Gold Price Forecast: Losing steam but holding above $1,800.00

XAU/USD Current price: $1,811.22

- US indexes flirt with record highs after more encouraging US macroeconomic data.

- The US Richmond Fed Manufacturing Index improved from 11 to 16 in December.

- XAU/USD retreated from a fresh one-month high, could turn bearish in the near term.

Spot gold reached an intraday high of $1,820.25 a troy ounce, its highest in over a month, later trimming gains. The American dollar met demand with Wall Street’s opening, helped by encouraging US data and subdued government bond yields. The Richmond Fed Manufacturing Index improved from 11 to 16 in December. At the same time, US indexes kept rallying, with the S&P reaching a fresh record high and the DJIA nearing its all-time maximum.

The good mood has little backup, although market participants keep hoping the coronavirus Omicron variant may be the end of the pandemic, as it seems to be far less deadly than its precursors. Despite the record number of daily contagions, the death toll remains low, and the US and the UK have dismissed changes of new restrictions, at least in the near term.

Gold price short-term technical outlook

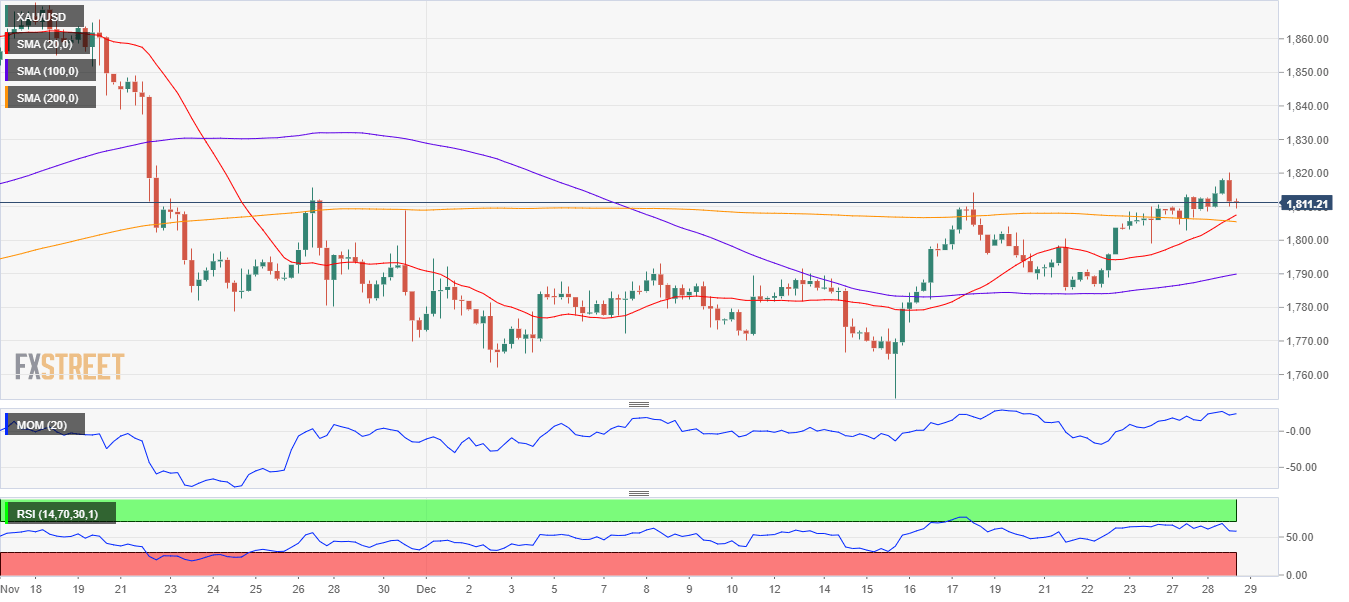

The daily chart for the XAU/USD pair shows that it may change course in the upcoming sessions, as the daily candle shows a long upper wick, following a three-day rally. In the mentioned time frame, the bright metal continues to develop above a congestion of directionless moving averages, while technical indicators are flat just above their midlines.

In the near term, and according to the 4-hour chart, gold is losing bullish steam, not yet confirming a bearish continuation. The 20 SMA is crossing above a flat 200 SMA, both in the 1,806 price zone, while the 100 SMA maintains a modest bullish slope at around 1,787. In the meantime, technical indicators continue retreating within positive levels with limited directional strength. The bearish case will be firmer on a break below 1,803.00, the immediate support level.

Support levels: 1,803.00 1,791.80 1,782.10

Resistance levels: 1,814.20 1,822.90 1,832.75

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.