Gold Price Forecast: XAU/USD awaits acceptance above $3,300 as buyers return

- Gold price extends its upbeat momentum to regain $3,300 early Wednesday.

- The US Dollar remains weighed by economic concerns, renewed US-China trade tensions and geopolitics.

- Gold price breaks the range as the daily RSI flips bullish while defending the key technical support.

Gold price is extending its upswing into the third consecutive day in Asian trading on Wednesday. Buyers look to regain the $3,300 on a sustained basis amid persistent US Dollar (USD) weakness and heightened geopolitical tensions.

Gold price looks to regain $3,300 and beyond

Markets have turned cautious, allowing increased safe-haven flows into the Gold price. US economic concerns resurfaced after last week’s downgrade of the nation’s sovereign credit rating by Moody’s and amid a likely passage of a bill on US President Donald Trump’s sweeping tax cuts. This approval is expected to widen the country’s fiscal deficit, further adding credence to the ‘Sell American’ campaign, maintaining the bearish pressures on the US Dollar (USD).

Further, uncertainty over US trade policies and a renewed spat between the US and China over chips alongside news that Group of Seven (G7) nations are mulling over coordinated efforts to impose levies on low-value Chinese raise concerns over the global economic outlook, exerting additional downside pressure on the Greenback while lifting the traditional safe-haven Gold price to fresh eight-day highs just above the $3,300 threshold.

Gold price also takes advantage of renewed geopolitical tensions. Multiple US officials familiar with the latest intelligence, CNN News reported late Tuesday that Israel is making preparations to strike Iranian nuclear facilities.

On Tuesday, Iran’s Supreme Leader noted that he doubts that nuclear talks with the US will lead to a new agreement, saying it had made "excessive and outrageous" demands on uranium enrichment. Moreover, markets remain wary about any progress in the Russia-Ukraine peace talks.

Looking ahead, Gold price will continue to display strong bullish potential, with recent speeches from Federal Reserve (Fed) policymakers signalling caution amid heightened economic uncertainty. Expectations surrounding increased Fed rate cuts are back on the table, aiding the upside in the non-interest-bearing Gold price.

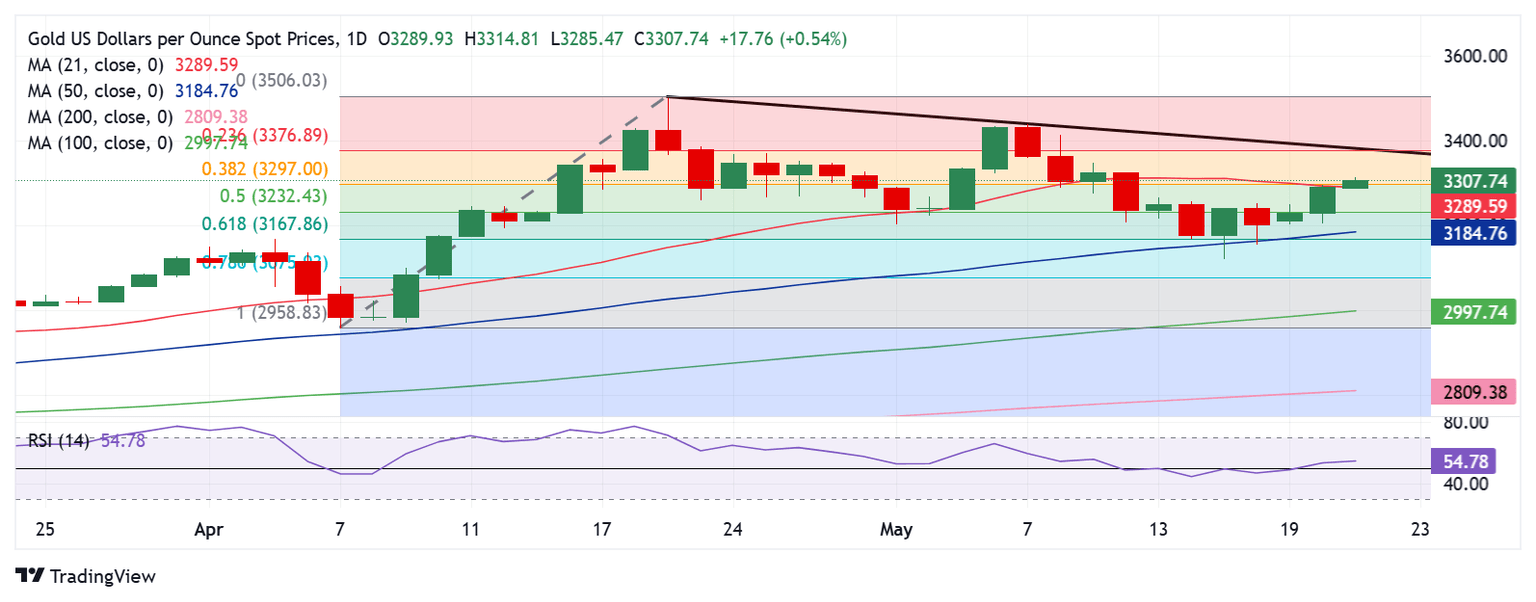

Gold price technical analysis: Daily chart

Gold price broke the recent range between the 21-day Simple Moving Average (SMA) and 50-day SMA to the upside on Tuesday as the 14-day Relative Strength Index (RSI) recaptured the midline.

Additionally, Gold price had defended the critical throwback support near $3,165, which is the 61.8% Fibonacci Retracement (Fibo) level of April’s record rally.

This Golden Ratio support helped Gold price staged a decent comeback, with more upside likely on the cards.

Gold buyers need acceptance above the 21-day SMA at $3,289 on a daily candlestick closing basis for a sustained uptrend,

The next topside target is at the falling trendline resistance at $3,387, above which the $3,400 level will be threatened.

Conversely, if sellers fight back control, the 50-day SMA at $3,185 will offer initial support, below which the abovementioned Fibo level will be retested.

A fresh sell-off could be fueled toward the $3,100 mark on a failure to resist that crucial support.

(This story was corrected on May 21 at 3:33 GMT to say that "Gold price extends its upbeat momentum to regain $3,300 early Wednesday," not test.)

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.