Gold Price Forecast: XAU/USD awaits Powell for a meaningful recovery above 100-DMA

- Gold price builds on Monday’s rebound, approaches the 100-DMA barrier.

- Easing tightening fears amid Fedspeak lift gold, as Treasury yields retreat.

- A daily closing above 100-DMA is needed for gold bulls to regain control.

Gold price (XAU/USD) staged an impressive rebound on Monday, snapping a six-day downtrend. Gold jumped as high as $1787 before easing slightly to finish the day at $1783. The choppiness in the US Treasury yields, as the post-FOMC unwinding of reflation trades extended the sell-off in the rates in the Asian session, which lifted gold price from two-month lows. In the second half of the day, the US returns on the market rebounded firmly but at the same time, the US dollar corrected sharply across the board, which helped gold maintain its recovery mode. The risk-on mood amid easing tightening fears amid a slew of Fedspeak added to the pullback in the greenback. Fed policymakers James Bullard, Robert Kaplan and John Williams said that the economy has still room for recovery and therefore, there is still time before withdrawing the stimulus.

Monday’s Fedspeak cooled off rate hike fears, as gold price extends the rebound towards the $1800 mark this Tuesday. The renewed optimism over the US infrastructure stimulus deal also favors gold bulls. Markets also reassess the Fed’s monetary policy goals, especially after the text of Fed Chair Jerome Powel’s testimony released early Tuesday. Powell said inflation had accelerated but should move back toward the central bank’s 2% target once supply imbalances resolve. All eyes remain on Fed Chair’s Q&A session during his testimony on the Fed’s emergency lending programs and current policies before the House Select Subcommittee on the Coronavirus Crisis.

Gold Price Chart - Technical outlook

Gold: Daily chart

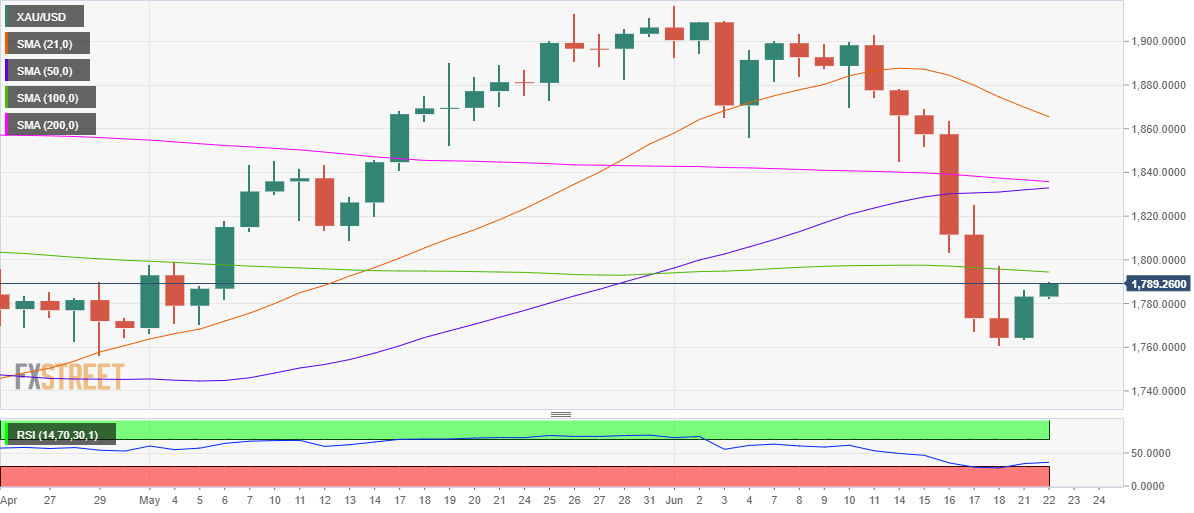

Gold’s daily chart shows that the price is fast approaching the critical 100-Daily Moving Average (DMA) at $1794, the previous key support now resistance.

The 14-day Relative Strength Index (RSI) is edging higher towards the midline, having recovered from the oversold territory. The momentum indicator suggests that there is some room for additional recovery.

Gold bulls need to find a foothold above the 100-DMA on a daily closing basis, in order to unleash recovery gains.

The next significant resistance awaits at $1797, the June 18 high. Further up, the $1800 round number could come into play, opening doors towards the June 17 highs of $1825.

On the flip side, should the 100-DMA continue to guard the upside, gold price could fall back towards the daily lows of $1782.

The $1763-$1760 demand zone will emerge as strong support for the bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.