Gold Price Forecast: XAU/USD awaits acceptance below $1750 to resume the downside

- Gold price snaps three-day uptrend, eyes deeper losses.

- China worries, inflation fears revive the dollar’s safe-haven demand.

- Gold’s daily technical setup remains in favor of bearish traders.

Gold price extended its recovery from seven-week troughs into the third straight day on Monday, starting out a fresh week on the right note. Gold price benefited from the renewed concerns over the debt-ridden China Evergrande property giant and fresh US-Sino trade jitters. US Trade Representative Katherine Tai said that the US will restart the tariff exclusion process on Chinese goods, adding that tariffs will stay in place for now.

The risk-off flows outweighed the rebound in the US Treasury yields, underpinning gold’s upside. Treasury yields jumped on expectations that the rising inflation could prompt the Fed to act sooner than expected on monetary policy tightening. Meanwhile, the US dollar slipped across the board amid repositioning heading towards the critical US Nonfarm Payrolls release. Further, uncertainty looming over the US debt ceiling and the infrastructure vote weighed down on the buck, helping gold price extend its recovery momentum.

This Tuesday, gold is feeling the pull of gravity amid the rebound in the greenback vs. its main rivals while the Treasury yields hold onto the recent gains. The risk sentiment improved slightly but investors continue to remain cautious amid default by another Chinese property developer Fantasia Limited. Meanwhile, rising inflation risks amid the ongoing surge in commodity prices raise global economic growth concerns, weighing on the market mood.

Gold price looks vulnerable going forward, with all eyes now on the US ISM Services PMI release for fresh trading insights. In the meantime, the US dollar price action and the risk on/ off sentiment will continue to influence gold price.

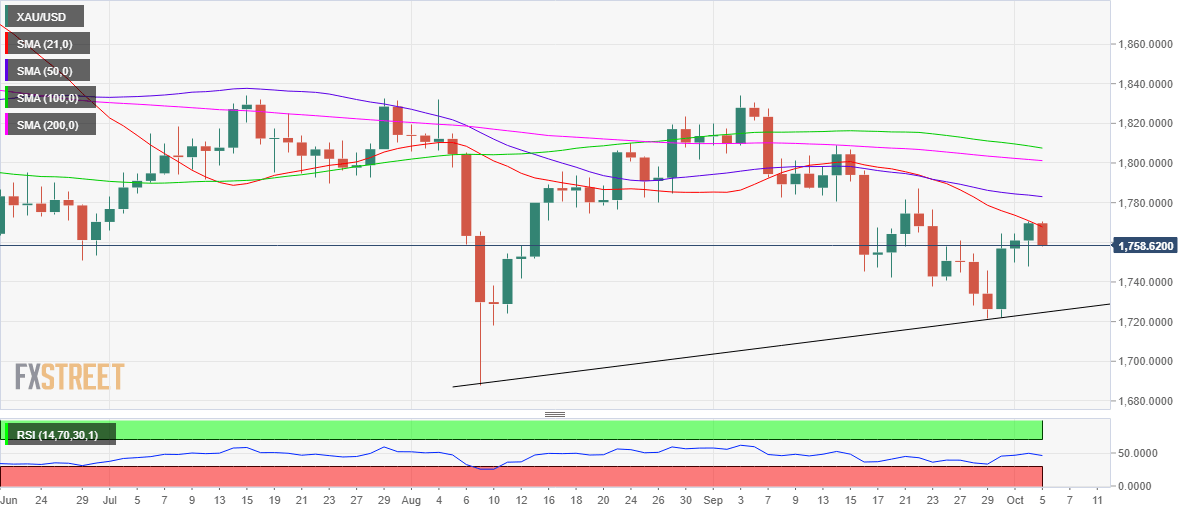

Gold Price Chart - Technical outlook

Gold: Daily chart

As explained here, gold price tested the bearish 21-Daily Moving Average (DMA) at 1.1771 and now turns south towards the $1750 psychological level.

The Relative Strength Index (RSI) is pointing lower while sitting just beneath the midline, adding credence to the latest leg down.

The September 27 highs of $1745 remain on the sellers’ radars if the $1750 barrier gives way. The downside will then open up towards the rising trendline support of $1726.

If the bulls manage to find acceptance above that short-term critical 21-DMA, then a fresh advance towards the downward-sloping 50-DMA at $1784 would be inevitable. Gold bulls will then look to recapture the $1800 round number.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.