Gold Price Forecast: XAU/USD down but not out; all eyes on US-China trade talks

- Gold price hits fresh weekly lows below $3,300 early Friday.

- The US Dollar firms up on US-UK trade deal, profit-taking ahead of US-China trade talks.

- Gold price needs a daily close below 21-day SMA at $3,307 to negate near-term bullish bias.

Gold price is flirting with weekly lows below $3,300 early Friday as the US Dollar (USD) stands tall on renewed optimism on the US trade deals front.

Gold price keenly awaits US-China trade talks

The US Dollar stands tall against its major currency rivals as worries over a potential US economic downturn ease following the announcement of a "breakthrough deal" by US President Donald Trump and British Prime Minister Keir Starmer on Thursday.

The US-UK trade deal raised hopes that US trade agreements with other countries are in the offing, especially as the US and China begin their first high-level trade talks in Switzerland on Saturday.

US Treasury Secretary Scott Bessent and Chief Trade Negotiator Jamieson Greer will meet with China's Vice Premier, He Lifeng, over the weekend.

The revival of the King Dollar has exerted downward pressure on the Gold price, but it remains to be seen if sellers can retain control in the day ahead. Markets may likely take profits off the table on their USD and Gold positions as the looming US-China trade risks approach.

Investors could also see bargain hunting in the bright metal as geopolitical risks globally remain elevated. FXStreet’s Analyst Haresh Menghani said, “Russia and Ukraine both reported attacks on their forces on the first day of a three-day unilateral ceasefire called by Russian President Vladimir Putin,”

“Furthermore, Israel’s escalation with Iran-backed Houthis in Yemen and fears of a broader military conflict along the India-Pakistan border keep geopolitical risks in play,” Haresh added.

Adding to this, a hit to the Chinese trade balance in April due to the probable impact of US tariffs could also bode well for the traditional safe haven. Meanwhile, China’s expansion to its Gld reserves for the sixth straight month also serves in the interest of Gold buyers.

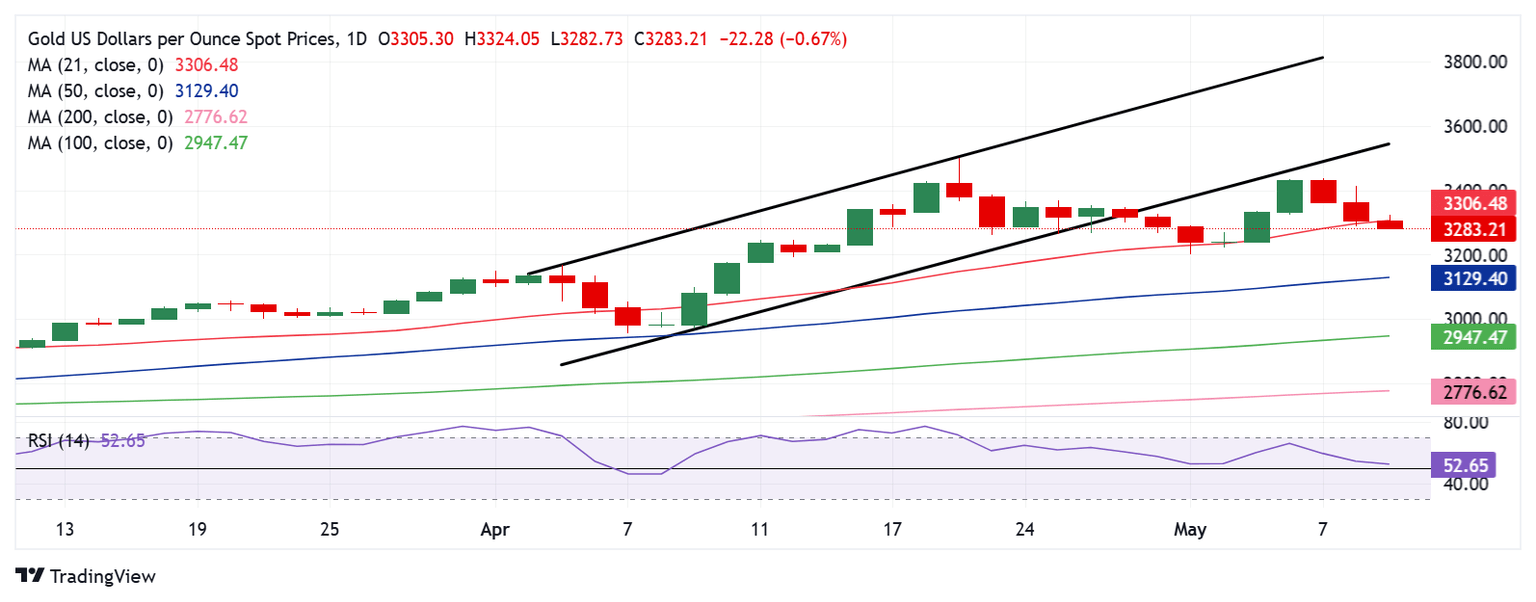

Gold price technical analysis: Daily chart

Gold price fell sharply after facing rejection once again above the $3,400 barrier. In doing so, Gold price has breached the critical 21-day Simple Moving Average (SMA) at $3,306.

However, the 14-day Relative Strength Index (RSI) has stalled its descent while defending the midline, suggesting that a rebound could be in the offing.

Gold price needs to recapture the $3,400 mark, above which buyers must establish a firm foothold above the two-week high of $3,440. The next topside target is at the record high of $3,500.

On the downside, Gold sellers yearn for a daily closing below the 21-day SMA at $3,306, which could negate any bullish potential in the near term, opening up a fresh downtrend toward the 50-day SMA at $3,129.

Ahead of that, the static support at $3,260 and the May 2 low of $3,223 will be challenged.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.