Gold Price Forecast: Optimistic buyers maintain the upward pressure

XAU/USD Current price: $1,876.6

- The US Consumer Price Index is expected to have increased by 6.5% YoY in December.

- Financial markets reflect optimism about the Chinese economic comeback.

- XAU/USD consolidates gains near a fresh eight-month high of $1,880.90 a troy ounce.

The broad US Dollar weakness pushed spot gold to $1,880.90 a troy ounce on Monday, its highest since May 2022. The Greenback eased on the back of an upbeat mood, based on speculation the US Federal Reserve has room to reduce the pace of monetary tightening, coupled with hopes China will positively influence global growth. News over the weekend indicated that the world’s second-largest economy re-opened sea and land crossings with Hong Kong, which were closed three years ago.

Asian and European indexes closed in the green, while US stock markets also trade in positive territory, maintaining the US Dollar at the lower end of its daily range. US Treasury yields, in the meantime, stand below their opening levels, shedding some ground ahead of the release of the US Consumer Price Index (CPI). The United States will publish an update on inflation next Thursday, with the annual CPI foreseen up by 6.5% YoY, further decelerating from the multi-decade high increase of 9.1% YoY posted last June.

XAU/USD price short-term technical outlook

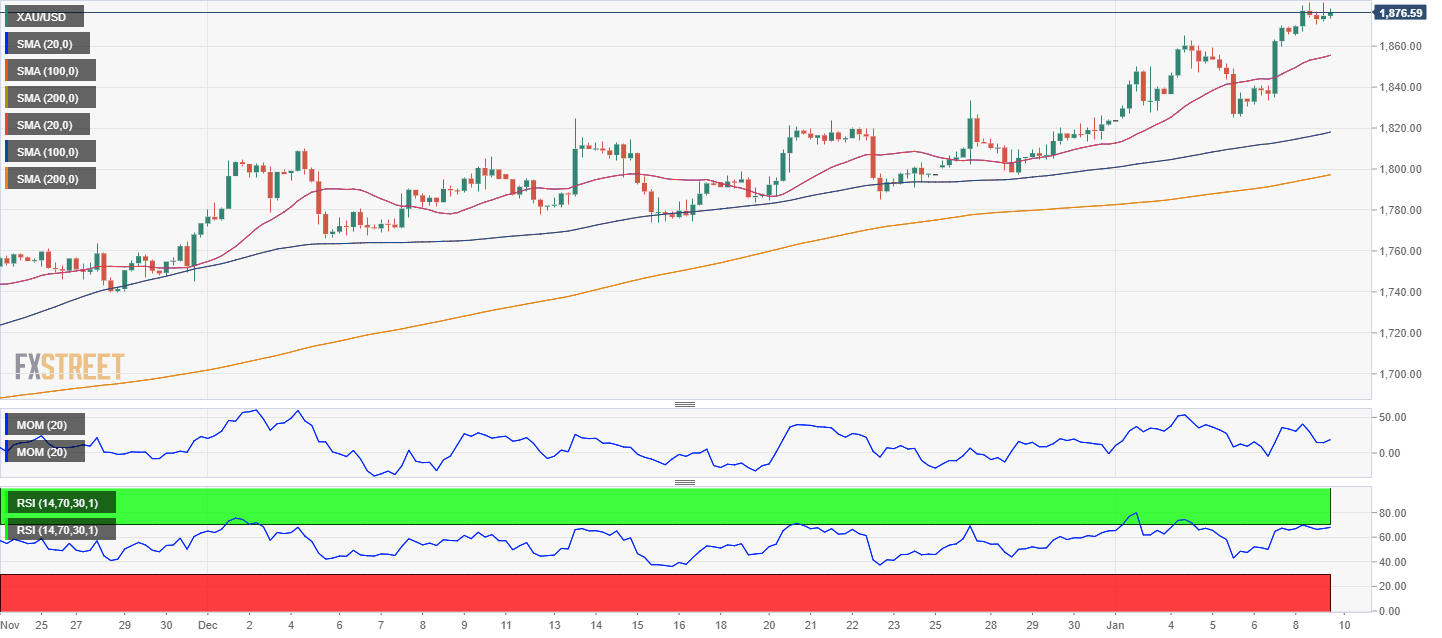

XAU/USD trades near daily highs in the $1,870.00 price zone, retaining its bullish strength according to the daily chart. Technical indicators lost their upward momentum after nearing overbought readings, holding ground mid-US session. At the same time, the bright metal extends its advance above its moving averages, with the 20 Simple Moving Average (SMA) gaining upward traction and providing dynamic support at around 1,815.00.

The 4-hour chart shows that bulls maintain control of XAU/USD, also that they are now in wait-and-see mode. Technical indicators are directionless, well above their midlines, without signs of bullish exhaustion. At the same time, moving averages keep heading north far above the current level, reflecting continued buying pressure.

Support levels: 1,883.50 1,897.45 1,910.00

Resistance levels: 1,865.50 1,843.10 1,825.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.