Gold Price Forecast: XAU/USD consolidates gains around $3,400

XAU/USD Current price: $3,394.97

- Fiscal and political woes in the United States undermine demand for the US Dollar.

- White House pressure on Federal Reserve Chairman Jerome Powell mounts.

- XAU/USD aims to extend its gains beyond the $3,400 in the near term.

Spot Gold surged in the European session Monday, flirting with the $3,400 level after Wall Street’s opening. The strong momentum in the bright metal comes from the broad US Dollar’s (USD) weakness, as the American currency keeps suffering from fiscal and political woes.

Trade-related tensions took centre stage in the absence of relevant data, with the focus particularly in negotiations between the United States (US) and the European Union (EU). Undergoing negotiations between the two economies is not enough to pause threats and retaliatory measures announcements. On the one hand, the White House noted that the deadline, set for August 1, will not be changed, while a base tariffs could be set at 30%. The EU, in the meantime, announced it’s studying retaliatory levies, should the US moves forward.

Other than that, Republican House Anna Paulina Luna is referring Federal Reserve (Fed) Chairman Jerome Powell to the Department of Justice (DOJ) for criminal charges, accusing him of perjury on two occasions. Additionally, Treasury Secretary Scott Bessent proposed a review of the whole Fed. “What we need to do is examine the entire Federal Reserve institution and whether they have been successful,” Bessent said on Monday.

XAU/USD short-term technical outlook

The daily chart for the XAU/USD pair shows it largely recovered above the 61.8% Fibonacci retracement of the $3,452.51 - $3,247.83 at around $3,374, opening the door for a recovery towards the top of the range. The same chart shows the pair is well above a now flat 20 Simple Moving Average (SMA), which consolidates at around $3,330, while the 100 SMA maintains its form bullish slope far below the shorter one, in line with the dominant bullish trend. Finally, technical indicators remain within positive levels with uneven upward strength, yet still suggesting higher highs ahead.

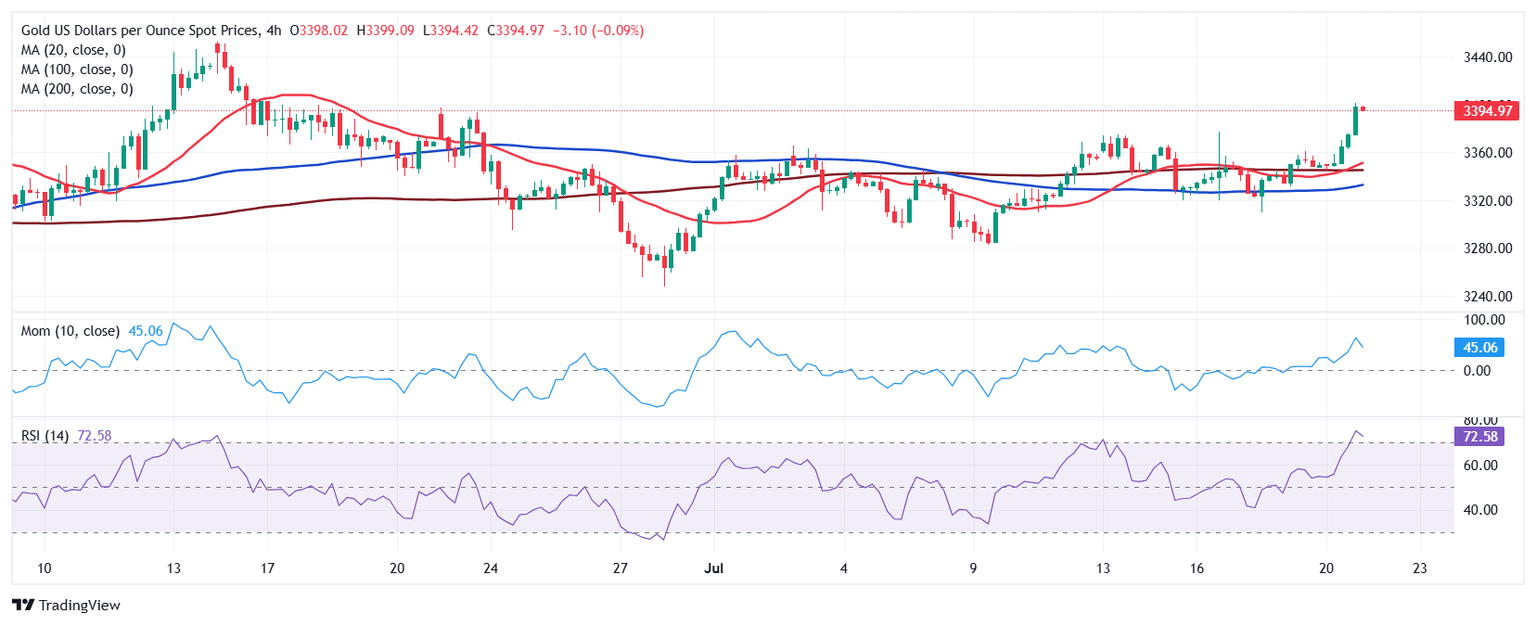

The near-term picture is supportive of another leg north, as technical indicators in the 4-hour chart reached overbought readings. The Momentum indicator maintains its almost vertical slope, while the Relative Strength Index (RSI) indicator decelerated, but keeps aiming north at around 71. At the same time, XAU/USD is far above all its moving averages, with the 100 and 200 SMA lacking directional strength, but the 20 SMA heading higher above the longer ones, skewing the risk to the upside.

Support levels: 3,390.10 3,374.50 3,350.00

Resistance levels: 3,403.20 3,417.90 3,430.35

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.