Gold Price Forecast: XAU/USD confronts key 23.6% Fibo resistance ahead of US inflation test

- Gold hits three-week highs near $3,375 early Monday, then retreats.

- The US Dollar wobbles as President Trump widens trade war ahead of Tuesday’s US inflation data.

- Gold price tested 23.6% Fibo level at $3,377, having regained all major daily averages amid bullish RSI.

Gold price has come under renewed selling pressure as buyers fail to sustain at higher levels early Monday. Traders gear up for an action-packed week amid looming trade war risks.

Gold price pulls back before the next leg north

Heightened tensions that US President Donald Trump’s latest tariff threats could widen a trade war globally pushed Gold price to the highest level in three weeks of $3,374 in the opening hours of Monday’s trading.

Asian traders hit their desks and reacted negatively to the weekend’s news of Trump threatening to impose a 30% tariff on imports from the European Union (EU) and Mexico, starting on August, having sent tariff letters to about 20 other countries last week.

The initial rush to safety propped up Gold price but sellers quickly jumped in after markets breathed a sigh of relief, digesting late Sunday’s comments from European Commission President Ursula von der Leyen.

von der Leyen noted that the EU will extend its suspension of trade countermeasures against new US tariffs until August 1, as it continues its efforts to resolve the trade dispute with the US through dialogue.

Signs of no imminent retaliation from the EU helped the US Dollar (USD) regain some lost ground, fuelling a pullback in Gold price even as US Treasury bond yields paused their recent uptrend.

All eyes turn to Tuesday’s US Consumer Price Index (CPI) data release, with investors looking to gauge the impact of Trump’s tariffs feeding through the prices.

US inflation data will help markets reprice expectations of the next US Federal Reserve interest rate cut, as calls for an extended pause through 2025 rise.

Markets are currently pricing in 50 basis points (bps) rate cuts this year, with a 60% chance that the Fed will reduce rates in September, according to the CME Group’s FedWatch Tool.

Ahead of the US inflation report, the Chinese second-quarter Gross Domestic Product (GDP) data will be released, which could have a significant market impact.

Also, in focus remains the US corporate earnings as a new season kicks in amid rife trade and geopolitical tensions.

US President Trump said on Sunday that he will send Patriot air defence missiles to Ukraine. He is due to make a "major statement" on Russia on Monday, per Reuters.

Gold price technical analysis: Daily chart

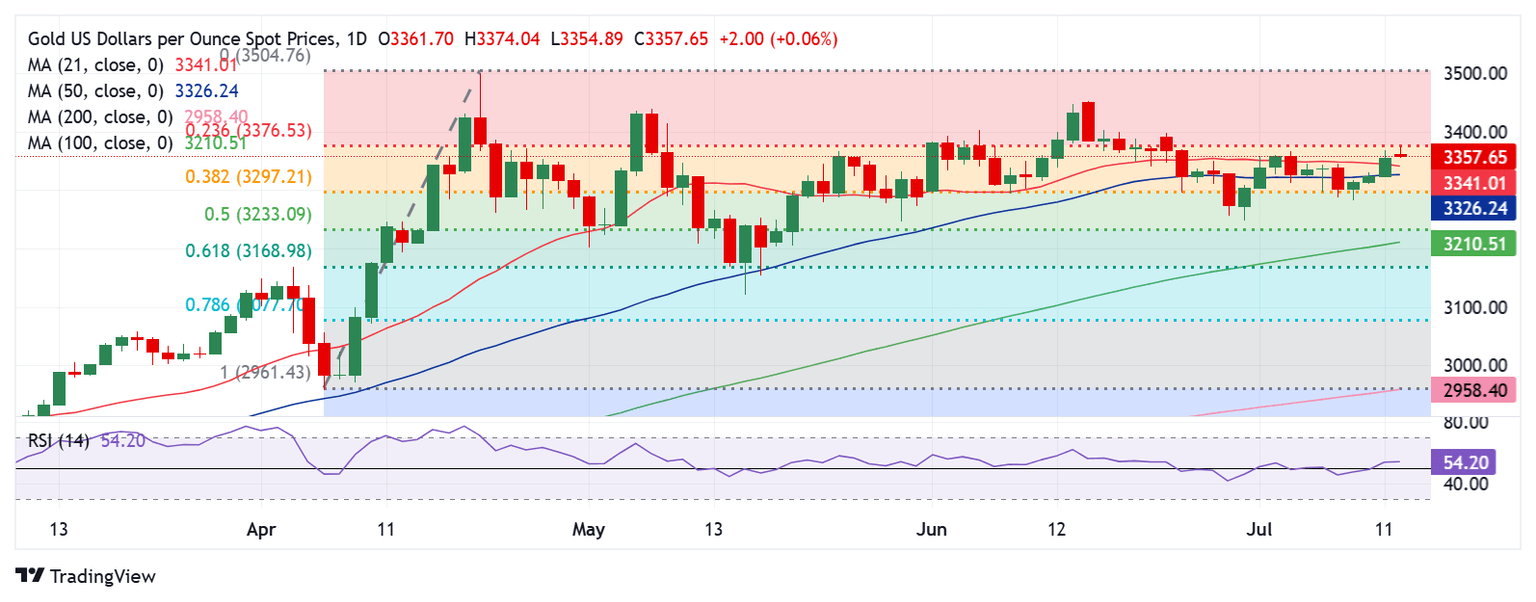

Gold price snapped a three-day recovery trend after facing rejection just shy of the 23.6% Fibonacci Retracement (Fibo) level of the April record rally at $3377 in early Asian trading this Monday.

Despite the pullback, the 14-day Relative Strength Index (RSI) continues to suggest additional upside as it holds well above the midline, currently near 54.20.

If selling pressure intensifies, Gold price could meet the initial demand area at the 21-day Simple Moving Average (SMA) at $3,341.

The 50-day SMA at $3,326 will provide the next cushion, below which the 38.2% Fibo level of the same rally at $3,297 will come into the picture once again.

In case buyers manage to take out the 23.6% Fibo level at $3,377 on a daily candlestick basis, a fresh uptrend will initiate toward the $3,400 round level and $3,440 static resistance.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.