Gold Price Forecast: XAU/USD down but not out as Powell speech looms

- Gold price holds correction near $2,650 early Monday, despite more Chinese stimulus.

- The US Dollar clings to recovery gains, as the US PCE cooldown supports bets for a big November Fed rate cut.

- Gold price eases off extreme overbought conditions on the daily chart, favoring buyers.

Gold price is holding the previous corrective downside near $2,650 in Asian trades on Monday, shrugging off another Chinese stimulus-driven upbeat market sentiment. Traders refrain from placing fresh directional bets on Gold price ahead of US Federal Reserve (Fed) Jerome Powell’s speech due later on Monday.

Gold price looks to Powell speech for a fresh boost

During his last Thursday’s opening remarks at the US Treasury Market Conference, Fed Chair Powell did not speak about the economic and monetary policy outlook. Therefore, traders keenly await Powell’s appearance for fresh hints on the size of the potential interest rate cut in November.

Markets are currently pricing in a 52% chance of a 50 basis points (bps) rate reduction in November, the CME Group’s FedWatch Tool shows, slightly up from a 50% probability seen a week ago. Friday’s core Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation measure, did little to alter the market’s expectations for the next Fed rate cut.

The headline PCE price index rose 0.1% for the month, putting the annual inflation rate at 2.2%. The core PCE Price Index increased by 2.7% YoY, as expected while the monthly core inflation ticked down to 0.1%, against the previous reading of 0.2%. The annual core PCE moved closer to the central bank’s 2% target in August, exacerbating the US Dollar’s (USD) pain.

However, Gold price failed to take advantage of the USD weakness and corrected from record highs of $2,686 reached last Thursday, as investors resorted to profit-taking heading into the US Nonfarm Payrolls week. Further, the month-end and quarter-end flows came into play, weighing negatively on Gold price.

In Monday’s trading so far, Gold price remains in the red, despite the renewed Middle East geopolitical escalation and additional Chinese stimulus measures.

Over the weekend, Israel continued to strike Lebanon and claimed to have killed another senior Hezbollah figure after the killing of leader Hassan Nasrallah. Iran, which backs the powerful militant group, vowed to strike back, noting that Nasrallah’s killing "will not go unanswered."

Meanwhile, China announced more stimulus measures, with the nation's central bank calling on the banks to lower mortgage rates for existing home loans by the end of October, likely by 50 bps on average.

The latest Chinese stimulus-driven optimism was partly dented by disappointing China’s business PMI data for September. China's official Manufacturing PMI came in at 49.8, slightly better than the 49.5 forecast. However, the country’s Caixin Manufacturing PMI returned to contraction, arriving at 49.3 in the same period vs. August’s 50.4.

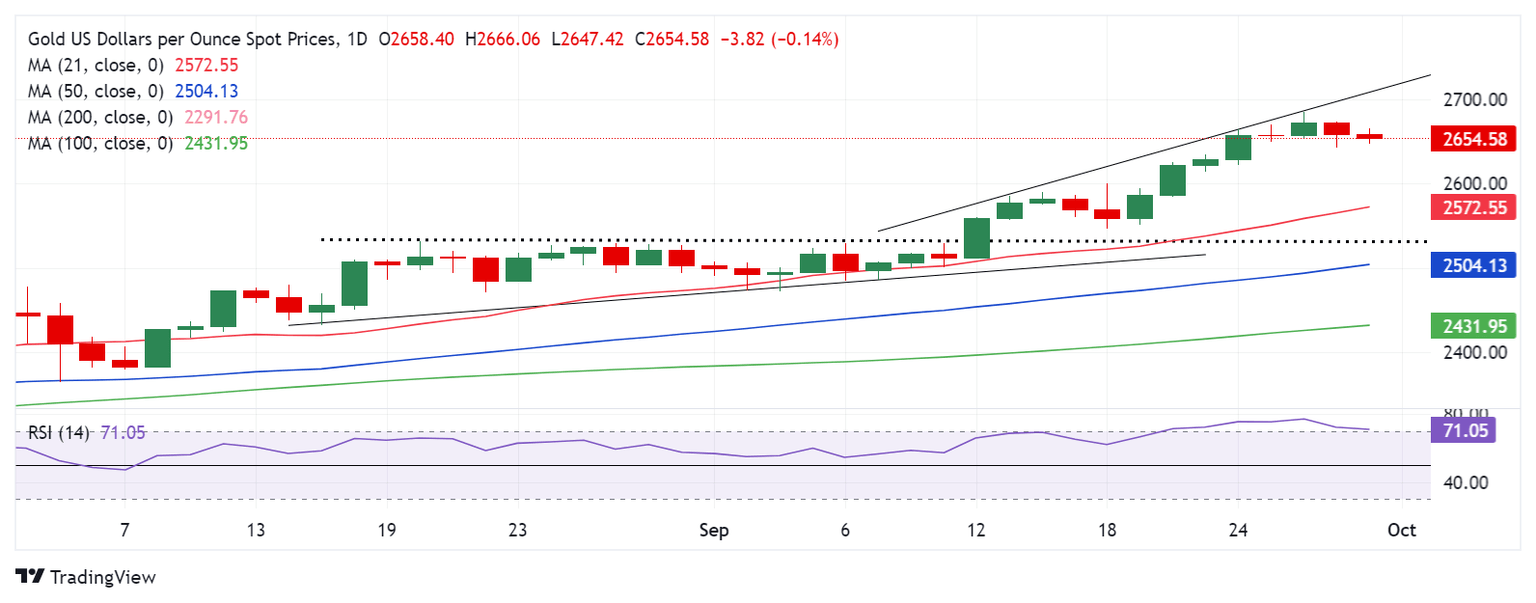

Gold price technical analysis: Daily chart

Gold price has eased from extremely overbought territory, with the 14-day Relative Strength Index (RSI) currently looks to enter the bullish zone near 71.

If buyers jump back on the bids, the previous high at $2,674 will be the initial content point, above which the record high of $2,686 will be tested.

A strong foothold above the all-time high is needed to take on the $2,700 barrier, followed by the rising trendline resistance at $2,710.

On the flip side, if the correction picks up pace, Gold price will likely test the September 24 low of $2,623, below which the $2,600 threshold will come into play.

Further south, Gold sellers could target the September 20 low of $2,585.

Economic Indicator

Fed's Chair Powell speech

Jerome H. Powell took office as a member of the Board of Governors of the Federal Reserve System on May 25, 2012, to fill an unexpired term. On November 2, 2017, President Donald Trump nominated Powell to serve as the next Chairman of the Federal Reserve. Powell assumed office as Chair on February 5, 2018.

Read more.Next release: Mon Sep 30, 2024 17:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.