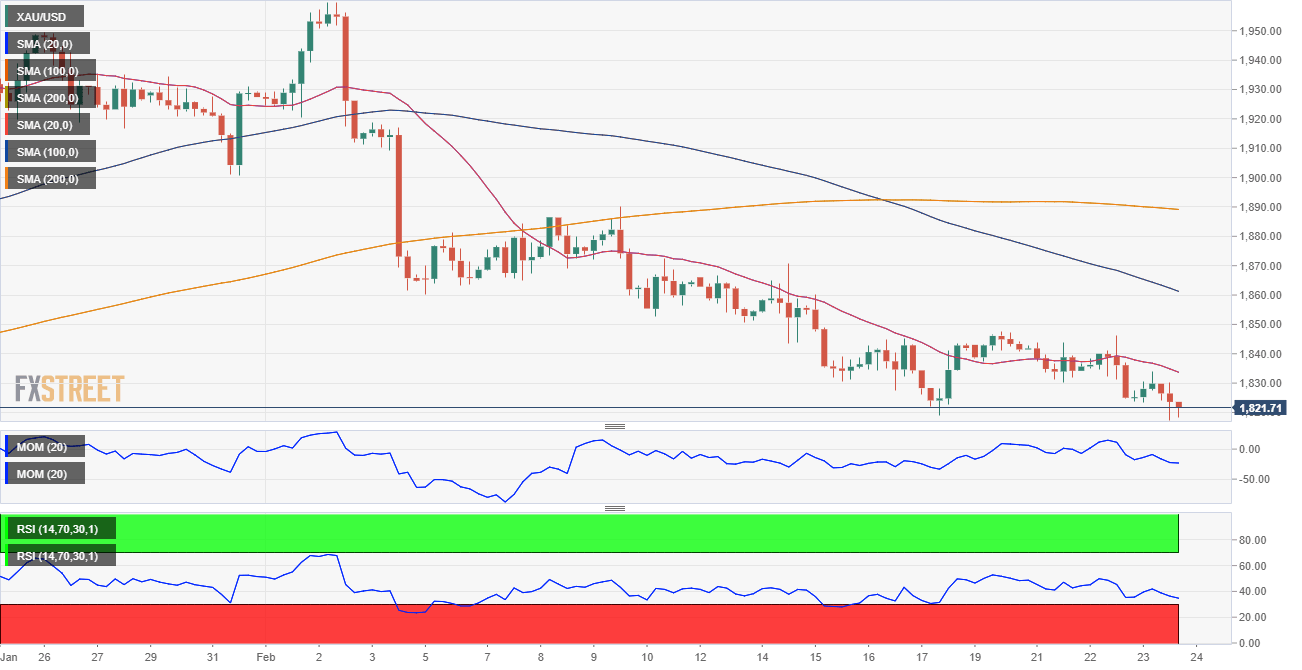

The XAU/USD pair pressures the aforementioned low, down for a fourth consecutive day but without signs of downward exhaustion. The daily chart shows that the pair keeps sliding below a firmly bearish 20 SMA, while the 100 SMA has lost its bullish strength, currently at around $1,789.15. Meanwhile, technical indicators hold within negative levels, the Momentum posting a modest advance, but the Relative Strength Index (RSI) maintaining its downward slope near oversold readings.

In the near term, and according to the 4-hour chart, bears have full control of the pair. It trades below all bearish moving averages, with the 20 SMA providing resistance at $1,834.00. The Momentum indicator remains directionless, just below its 100 level, while the RSI indicator heads south at around 36, in line with another leg lower.

Support levels: 1,811.30 1,797.45 1,782.90

Resistance levels: 1,834.00 1,845.99 1,860.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.