Gold Price Forecast: XAU/USD holds firm above $3,400 aims for higher highs

XAU/USD Current price: $3,414.05

- US President Donald Trump renewed his attack on Fed Chairman Jerome Powell.

- US indexes collapse amid concerns about the economic performance under Trump.

- XAU/USD is likely to keep posting record highs, with dips seen as buying opportunities.

Spot Gold traded as high as $3,430.36 on Monday, rallying on continued US Dollar (USD) weakness. Market players keep losing confidence in the Greenback amid United States (US) President Donald Trump's decisions.

After launching a trade war with all its trading counterparts, Trump has chosen a new target: Federal Reserve (Fed) Chairman Jerome Powell. The US President complained last Thursday about Powell’s decision to go slow with rate cuts. Even further, he called for his dismissal, saying Powell’s “termination cannot come fast enough.”

Trump lifted the bets on Monday, posting "Preemptive cuts in interest rates are being called for by many. With energy costs way down, food prices (including Biden’s egg disaster!) substantially lower, and most other 'things' trending down, there is virtually no inflation," calling Powell Mr. Too Late and a major loser.

Other than that, the American President reported progress on talks with Russia and Ukraine. According to his words, there is a good chance a deal will be done this week. His latest words, however, fell short of impressing investors, with all the major US indexes in sell-off mode.

XAU/USD short-term technical outlook

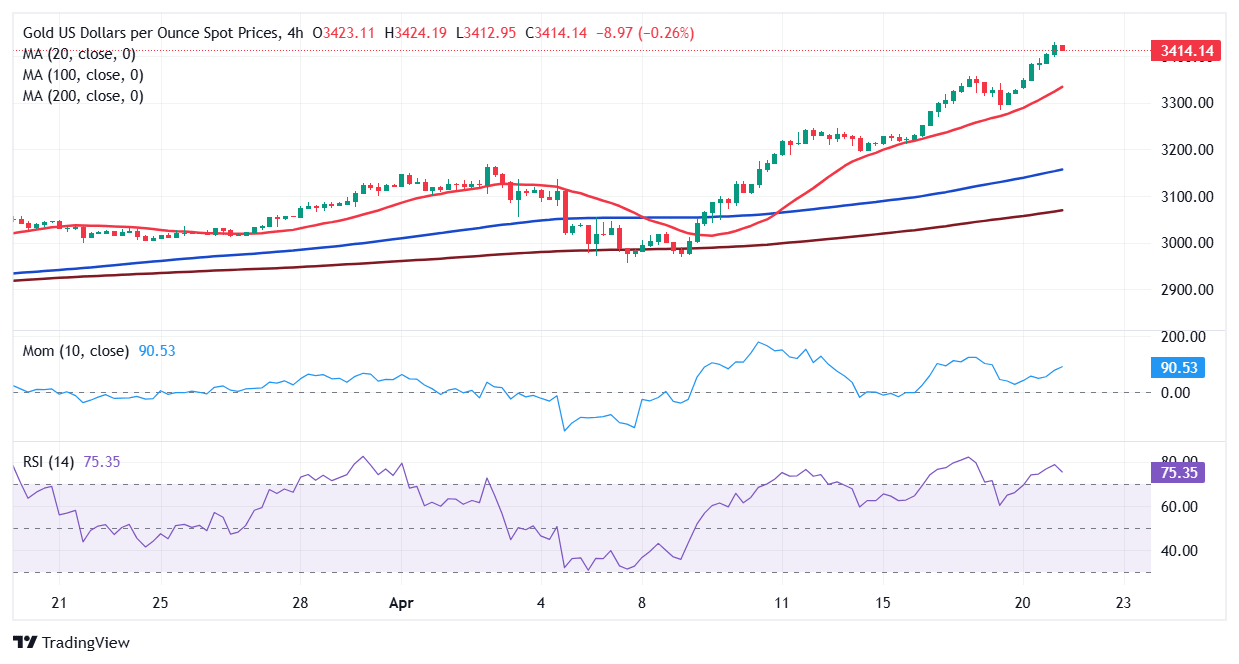

From a technical point of view, the XAU/USD pair is poised to extend its gains. The daily chart shows it keeps moving above bullish moving averages, with the 20 Simple Moving Average (SMA) currently at around $3,134. The distance between the closest moving average and the current price is a clear indication of the strong buying momentum. At the same time, technical indicators keep heading north, despite standing in overbought readings, another sign of bulls' dominance.

In the near term, and according to the 4-hour chart, XAU/USD has room to extend its advance. Technical indicators eased modestly from their recent highs but lack any bearish momentum. Particularly, the Relative Strength Index (RSI) indicator hovers at around 81 with no signs of giving back. Finally, the 20 SMA accelerated north above the longer ones, while offering dynamic support in the $3,320 region.

Support levels:3,400.00 3,386.40 3,375.50

Resistance levels: 3,430.40 3,445.00 3,460.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.