Gold Price Forecast: XAU/USD bounces from lower lows, hovers around $1,910

XAU/USD Current price: $1,910.60

- US Retail Sales jumped 0.6% in August, the Producer Price Index surpassed expectations.

- Demand for the US Dollar recedes near term as investors remain optimistic.

- XAU/USD flirted with the $1,900 mark bears lead despite a modest bounce.

Gold prices extended their monthly decline, with XAU/USD trading as low as $1,901 in the aftermath of the European Central Bank (ECB) monetary policy announcement. The bright metal later rebounded amid optimistic stocks, although it holds around the $1,910 price zone.

The ECB hiked rates by 25 basis points (bps) against analysts' expectations, accompanying the decision with a dovish statement. The central bank downwardly revised growth forecast while inflation previsions were lifted, although policymakers refrained from anticipating additional hikes. On the contrary, President Christine Lagarde said that the focus will probably move to the duration of higher rates than to the level of such rates. Stagnation in the Euro Zone is evident, leaving the ECB without room to manoeuvre.

At the same time, the US Dollar got a boost from mixed local data. On the one hand, Retail Sales jumped in August, up 0.6% in the month vs. expectations of a 0.2% gain. On the other, wholesale prices rose by more than anticipated, as the August Producer Price Index (PPI) increased 0.7% MoM and 1.6% YoY. Hotter inflation, however, was not enough to convince investors the Federal Reserve (Fed) could opt for another rate hike. After the dust settled, risk appetite took the lead, weighing unevenly on US Dollar demand.

The next round of relevant data will come in the Asian session, as China will publish August Industrial Production and Retail Sales. The figures could set the market sentiment for the last trading day of the week.

XAU/USD price short-term technical outlook

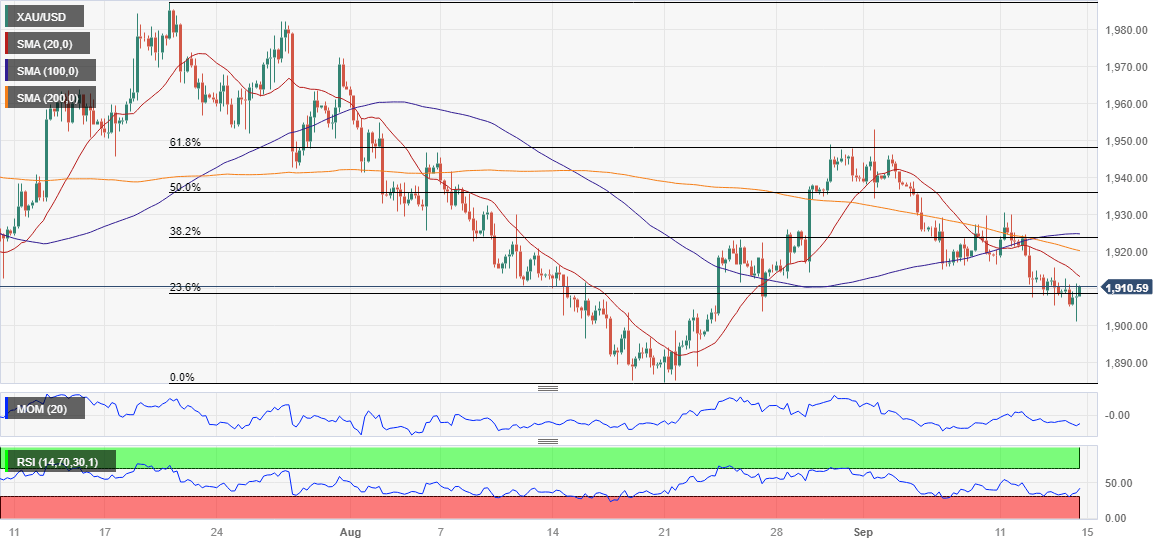

The XAU/USD pair is unchanged from its daily opening but posted a third consecutive lower low, which maintains the risk to the downside. In the mentioned time frame, the pair develops below all its moving averages and around the 23.6% Fibonacci retracement of its latest daily slump at 1,907.30. The Momentum indicator, in the meantime, remains directionless around its 100 level, while the Relative Strength Index (RSI) indicator consolidates at around 42, reflecting sellers' dominance.

In the near term, and according to the 4-hour chart, the ongoing bounce limits the bearish potential. Technical indicators aim north within negative levels, with the RSI indicator recovering from oversold readings. At the same time, XAU/USD develops below all its moving averages, with the 20 SMA maintaining its downward slope above the current level.

Support levels: 1,907.30 1,893.90 1,884.70

Resistance levels: 1,921.80 1,933.30 1,944.85

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.