Gold Price Forecast: Seesawing around 1,800 with a bearish tilt

XAU/USD Current price: $1,802.63

- The American dollar is down, despite US government bond yields soaring.

- Global stocks traded mixed as investors prepare to close the year.

- XAU/USD trimmed part of its intraday losses and recovered above the 1,800 threshold.

Spot gold plummeted below the 1,800 level as demand for the American currency picked up during European trading hours, extending its decline to $1,789.38 a troy ounce during the US session. The greenback temporarily strengthened across the FX board ahead of Wall Street’s opening but gave up pretty fast, with the bright metal recovering up to the current 1,802 price zone.

Position adjustments ahead of the year-end result in some assets trading without rhyme or reason, as the greenback is down while US government bond yields are firmly up, with the yield on the benchmark 10-year Treasury note hitting 1.55%. Most Asian and European indexes closed in the red, but Wall Street is up, although gains are limited.

Gold price short-term technical outlook

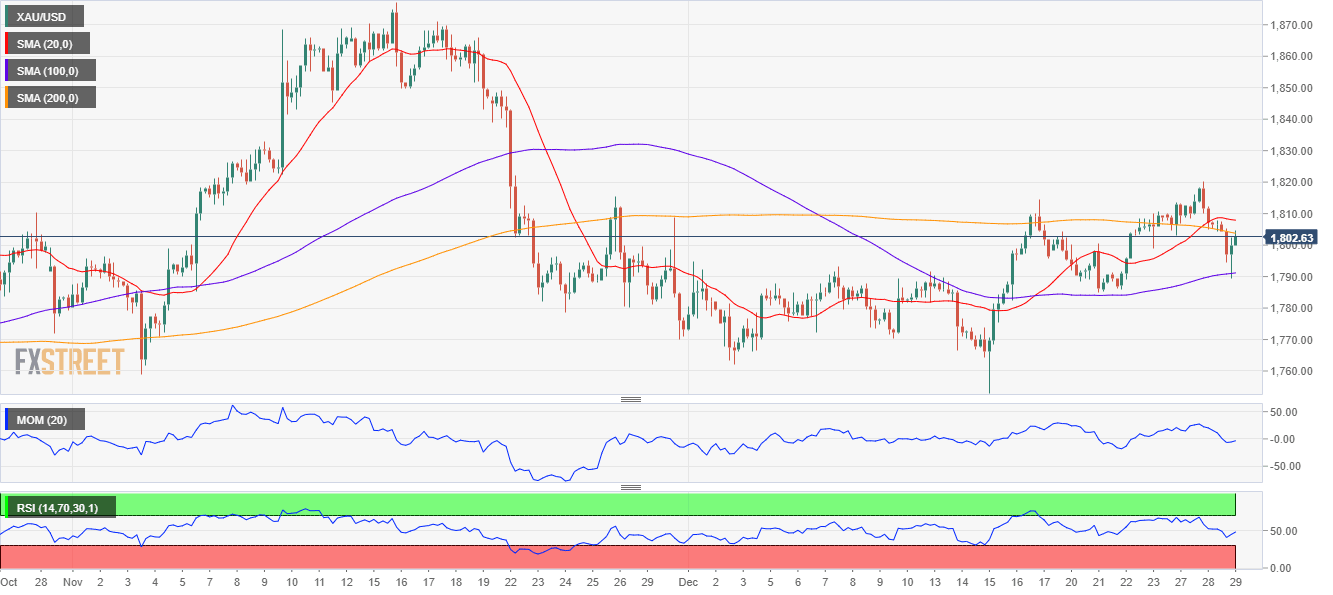

The daily chart for the XAU/USD pair shows that it remains in the red, down for a second consecutive day. The lower low skews the risk to the downside, and a break below the mentioned daily low should signal a steeper decline. In the mentioned time frame, the pair bottomed around the 20 and 100 SMAs, both converging with modest bullish slopes. Technical indicators head marginally lower but remain above their midlines.

The 4-hour chart shows that the metal bounced from a flat 100 SMA, while the current recovery is meeting sellers around a mildly bearish 200 SMA. Technical indicators are recovering within negative levels, reflecting the ongoing advance rather than hinting at further gains ahead.

Support levels: 1,789.30 1,778.20 1,766.40

Resistance levels: 1,808.10 1,820.35 1,831.10

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.