Gold Price Forecast: XAU/USD grinds north above $1,950

XAU/USD Current price: $1,968.07

- United States CB Consumer Confidence unexpectedly improved in March to 103.4.

- The yield on the 2-year Treasury note recovered above the 4% threshold on a better market mood.

- XAU/USD advances on broad US Dollar weakness, bullish strength limited.

Spot gold trades near a daily high of $1,970.03 a troy ounce, as broad US Dollar weakness helped the metal recover some ground. XAU/USD trimmed half of its Monday’s losses, although a better market mood subdued demand for the bright metal.

Wide-spread concerns about banks’ stability eased further on Tuesday, pushing global stock markets into the green. Wall Street, however, struggles to preserve its positive momentum, with only the Dow Jones Industrial Average trading in the green at the time being. Meanwhile, US Treasury yields advance on Tuesday, reflecting easing demand for bonds. The 10-year note currently yields 3.56%, while the 2-year note yield recovered the 4% threshold and now offers 4.05%.

Further boosting the market sentiment, the United States CB Consumer Confidence unexpectedly improved in March to 104.2, while the February figure was upwardly revised from 102.9 to 103.4. The report shows that the Present Situation Index decreased to 151.1 from 153.0 in the previous month, while the Expectations Index ticked up to 73.0 from 70.4 in February. The latter has been below 80 for most of the past year, usually seen as a sign of an upcoming recession.

XAU/USD price short-term technical outlook

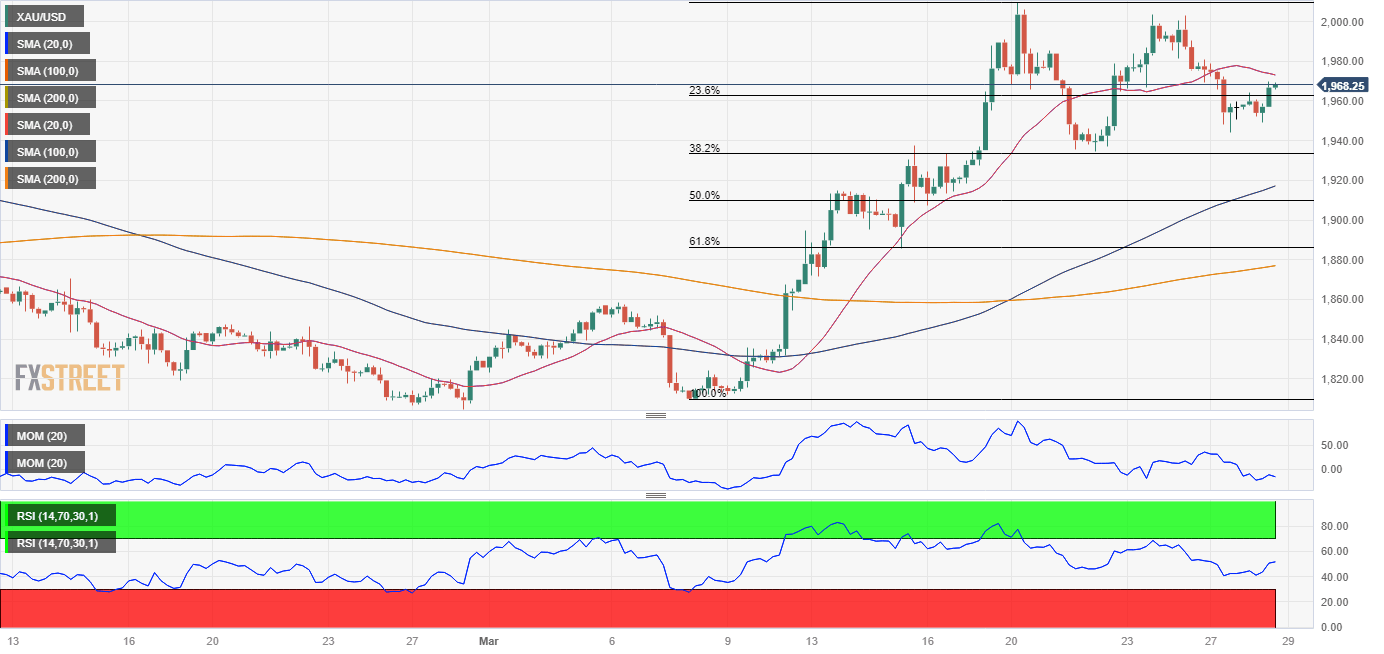

The daily chart for XAU/USD shows that it is trading above the 23.6% Fibonacci retracement of its March rally at $1,962.30, the immediate support level. Technical readings favor a bullish continuation, as the 20 Simple Moving Average (SMA) heads north almost vertically far below the current level while above also bullish longer ones. At the same time, the Momentum indicator extended its advance into overbought territory, while the Relative Strength Index (RSI) indicator pared its corrective decline and aims higher at around 61.

The 4-hour chart shows that, despite the ongoing advance, further gains are not yet clear. XAU/USD develops below a mildly bearish 20 SMA, although above bullish longer ones. The Momentum indicator, in the meantime, remains flat below its 100 level, while the RSI ticked higher but currently stands at 52, falling short of indicating increased buying interest. The bright metal could gain additional upward traction on a break above $1,978.94, the weekly high.

Support levels: 1,962.30 1,947.50 1,932.65

Resistance levels: 1,978.95 1,988.30 2,000.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.