Gold Price Forecast: XAU/USD aims to break the monthly low at $1,951.92

XAU/USD Current price: $1,962.60

- Risk aversion dominates financial markets and boosts the US Dollar.

- FOMC Meeting Minutes could shed light on upcoming Federal Reserve monetary policy decisions.

- XAU/USD trades near its May monthly low and aims to break below it.

Risk aversion weighs on financial markets, with the US Dollar making the most of it. XAU/USD is down for the day and pressuring daily lows in the $1,956 price zone, fueled by comments from United States House Speaker Kevin McCarthy. Following another round of talks with President Joe Biden on the extension of the debt ceiling, McCarthy offered a press conference in which he noted they are still apart on a number of things, remarking Republicans aim for spending cuts and no tax hikes. Finally, he added that the US would not default and that they still eventually reach a deal.

Uncertainty about the Federal Reserve (Fed) monetary policy future also undermines the mood. The Federal Open Market Committee (FOMC) will soon publish the Minutes of its latest meeting and could shed some light on the matter. Policymakers have surprised investors these last few days with hawkish comments, suggesting there’s room for one or two more rate hikes before a pause.

XAU/USD price short-term technical outlook

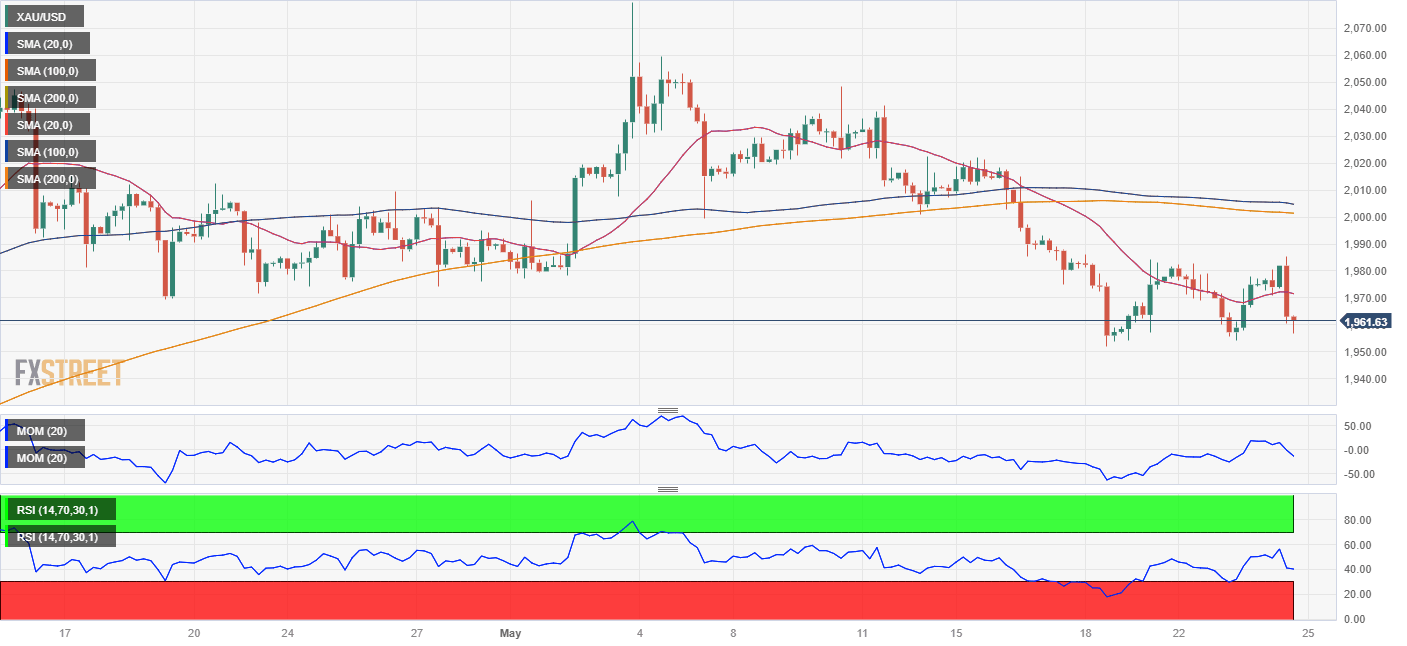

The daily chart for XAU/USD favors a bearish extension, as the pair trades at the lower end of its latest range, with last week’s low at $1,951.92 providing immediate support. In the mentioned time frame, the pair extends its decline below a mildly bearish 20 Simple Moving Average (SMA) while the longer moving averages maintain their upward strength far below the current level. At the same time, the Momentum indicator heads firmly south well into negative levels, while the Relative Strength Index (RSI) indicator resumed its decline and currently stands at around 41.

In the near term, and according to the 4-hour chart, the risk also skews to the downside. The pair develops below all its moving averages, with a flat 20 SMA providing dynamic resistance at around $1,972. At the same time, technical indicators head firmly lower within negative levels, still above oversold readings.

Support levels: 1,951.90 1,944.00 1,931.60

Resistance levels: 1,972.00 1,984.20 1,996.80

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.