Gold Price Forecast: Fresh record high appears on cards for XAU/USD

· Gold remains within striking distance of lifetime highs of $3,708 early Monday.

· US Dollar sustains post-Fed recovery, bracing for Fedspeak, Treasury auctions.

· Gold looks to retest record highs as the daily RSI holds just above the 70 level.

Gold is looking to build on Friday’s solid rebound, hanging close to $3,700 at the start of the week on Monday.

Gold: Bullish potential remains intact

Having booked a fifth consecutive weekly advance, Gold stands tall near record highs of $3,7085 reached last Wednesday, despite the ongoing recovery stint in the US Dollar (USD).

Less dovish-than-expected US Federal Reserve (Fed) policy announcements and a fresh batch of upbeat US data continue to power the USD upswing, while traders keep taking profits off the table on their USD shorts, considering the recent sell-off as excessive.

Traders gear up for the Fed’s favorite inflation measure, the core Personal Consumption Expenditure Price Index, due for release on Friday, for fresh directional impetus.

In the meantime, markets will pay close attention to a barrage of speeches from Fed officials for fresh hints on future interest rate cuts, especially after the Fed’s projections of two more rate cuts by the year-end and Chairman Jerome Powell’s measured approach on further easing.

Also, affecting the performance of the USD, and hence, Gold’s could be a deluge of Treasury auctions this week.

Further, trade concerns between the US and India, combined with fresh geopolitical developments, could play a pivotal role in the Gold price action going forward.

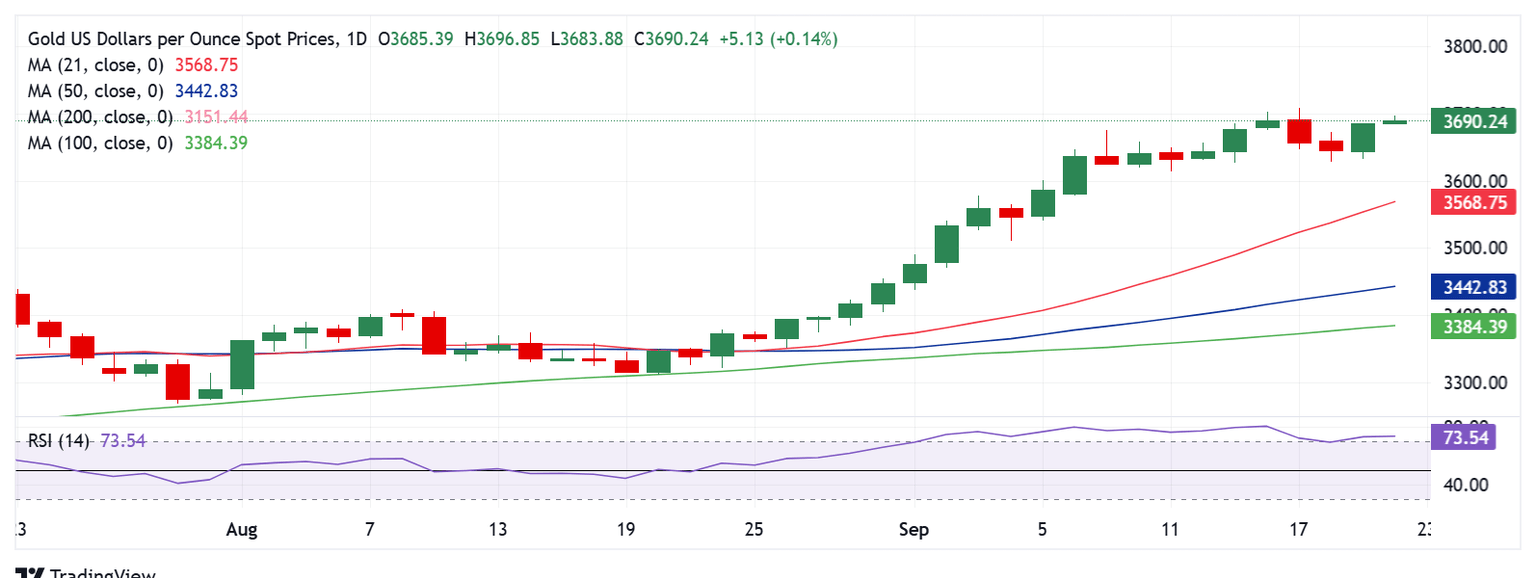

Gold price technical analysis: Daily chart

The daily chart shows that the 14-day Relative Strength Index (RSI) has re-entered the overbought territory, but hovers near 73.50, suggesting more room to the upside.

If buyers gathers strength, Gold could retest the record high at $3,708. A daily candlestick closing above that level will open doors toward the $3,750 region.

On the flip side, Gold could challenge the $3,650 psychological barrier, below which the previous week’s low at $3,627 could be tested.

Further down, the $3,600 round figure could come to the rescue of buyers.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.