Gold Price Forecast: XAU/USD could see choppy trading between two key DMAs

- Gold price consolidates for the next push higher as the US Dollar stays vulnerable.

- Dismal United States economic data dents risk appetite, drowns US Dollar with US Treasury bond yields.

- Gold buyers defend 100-Daily Moving Average again even as RSI stays bearish.

Gold price looks to extend the previous rebound from a key support near $1,940 as the United States Dollar (USD) remains vulnerable amid sluggish US Treasury bond yields and after Monday’s disappointing economic data.

United States data downs the US Dollar, lifts Gold price

The US Dollar has entered a downside consolidation phase, alongside US Treasury bond yields, despite a mixed market mood and fresh US-China headlines. A broadly weaker US Dollar allows Gold bulls to gather pace for the next push higher. Asian equities are trading mixed amid a pause in the US stocks rally, as the latest downbeat economic data releases from the United States dent risk sentiment.

Gold price witnessed good two-way business on Monday, initially losing ground to test the key support near $1,940, only to find strong demand at the latter to recapture the $1,960 round figure. Earlier in the day, the US Dollar held on to the recovery gains, led by a solid US Nonfarm Payrolls report. The NFP report showed that the US economy added 339K jobs in May vs. 190K expected and the upwardly revised previous reading of 294K. The wage inflation component in the jobs report softened to 4.3% while the Unemployment Rate ticked higher to 3.7% in the reported period, compared with expectations of 3.5%.

Later in American trading, the US Dollar failed to sustain the previous rebound and succumbed to the bearish pressure after a slew of economic data from the United States fell short of expectations and justified increased bets on a US Federal Reserve (Fed) rate hike pause next week.

The Institute for Supply Management (ISM) said on Monday its services PMI fell sharply to 50.3 last month from 51.9 in April and against expectations of 51.5. All its sub-indices, including the Price Paid component, also disappointed markets. US Factory Orders increased 0.4% after a 0.6% gain in March but missed the 0.5% estimates. The US S&P Global Composite PMI for May was also revised lower to 54.3, adding to worries over the health of the US economy. The CMEGroup’s FedWatch Tool shows that the probability of a Fed pause in June is holding up at around 76%.

Looking ahead, risk sentiment is likely to be the primary driver for the US Dollar trades in the absence of any top-tier US economic data release. Federal Reserve policymakers are adhering to the ‘blackout period’ ahead of the June 13-14 policy meeting. Therefore, Gold price is likely to remain at the mercy of the US Treasury bond yields and the US Dollar as markets reprice Fed expectations.

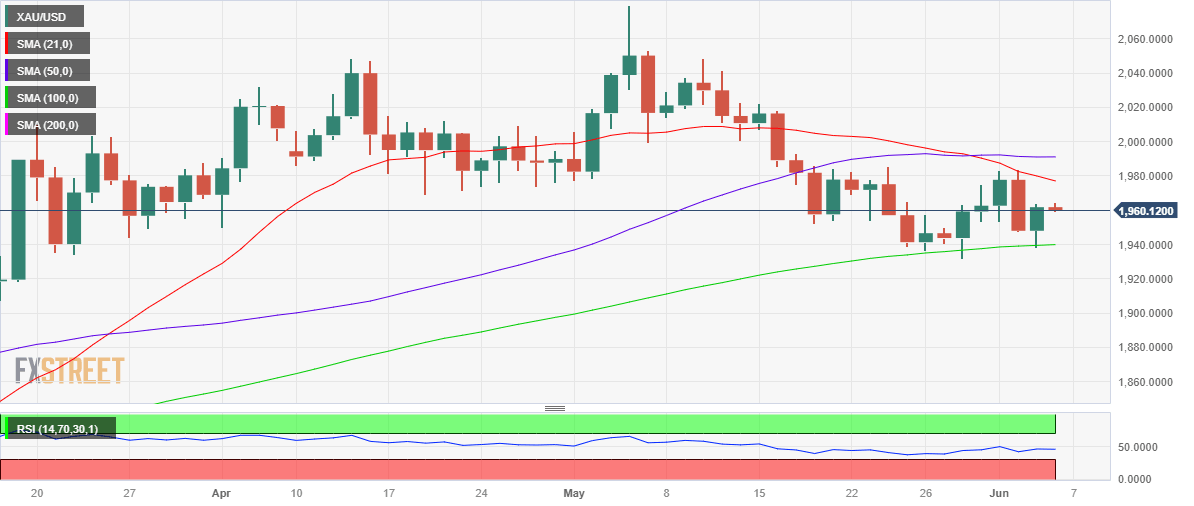

Gold price technical analysis: Daily chart

Gold price bounced off the critical 100-Daily Moving Average (DMA) at $1,940, having briefly pierced in the first half of Monday’s trading.

The 21 and 50 DMA Bear Cross and the bearish 14-day Relative Strength Index (RSI) continue to exert downside pressure on Gold price.

However, the 100 DMA remains a tough nut to crack for Gold sellers, generating fresh demand on every attempt to breach it.

That said, Gold price is likely to keep its range play intact between the 100 DMA and bearish 21 DMA. The 21 DMA aligns at $1,977.

Acceptance above the latter will initiate a meaningful recovery toward the $2,000 barrier. Ahead of that, the mildly bullish 50 DMA at $1,991 could come into play.

Conversely, immediate support is seen at the flattish 100 DMA at $1,940. Daily closing below the latter will resume the correction toward the March 17 low of $1,918.

Further south, Gold sellers could flex their muscles to challenge the $1,900 threshold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.