Gold Price Forecast: XAU/USD buyers jump back amid tariff uncertainty

- Gold price holds the previous rebound from weekly lows early Wednesday.

- Fresh haven demand on tariff uncertainty and US economic woes underpin Gold price.

- Gold buyers stay hopeful amid bullish daily RSI, while the 21-day SMA at $2,883 holds.

Gold price struggles to build on Tuesday’s rebound in the Asian session on Wednesday. Gold buyers try their luck as safe-haven flows return on US President Donald Trump’s tariff uncertainty and weak US economic prospects.

Gold price bounces after the profit-taking slide

It was a classic case of profit-taking in Gold price on Tuesday, following a fresh record high of $2,956 set on Monday. Further, Gold price lost ground after the Hong Kong Census and Statistics Department showed that China's total Gold imports via Hong Kong in January fell 44.8% from December to their lowest point since April 2022.

However, Gold buyers managed to stage a decent comeback in the mid-American session, courtesy of the weak US Conference Board (CB) Consumer Confidence data that sparked US economic concerns and weighed heavily on the US Dollar (USD) alongside the US Treasury bond yields.

US Consumer Confidence Index declined 7 points, its largest fall since August 2021, to 98.3, well below the Reuters estimate of 102.5.

Early Wednesday, Gold price sustains Tuesday’s late rebound as the tariff deadline on Canada and Mexico draws close. Meanwhile, underlying fears over a potential trade war continue to underpin the haven demand for the traditional store of value – Gold, keeping the downside short-lived.

Markets also weigh Trump’s ordering a new probe into possible new tariffs on copper imports to rebuild US production of the red metal.

US President signed an order on Tuesday, directing Commerce Secretary Howard Lutnick to start a new national security probe under Section 232 of the Trade Expansion Act of 1962, the same law that Trump used in his first term to impose 25% global tariffs on steel and aluminium.

The Gold price upswing, however, could face headwinds from a modest rebound in the Greenback and the US Treasury bond yields following the US House approval of the Republican Budget plan, which will likely advance Trump’s tax plans

Additionally, the optimism over the US-Sino meeting on tariffs also thwart the Gold price uptick but trade war concerns could continue to fuel dip-buying in the metal. Speeches from Fed policymakers could also provide some impetus to the non-interest-bearing Gold price due to a lack of top-tier US economic data releases on Wednesday.

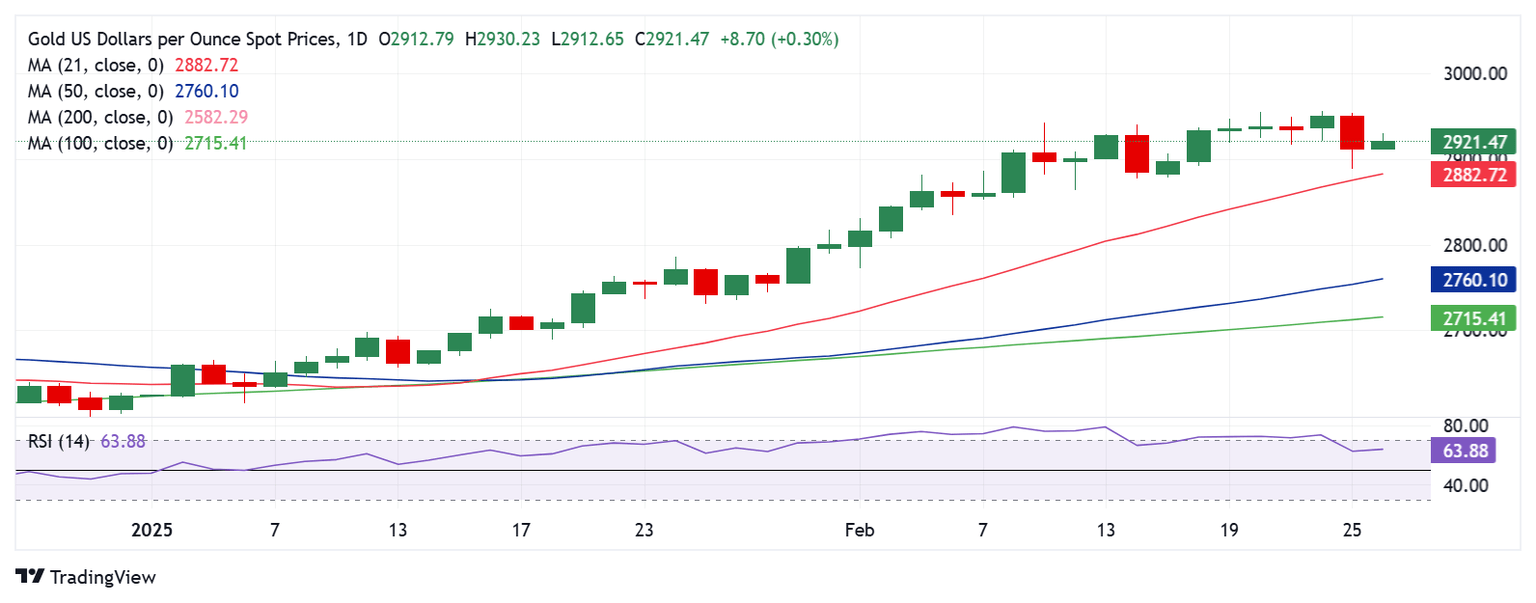

Gold price technical analysis: Daily chart

Despite the previous corrective decline, Gold price defended the 21-day Simple Moving Average (SMA) at $2,883.

The 14-day Relative Strength Index (RSI) has stalled its descent to turn higher, currently near 64, pointing to the additional upside.

Gold buyers could retest the all-time highs at $2,956 if the rebound gathers steam. The next topside barriers are seen at the $2,970 resistance and the $3,000 threshold.

On the flip side, the immediate support is seen at the $2,900 round level, below which the 21-day SMA at $2,883 will be challenged again.

Further south, the February 14 low of $2,877 will be tested.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.