Gold Price Forecast: XAU/USD bears await Federal Reserve Minutes for fresh boost

- Gold price is licking its wounds amid subdued US Dollar and US Treasury bond yields.

- Strong United States PMIs reaffirm hawkish Federal Reserve expectations.

- Gold price remains exposed to downside risks; FOMC Minutes awaited.

Gold price is attempting a temporary recovery above the $1,830 mark early Wednesday after the dismal performance this week. Upbeat United States Manufacturing and Services PMIs reaffirm the hawkish US Federal Reserve rate hike expectations as all eyes turn toward the Minutes of the first Federal Reserve meeting of 2023.

How will Gold price react to the Federal Reserve Minutes?

Markets will closely scrutinize whether the Federal Reserve board members debate the scenarios to return to 50 basis points (bps) rate hikes while the focus will also be on their inflation outlook. At present, markets are pricing in 25 bps rate hikes each at the Fed’s March and May meetings. Some US banks forecast 25 bps rate increases each at the following three meetings, raising the terminal rate forecast to 5.25%-5.50%. These revised expectations come from the recent slew of upbeat economic data from the United States, led by outstanding Nonfarm Payrolls and rightly followed by a hot Consumer Price Index (CPI) and strong Retail Sales report.

The Gold price reaction to the Fed Minutes could be limited, as traders could see it as outdated and choose to pay more attention to Friday’s United States Core PCE inflation – the Fed’s preferred inflation gauge. An uptick in the Core PCE Price Index is expected on a monthly basis, which could bolster the hawkish Fed outlook.

United States Dollar repositioning supports Gold price

In the meantime, the United States Dollar (USD) has once again stalled its upside above the 104.00 level compared to its major rivals. The US Dollar is pulling back slightly as traders take a breather and reposition themselves ahead of the Federal Open Market Committee (FOMC) Minutes.

The sharp sell-off in Wall Street indices overnight is taking its toll on the Asian market sentiment, as the above-forecasts United States S&P Global Manufacturing and Services PMI added to the hawkish Fed narrative. US business activity unexpectedly rebounded in February, reaching its highest level in eight months. US Composite PMI Output Index, which tracks the manufacturing and services sectors, increased to 50.2 this month from a final reading of 46.8 in January.

The US Dollar, however, is struggling to capitalise on the dominating risk-off flows, allowing Gold bulls to try their luck mid-week. The subdued performance in the US Treasury bond yields also supports the non-yielding Gold price. The benchmark 10-year US Treasury bond yields is trading on the back foot, facing rejection just shy of the 4.0% level on Tuesday.

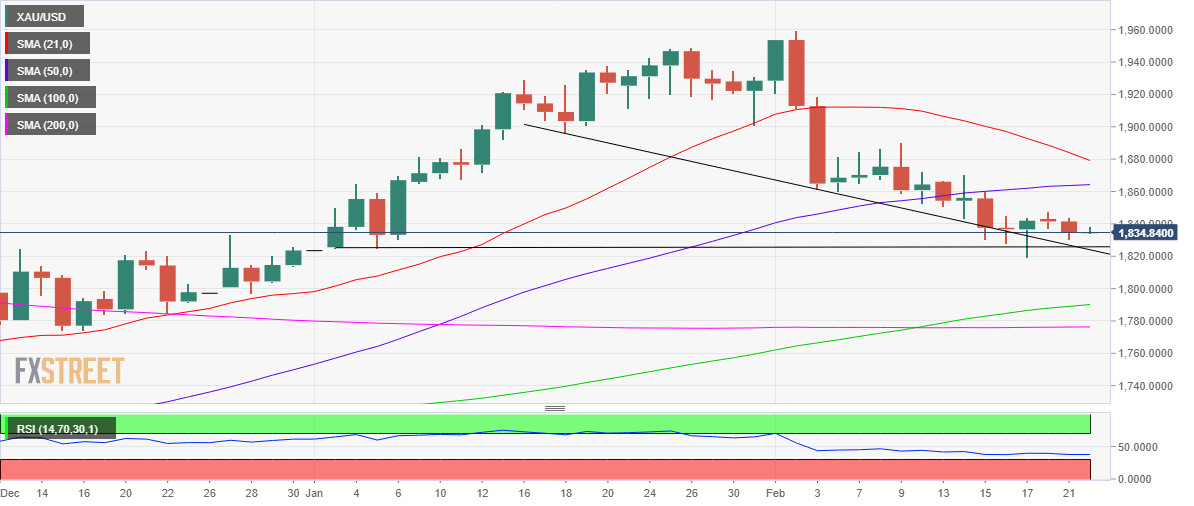

Gold price technical analysis: Daily chart

The short-term technical outlook for the Gold price remains more or less the same as the bright metal enters a bearish consolidative phase.

A break to the downside looks more likely amid a bearish 14-day Relative Strength Index (RSI).

The critical horizontal trendline support from the January 5 low at $1,825 could hold the fort, as Gold sellers are seen threatening the $1,830 round figure.

The next target for Gold bears is envisioned at Friday’s low of $1,819 on a sustained selling momentum.

Alternatively, Gold buyers need to find acceptance above the $1,850 psychological level on the road to recovery, above which a new run-up toward the flattish 50-Daily Moving Average (DMA) at $1,864 cannot be ruled out. Fresh buying opportunities will likely emerge above Valentine’s Day high at $1,870.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.