Gold Price Forecast: XAU/USD awaits US inflation for next big move after recapturing 21-DMA

- Gold price consolidates Tuesday’s rebound amid risk-off mood.

- US dollar eases across the board ahead of the key US inflation, Fed minutes.

- Gold price yielded a daily closing above 21-DMA but RSI still stays bearish.

Strong bids at $1750 once again came to the rescue of the bulls, aiding gold price stage a decisive rebound on Tuesday. The turnaround in gold price was mainly due to the sharp pullback in the benchmark 10-year US Treasury yields from four-month highs of 1.631%. The prevalent risk-off mood, in the face of troubled China Evergrande woes, stagflation fears and energy crunch, boosted the safe-haven flows back into the US bonds and the dollar, downing the yields across the time horizon. The International Monetary Fund’s (IMF) downward revision to its global growth forecast to 5.9% from 6% this year added legs to gold’s rebound.

However, the risk-aversion fuelled rally in the US dollar to fresh yearly highs against its main rivals capped gold’s upside. Further, hawkish comments from Fed officials Richard Clarida and Raphael Bostic, backing the case for November tapering also cooled off the buying pressure around the non-interest-bearing gold.

In the run-up to the US inflation and FOMC minutes showdown, gold price is holding onto Tuesday’s advance, as investors resort to repositioning their US dollar longs after the recent upsurge. The market mood remains cautious amid persisting China concerns and global growth risks, putting a floor under gold price. But its remains to be seen if the bright metal will sustain the renewed upbeat momentum, as hotter US CPI will further fan the Fed’s tapering and earlier-than-anticipated rate hike expectations. The September Fed meeting’s minutes will also shed light on the central bank’s next policy move, impacting the dollar and gold valuations. The annualized US Consumer Price Index (CPI) is seen steady at 5.3% in September while the core figure is also likely to stay unchanged at 4%. Stronger-than-expected reading is expected to cement the Fed’s tapering for November.

Gold Price Chart - Technical outlook

Gold: Daily chart

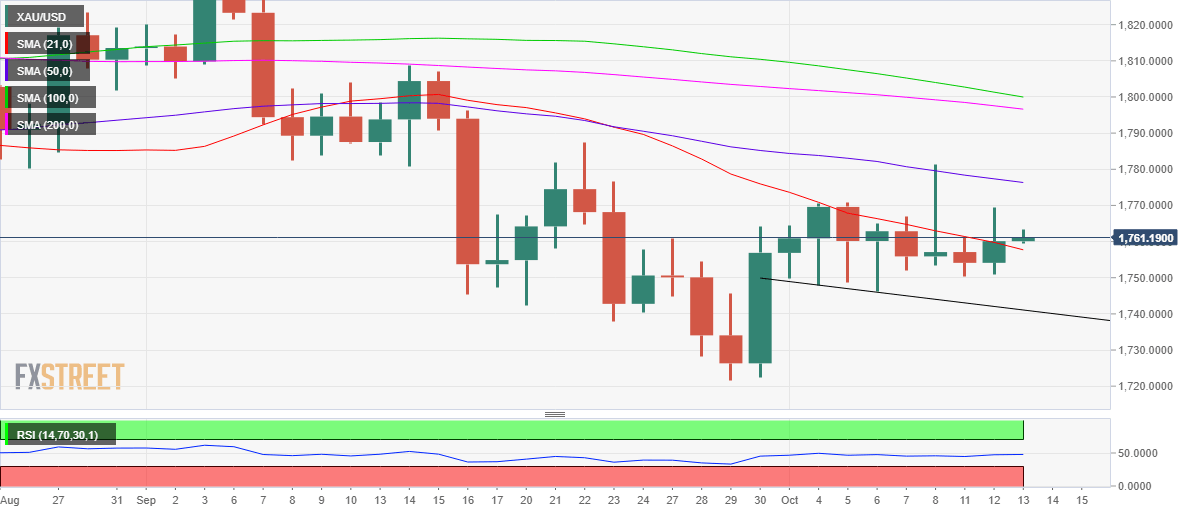

The daily chart shows that gold price finally yielded a daily closing above the short-term critical resistance of the 21-Daily Moving Average (DMA), then at $1760, reviving the bullish interests.

Should Tuesday’s upbeat momentum extend, then gold price could look to retest the downward-sloping 50-DMA at $1776.

The next crucial level for gold bulls is seen at the mildly bearish 200-DMA at $1797.

However, the 14-day Relative Strength Index (RSI) continues to trade listlessly below the midline, warranting caution for the gold buyers.

On the downside, the 21-DMA resistance turned support now at $1758 will emerge as a fierce cap, below which the $1750 demand area will be back into play.

Further south, the falling trendline support at $1741 will be on the sellers’ radars. On a sustained break below the latter, all eyes will be on the multi-week troughs of $1722.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.